- France

- /

- Aerospace & Defense

- /

- ENXTPA:FGA

Why Figeac Aero Société Anonyme (EPA:FGA) Could Be Worth Watching

Figeac Aero Société Anonyme (EPA:FGA), which is in the aerospace & defense business, and is based in France, led the ENXTPA gainers with a relatively large price hike in the past couple of weeks. Less-covered, small caps sees more of an opportunity for mispricing due to the lack of information available to the public, which can be a good thing. So, could the stock still be trading at a low price relative to its actual value? Let’s examine Figeac Aero Société Anonyme’s valuation and outlook in more detail to determine if there’s still a bargain opportunity.

Check out our latest analysis for Figeac Aero Société Anonyme

What is Figeac Aero Société Anonyme worth?

Good news, investors! Figeac Aero Société Anonyme is still a bargain right now. According to my valuation, the intrinsic value for the stock is €5.15, but it is currently trading at €3.76 on the share market, meaning that there is still an opportunity to buy now. However, given that Figeac Aero Société Anonyme’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

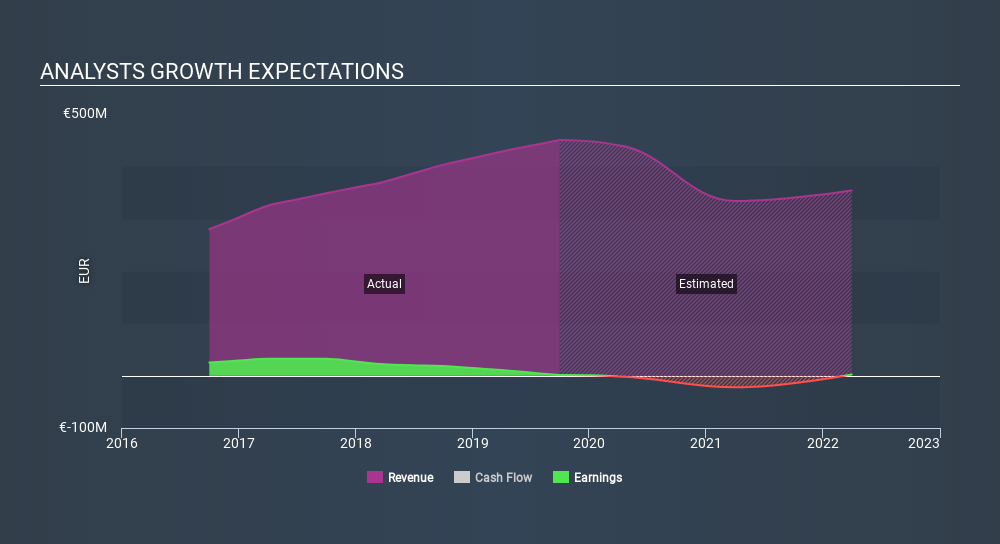

Can we expect growth from Figeac Aero Société Anonyme?

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. However, with an extremely negative double-digit change in profit expected over the next couple of years, near-term growth is certainly not a driver of a buy decision. It seems like high uncertainty is on the cards for Figeac Aero Société Anonyme, at least in the near future.

What this means for you:

Are you a shareholder? Although FGA is currently undervalued, the adverse prospect of negative growth brings about some degree of risk. I recommend you think about whether you want to increase your portfolio exposure to FGA, or whether diversifying into another stock may be a better move for your total risk and return.

Are you a potential investor? If you’ve been keeping an eye on FGA for a while, but hesitant on making the leap, I recommend you dig deeper into the stock. Given its current undervaluation, now is a great time to make a decision. But keep in mind the risks that come with negative growth prospects in the future.

Price is just the tip of the iceberg. Dig deeper into what truly matters – the fundamentals – before you make a decision on Figeac Aero Société Anonyme. You can find everything you need to know about Figeac Aero Société Anonyme in the latest infographic research report. If you are no longer interested in Figeac Aero Société Anonyme, you can use our free platform to see my list of over 50 other stocks with a high growth potential.

When trading Figeac Aero Société Anonyme or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:FGA

Figeac Aero Société Anonyme

Manufactures, supplies, and sells equipment and sub-assemblers for aeronautics sector in France.

High growth potential with acceptable track record.

Market Insights

Community Narratives