Darin Rayburn has been the CEO of Melcor Developments Ltd. (TSE:MRD) since 2017. First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Melcor Developments

How Does Darin Rayburn's Compensation Compare With Similar Sized Companies?

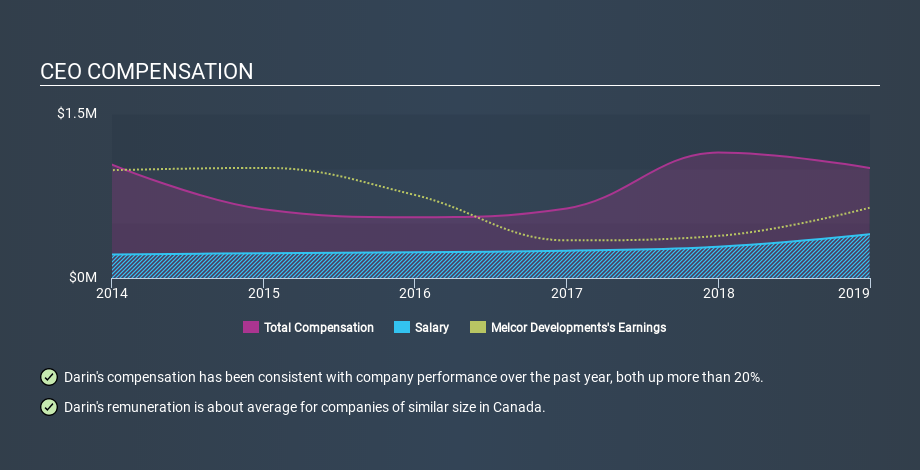

According to our data, Melcor Developments Ltd. has a market capitalization of CA$246m, and paid its CEO total annual compensation worth CA$1.0m over the year to December 2018. While we always look at total compensation first, we note that the salary component is less, at CA$400k. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. We examined companies with market caps from CA$140m to CA$559m, and discovered that the median CEO total compensation of that group was CA$1.0m.

Next, let's break down remuneration compositions to understand how the industry and company compare with each other. Speaking on an industry level, we can see that nearly 54% of total compensation represents salary, while the remainder of 46% is other remuneration. Melcor Developments does not set aside a larger portion of remuneration in the form of salary, maintaining the same rate as the wider market.

So Darin Rayburn receives a similar amount to the median CEO pay, amongst the companies we looked at. Although this fact alone doesn't tell us a great deal, it becomes more relevant when considered against the business performance. You can see a visual representation of the CEO compensation at Melcor Developments, below.

Is Melcor Developments Ltd. Growing?

On average over the last three years, Melcor Developments Ltd. has seen earnings per share (EPS) move in a favourable direction by 23% each year (using a line of best fit). It saw its revenue drop 20% over the last year.

This demonstrates that the company has been improving recently. A good result. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. It could be important to check this free visual depiction of what analysts expect for the future.

Has Melcor Developments Ltd. Been A Good Investment?

With a three year total loss of 48%, Melcor Developments Ltd. would certainly have some dissatisfied shareholders. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

Darin Rayburn is paid around what is normal for the leaders of comparable size companies.

We'd say the company can boast of its EPS growth, but we cannot say the same about the lacklustre shareholder returns (over the last three years). Considering the the positives we don't think the CEO pays is too high, but it's certainly hard to argue it is too low. Taking a breather from CEO compensation, we've spotted 4 warning signs for Melcor Developments (of which 2 are significant!) you should know about in order to have a holistic understanding of the stock.

Important note: Melcor Developments may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSX:MRD

Melcor Developments

Operates as a real estate development company in the United States and Canada.

Flawless balance sheet and fair value.

Market Insights

Community Narratives