- United States

- /

- Consumer Finance

- /

- NYSE:BFH

Why Alliance Data Systems Corporation (NYSE:ADS) Should Be In Your Dividend Portfolio

Dividend paying stocks like Alliance Data Systems Corporation (NYSE:ADS) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

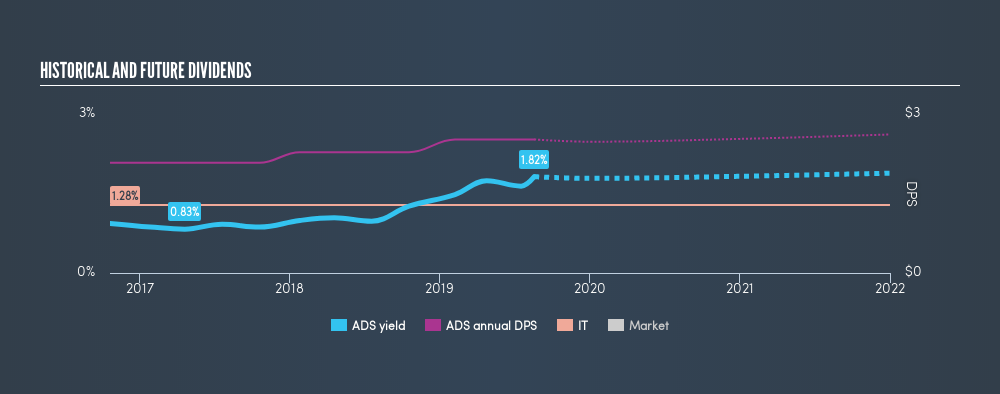

With only a three-year payment history, and a 1.8% yield, investors probably think Alliance Data Systems is not much of a dividend stock. A low dividend might not be a bad thing, if the company is reinvesting heavily and growing its sales and profits. The company also bought back stock during the year, equivalent to approximately 7.8% of the company's market capitalisation at the time. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on Alliance Data Systems!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Alliance Data Systems paid out 15% of its profit as dividends, over the trailing twelve month period. Given the low payout ratio, it is hard to envision the dividend coming under threat, barring a catastrophe.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Alliance Data Systems paid out 5.5% of its free cash flow as dividends last year, which is conservative and suggests the dividend is sustainable. It's positive to see that Alliance Data Systems's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Is Alliance Data Systems's Balance Sheet Risky?

As Alliance Data Systems has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. With a net debt to EBITDA ratio of 11.84 times, Alliance Data Systems is very highly levered. While this debt might be serviceable, we would still say it carries substantial risk for the investor who hopes to live on the dividend.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. Alliance Data Systems has EBIT of 5.11 times its interest expense, which we think is adequate. Despite a decent level of interest cover, shareholders should remain cautious about the high level of net debt. Rising rates or tighter debt markets have a nasty habit of making fools of highly-indebted dividend stocks.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. During the past three-year period, the first annual payment was US$2.08 in 2016, compared to US$2.52 last year. Dividends per share have grown at approximately 6.6% per year over this time.

The dividend has been growing at a reasonable rate, which we like. We're conscious though that one of the best ways to detect a multi-decade consistent dividend-payer, is to watch a company pay dividends for 20 years - a distinction Alliance Data Systems has not achieved yet.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Alliance Data Systems has grown its earnings per share at 10% per annum over the past five years. Earnings per share are growing at a solid clip, and the payout ratio is low. We think this is an ideal combination in a dividend stock.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. It's great to see that Alliance Data Systems is paying out a low percentage of its earnings and cash flow. Second, the company has not been able to generate earnings growth, and its history of dividend payments too short for us to thoroughly evaluate the dividend's consistency across an economic cycle. Overall we think Alliance Data Systems scores well on our analysis. It's not quite perfect, but we'd definitely be keen to take a closer look.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 20 Alliance Data Systems analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:BFH

Bread Financial Holdings

Provides tech-forward payment and lending solutions to customers and consumer-based industries in North America.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives