- United States

- /

- Construction

- /

- NasdaqGS:MTRX

What Do The Returns At Matrix Service (NASDAQ:MTRX) Mean Going Forward?

There are a few key trends to look for if we want to identify the next multi-bagger. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So when we looked at Matrix Service (NASDAQ:MTRX) and its trend of ROCE, we really liked what we saw.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Matrix Service, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.098 = US$34m ÷ (US$567m - US$224m) (Based on the trailing twelve months to March 2020).

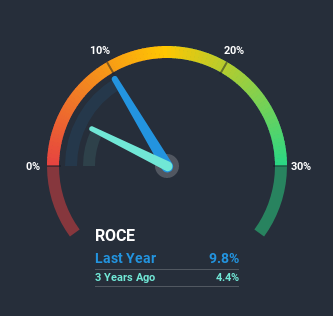

Thus, Matrix Service has an ROCE of 9.8%. In absolute terms, that's a low return, but it's much better than the Energy Services industry average of 5.7%.

Check out our latest analysis for Matrix Service

Above you can see how the current ROCE for Matrix Service compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Matrix Service.

The Trend Of ROCE

Matrix Service has not disappointed with their ROCE growth. Looking at the data, we can see that even though capital employed in the business has remained relatively flat, the ROCE generated has risen by 328% over the last five years. So our take on this is that the business has increased efficiencies to generate these higher returns, all the while not needing to make any additional investments. The company is doing well in that sense, and it's worth investigating what the management team has planned for long term growth prospects.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 39%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. Therefore we can rest assured that the growth in ROCE is a result of the business' fundamental improvements, rather than a cooking class featuring this company's books.The Bottom Line On Matrix Service's ROCE

In summary, we're delighted to see that Matrix Service has been able to increase efficiencies and earn higher rates of return on the same amount of capital. Astute investors may have an opportunity here because the stock has declined 61% in the last five years. So researching this company further and determining whether or not these trends will continue seems justified.

One more thing, we've spotted 1 warning sign facing Matrix Service that you might find interesting.

While Matrix Service may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade Matrix Service, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:MTRX

Matrix Service

Provides engineering, fabrication, construction, and maintenance services to support critical energy infrastructure and industrial markets in the United States, Canada, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Strong buy

Proximus The Amplify Reset, State-Backed, Debt-Disciplined, and Building Toward €400M FCF by 2030

Delta Air Lines Inc. (DAL): The Premium Powerhouse – Scaling Loyalty and International Dominance in 2026

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion