- India

- /

- Metals and Mining

- /

- NSEI:TATAMETALI

What Did Tata Metaliks' (NSE:TATAMETALI) CEO Take Home Last Year?

This article will reflect on the compensation paid to Sandeep Kumar who has served as CEO of Tata Metaliks Limited (NSE:TATAMETALI) since 2017. This analysis will also assess whether Tata Metaliks pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Tata Metaliks

Comparing Tata Metaliks Limited's CEO Compensation With the industry

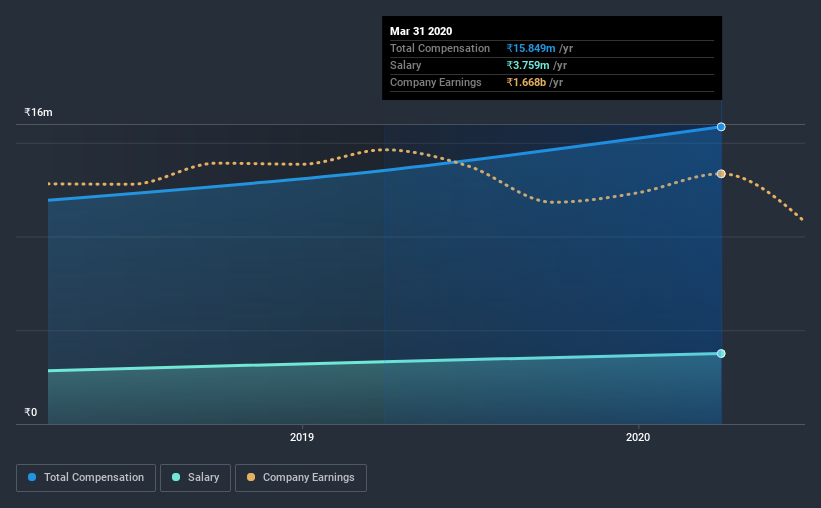

Our data indicates that Tata Metaliks Limited has a market capitalization of ₹14b, and total annual CEO compensation was reported as ₹16m for the year to March 2020. That's a notable increase of 17% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at ₹3.8m.

For comparison, other companies in the same industry with market capitalizations ranging between ₹7.4b and ₹29b had a median total CEO compensation of ₹31m. In other words, Tata Metaliks pays its CEO lower than the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹3.8m | ₹3.3m | 24% |

| Other | ₹12m | ₹10m | 76% |

| Total Compensation | ₹16m | ₹14m | 100% |

Speaking on an industry level, nearly 99% of total compensation represents salary, while the remainder of 1.2% is other remuneration. It's interesting to note that Tata Metaliks allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Tata Metaliks Limited's Growth

Tata Metaliks Limited's earnings per share (EPS) grew 2.4% per year over the last three years. It saw its revenue drop 19% over the last year.

We would argue that the lack of revenue growth in the last year is less than ideal, but it is good to see a modest EPS growth at least. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Tata Metaliks Limited Been A Good Investment?

Since shareholders would have lost about 23% over three years, some Tata Metaliks Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we noted earlier, Tata Metaliks pays its CEO lower than the norm for similar-sized companies belonging to the same industry. But the company isn't growing and total shareholder returns have been disappointing. So while we don't think, Sandeep is paid too much, shareholders may hope that business performance translates to investment returns before pay rises are given out.

Shareholders may want to check for free if Tata Metaliks insiders are buying or selling shares.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Tata Metaliks, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tata Metaliks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:TATAMETALI

Tata Metaliks

Tata Metaliks Limited engages in the manufacture and sale of pig iron and ductile iron pipes in India and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026