- United States

- /

- Biotech

- /

- NasdaqGS:ACAD

What Can We Learn About ACADIA Pharmaceuticals' (NASDAQ:ACAD) CEO Compensation?

Steve Davis has been the CEO of ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) since 2015, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for ACADIA Pharmaceuticals.

View our latest analysis for ACADIA Pharmaceuticals

Comparing ACADIA Pharmaceuticals Inc.'s CEO Compensation With the industry

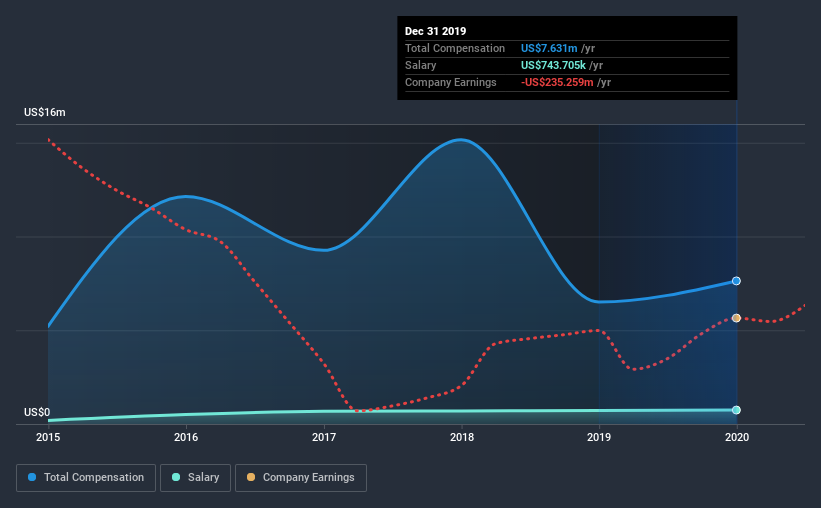

According to our data, ACADIA Pharmaceuticals Inc. has a market capitalization of US$6.0b, and paid its CEO total annual compensation worth US$7.6m over the year to December 2019. Notably, that's an increase of 17% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at US$744k.

In comparison with other companies in the industry with market capitalizations ranging from US$4.0b to US$12b, the reported median CEO total compensation was US$6.5m. This suggests that ACADIA Pharmaceuticals remunerates its CEO largely in line with the industry average. Furthermore, Steve Davis directly owns US$453k worth of shares in the company.

Talking in terms of the industry, salary represented approximately 23% of total compensation out of all the companies we analyzed, while other remuneration made up 77% of the pie. In ACADIA Pharmaceuticals' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

ACADIA Pharmaceuticals Inc.'s Growth

ACADIA Pharmaceuticals Inc.'s earnings per share (EPS) grew 16% per year over the last three years. It achieved revenue growth of 49% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has ACADIA Pharmaceuticals Inc. Been A Good Investment?

With a total shareholder return of 15% over three years, ACADIA Pharmaceuticals Inc. shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

As previously discussed, Steve is compensated close to the median for companies of its size, and which belong to the same industry. However, it's admirable that over the last three years, EPS growth for the company has been impressive, though the same can't be said for investor returns. Considering overall performance, we'd say the compensation is fair, although stockholders will want to see higher returns moving forward.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 2 warning signs for ACADIA Pharmaceuticals that investors should look into moving forward.

Switching gears from ACADIA Pharmaceuticals, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade ACADIA Pharmaceuticals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:ACAD

ACADIA Pharmaceuticals

A biopharmaceutical company, focuses on the development and commercialization of medicines for central nervous system (CNS) disorders and rare diseases in the United States.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Very Bullish

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

This strategic transformation of TTE? Significant re-rating potential

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.