- Poland

- /

- Entertainment

- /

- WSE:11B

Why 11 bit studios S.A.'s (WSE:11B) High P/E Ratio Isn't Necessarily A Bad Thing

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll show how you can use 11 bit studios S.A.'s (WSE:11B) P/E ratio to inform your assessment of the investment opportunity. 11 bit studios has a P/E ratio of 48.75, based on the last twelve months. That corresponds to an earnings yield of approximately 2.1%.

See our latest analysis for 11 bit studios

How Do I Calculate A Price To Earnings Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for 11 bit studios:

P/E of 48.75 = PLN406 ÷ PLN8.33 (Based on the year to June 2019.)

Is A High P/E Ratio Good?

A higher P/E ratio implies that investors pay a higher price for the earning power of the business. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

Does 11 bit studios Have A Relatively High Or Low P/E For Its Industry?

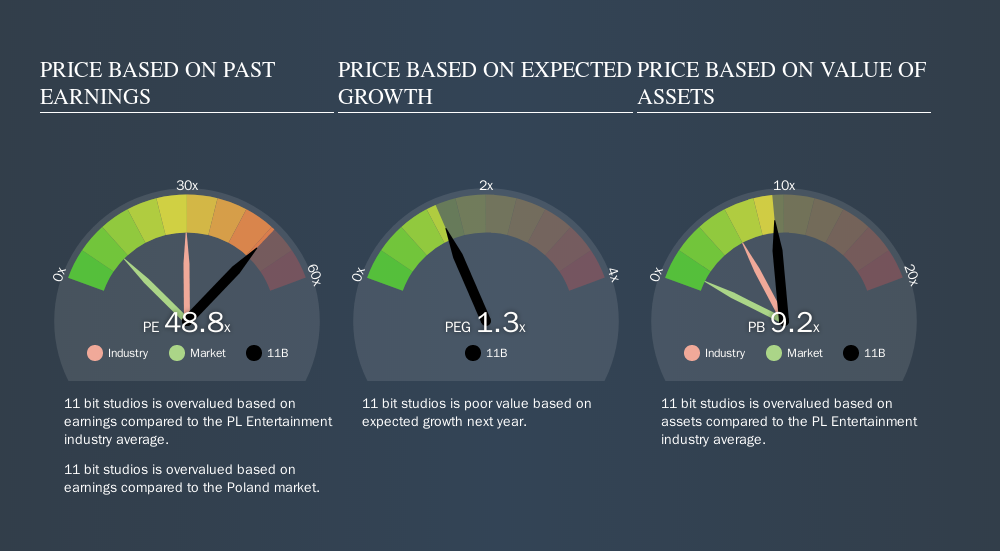

The P/E ratio indicates whether the market has higher or lower expectations of a company. As you can see below, 11 bit studios has a higher P/E than the average company (29) in the entertainment industry.

That means that the market expects 11 bit studios will outperform other companies in its industry.

How Growth Rates Impact P/E Ratios

Earnings growth rates have a big influence on P/E ratios. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

11 bit studios saw earnings per share decrease by 33% last year. But EPS is up 22% over the last 3 years.

Remember: P/E Ratios Don't Consider The Balance Sheet

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. Thus, the metric does not reflect cash or debt held by the company. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

11 bit studios's Balance Sheet

11 bit studios has net cash of zł58m. That should lead to a higher P/E than if it did have debt, because its strong balance sheets gives it more options.

The Verdict On 11 bit studios's P/E Ratio

11 bit studios trades on a P/E ratio of 48.8, which is multiples above its market average of 10.4. The recent drop in earnings per share might keep value investors away, but the healthy balance sheet means the company retains potential for future growth. If fails to eventuate, the current high P/E could prove to be temporary, as the share price falls.

When the market is wrong about a stock, it gives savvy investors an opportunity. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

You might be able to find a better buy than 11 bit studios. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About WSE:11B

11 bit studios

Engages in the production and sale of cross-platform computer games worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives