What You Can Learn From Mahindra EPC Irrigation Limited's (NSE:MAHEPC) P/E

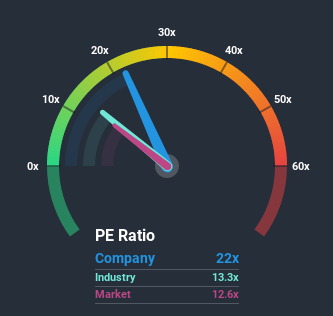

With a price-to-earnings (or "P/E") ratio of 22x Mahindra EPC Irrigation Limited (NSE:MAHEPC) may be sending very bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 12x and even P/E's lower than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Mahindra EPC Irrigation certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Mahindra EPC Irrigation

Where Does Mahindra EPC Irrigation's P/E Sit Within Its Industry?

An inspection of average P/E's throughout Mahindra EPC Irrigation's industry may help to explain its particularly high P/E ratio. The image below shows that the Machinery industry as a whole has a P/E ratio similar to the market. So we'd say there is little merit in the premise that the company's ratio being shaped by its industry at this time. In the context of the Machinery industry's current setting, most of its constituents' P/E's would be expected to be held back. However, what is happening on the company's own income statement is the most important factor to its P/E.

How Is Mahindra EPC Irrigation's Growth Trending?

Mahindra EPC Irrigation's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 103%. Pleasingly, EPS has also lifted 132% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 6.8% shows it's a great look while it lasts.

With this information, we can see why Mahindra EPC Irrigation is trading at a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse. Nonetheless, with most other businesses facing an uphill battle, staying on its current earnings path is no certainty.

What We Can Learn From Mahindra EPC Irrigation's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Mahindra EPC Irrigation maintains its high P/E on the strength of its recentthree-year growth beating forecasts for a struggling market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader market turmoil. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Mahindra EPC Irrigation that you should be aware of.

If you're unsure about the strength of Mahindra EPC Irrigation's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you’re looking to trade Mahindra EPC Irrigation, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

If you're looking to trade Mahindra EPC Irrigation, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:MAHEPC

Mahindra EPC Irrigation

Manufactures, sells, and markets micro irrigation systems in India and Uganda.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives