- Greece

- /

- Hospitality

- /

- ATSE:LAMPS

What Does Lampsa Hellenic Hotels S.A.'s (ATH:LAMPS) P/E Ratio Tell You?

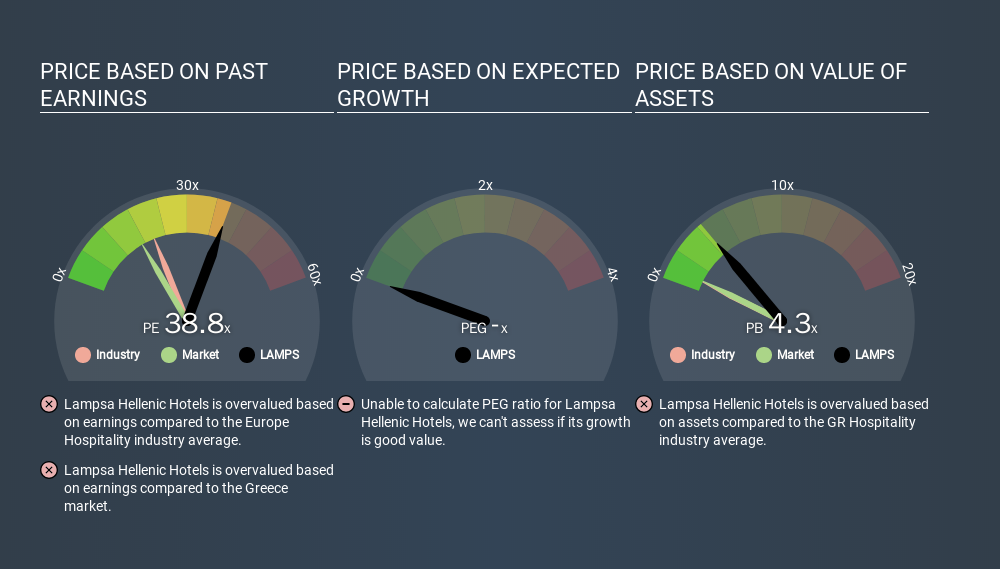

Today, we'll introduce the concept of the P/E ratio for those who are learning about investing. We'll look at Lampsa Hellenic Hotels S.A.'s (ATH:LAMPS) P/E ratio and reflect on what it tells us about the company's share price. Lampsa Hellenic Hotels has a P/E ratio of 38.84, based on the last twelve months. In other words, at today's prices, investors are paying €38.84 for every €1 in prior year profit.

See our latest analysis for Lampsa Hellenic Hotels

How Do I Calculate A Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for Lampsa Hellenic Hotels:

P/E of 38.84 = EUR20.40 ÷ EUR0.53 (Based on the trailing twelve months to June 2019.)

Is A High Price-to-Earnings Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

Does Lampsa Hellenic Hotels Have A Relatively High Or Low P/E For Its Industry?

We can get an indication of market expectations by looking at the P/E ratio. You can see in the image below that the average P/E (20.5) for companies in the hospitality industry is lower than Lampsa Hellenic Hotels's P/E.

That means that the market expects Lampsa Hellenic Hotels will outperform other companies in its industry. The market is optimistic about the future, but that doesn't guarantee future growth. So investors should always consider the P/E ratio alongside other factors, such as whether company directors have been buying shares.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. Earnings growth means that in the future the 'E' will be higher. That means even if the current P/E is high, it will reduce over time if the share price stays flat. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

Notably, Lampsa Hellenic Hotels grew EPS by a whopping 32% in the last year. And earnings per share have improved by 36% annually, over the last five years. I'd therefore be a little surprised if its P/E ratio was not relatively high.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. In other words, it does not consider any debt or cash that the company may have on the balance sheet. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

How Does Lampsa Hellenic Hotels's Debt Impact Its P/E Ratio?

Lampsa Hellenic Hotels has net debt worth 20% of its market capitalization. This could bring some additional risk, and reduce the number of investment options for management; worth remembering if you compare its P/E to businesses without debt.

The Verdict On Lampsa Hellenic Hotels's P/E Ratio

Lampsa Hellenic Hotels trades on a P/E ratio of 38.8, which is above its market average of 17.0. While the company does use modest debt, its recent earnings growth is superb. So on this analysis a high P/E ratio seems reasonable.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. Although we don't have analyst forecasts you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ATSE:LAMPS

Lampsa Hellenic Hotels

Operates hotels primarily in Greece, Cyprus, and Serbia.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives