- United Kingdom

- /

- Consumer Services

- /

- AIM:ANX

Why Anexo Group Plc (LON:ANX) Should Be In Your Dividend Portfolio

Today we'll take a closer look at Anexo Group Plc (LON:ANX) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

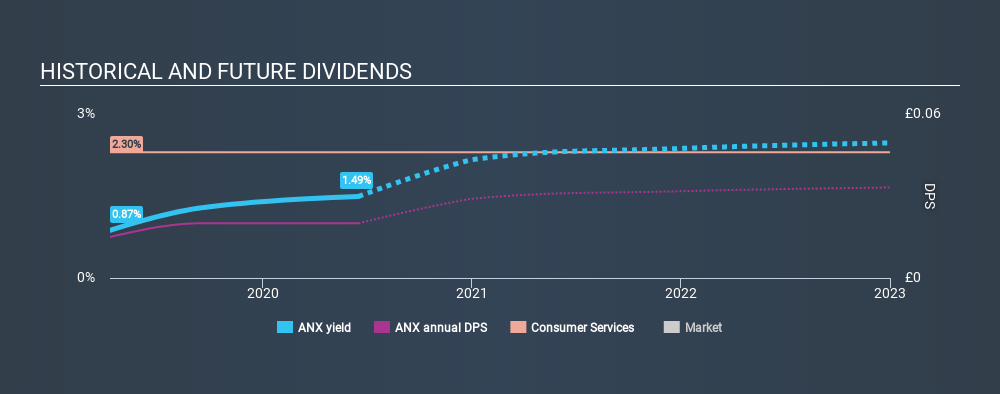

Anexo Group has only been paying a dividend for a year or so, so investors might be curious about its 1.5% yield. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Anexo Group paid out 18% of its profit as dividends. We'd say its dividends are thoroughly covered by earnings.

Remember, you can always get a snapshot of Anexo Group's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. This works out to be a compound annual growth rate (CAGR) of approximately 33% a year over that time.

The dividend has been growing pretty quickly, which could be enough to get us interested even though the dividend history is relatively short. Further research may be warranted.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. Anexo Group has grown its EPS 54% over the past 12 months. We're glad to see EPS up on last year, but we're conscious that growth rates typically slow as companies increase in size. The company is only paying out a fraction of its earnings as dividends, and in the past been able to use the retained earnings to grow its profits rapidly - an ideal combination. We do note though, one year is too short a time to be drawing strong conclusions about a company's future prospects.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're glad to see Anexo Group has a low payout ratio, as this suggests earnings are being reinvested in the business. Next, earnings growth has been good, but unfortunately the company has not been paying dividends as long as we'd like. Overall we think Anexo Group is an interesting dividend stock, although it could be better.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. To that end, Anexo Group has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About AIM:ANX

Anexo Group

Anexo Group Plc, along with its subsidiaries, provides integrated credit hire and legal services in the United Kingdom.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives