- Canada

- /

- Commercial Services

- /

- TSXV:COO

What Kind Of Shareholder Appears On The NatureBank Asset Management Inc.'s (CVE:COO) Shareholder Register?

Every investor in NatureBank Asset Management Inc. (CVE:COO) should be aware of the most powerful shareholder groups. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

NatureBank Asset Management is not a large company by global standards. It has a market capitalization of CA$926k, which means it wouldn't have the attention of many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutional investors have not yet purchased shares. We can zoom in on the different ownership groups, to learn more about NatureBank Asset Management.

See our latest analysis for NatureBank Asset Management

What Does The Lack Of Institutional Ownership Tell Us About NatureBank Asset Management?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

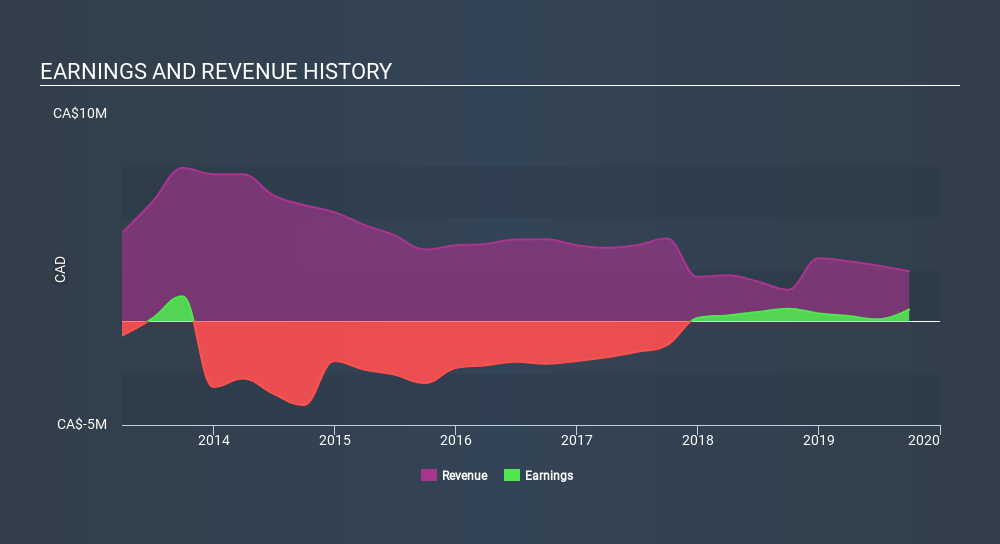

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to fund under management, so the institition does not bother to look closely at the company. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of NatureBank Asset Management, for yourself, below.

NatureBank Asset Management is not owned by hedge funds. Forest Finance Service GmbH is currently the company's largest shareholder with 24% of shares outstanding. WBZ GmbH is the second largest shareholder with 18% of common stock, followed by Guy O'Loughnane, holding 6.7% of the stock. Guy O'Loughnane also happens to hold the title of Member of the Board of Directors.

Additionally, we found that 55% of the shares are owned by the top 4 shareholders. In other words, these shareholders have a meaningful say in the decisions of the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of NatureBank Asset Management

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

It seems insiders own a significant proportion of NatureBank Asset Management Inc.. It has a market capitalization of just CA$926k, and insiders have CA$162k worth of shares in their own names. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

With a 40% ownership, the general public have some degree of sway over COO. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

Our data indicates that Private Companies hold 43%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand NatureBank Asset Management better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 7 warning signs with NatureBank Asset Management (at least 3 which can't be ignored) , and understanding them should be part of your investment process.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:COO

Ostrom Climate Solutions

Provides carbon project development and management, and climate solutions in Canada, Europe, the United States, and internationally.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion