- United States

- /

- Tech Hardware

- /

- NasdaqGS:AAPL

What We Learnt About Apple's (NASDAQ:AAPL) CEO Pay

Tim Cook became the CEO of Apple Inc. (NASDAQ:AAPL) in 2011, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Apple.

See our latest analysis for Apple

Comparing Apple Inc.'s CEO Compensation With the industry

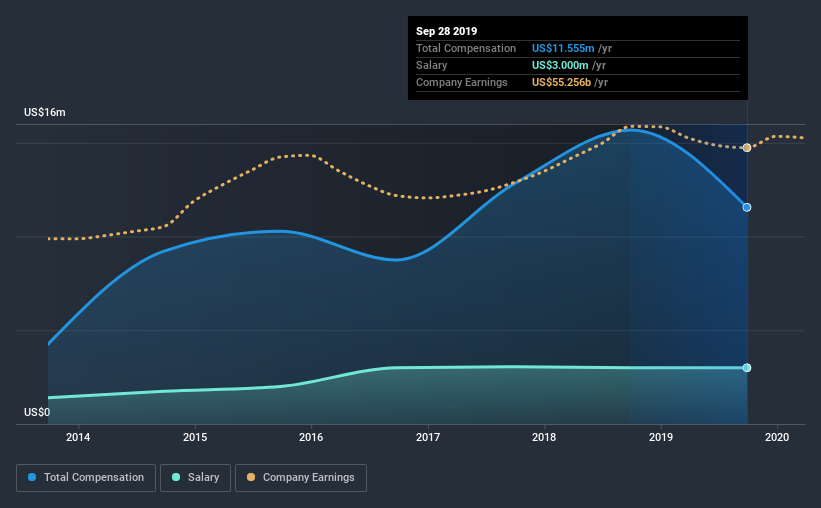

According to our data, Apple Inc. has a market capitalization of US$1.5t, and paid its CEO total annual compensation worth US$12m over the year to September 2019. We note that's a decrease of 26% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$3.0m.

In comparison with other companies in the industry with market capitalizations over US$8.0b , the reported median total CEO compensation was US$9.4m. This suggests that Apple remunerates its CEO largely in line with the industry average. What's more, Tim Cook holds US$300m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Talking in terms of the industry, salary represented approximately 21% of total compensation out of all the companies we analyzed, while other remuneration made up 79% of the pie. Apple pays out 26% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Apple Inc.'s Growth

Apple Inc. has seen its earnings per share (EPS) increase by 14% a year over the past three years. Its revenue is up 3.7% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Apple Inc. Been A Good Investment?

Most shareholders would probably be pleased with Apple Inc. for providing a total return of 156% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we touched on above, Apple Inc. is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. The company is growing earnings per share and total shareholder returns have been pleasing. So one could argue that CEO compensation is quite modest, if you consider company performance! In fact, shareholders might even think the CEO deserves a raise as a reward due to the fantastic returns generated.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 2 warning signs for Apple that investors should be aware of in a dynamic business environment.

Important note: Apple is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Apple or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:AAPL

Apple

Designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

EchoStar Corporation (SATS): The Spectrum Sovereign – Orchestrating the Great Satellite-to-5G Pivot

Netflix (NFLX): The Discipline Play – Capitalizing on Content Scale and Strategic Restraint

Vertex Pharmaceuticals (VRTX): The Diversification Juggernaut – Beyond the CF Monopoly

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks