- United Kingdom

- /

- Diversified Financial

- /

- AIM:PCIP

We're Keeping An Eye On PCI-PAL's (LON:PCIP) Cash Burn Rate

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should PCI-PAL (LON:PCIP) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business's cash, relative to its cash burn.

See our latest analysis for PCI-PAL

When Might PCI-PAL Run Out Of Money?

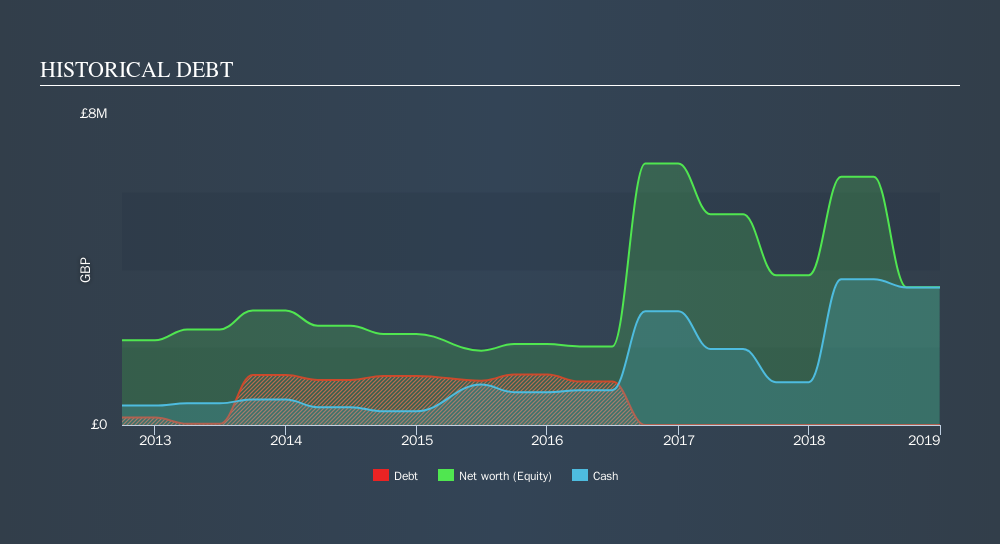

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When PCI-PAL last reported its balance sheet in December 2018, it had zero debt and cash worth UK£3.5m. Looking at the last year, the company burnt through UK£4.6m. That means it had a cash runway of around 9 months as of December 2018. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. Depicted below, you can see how its cash holdings have changed over time.

How Well Is PCI-PAL Growing?

Notably, PCI-PAL actually ramped up its cash burn very hard and fast in the last year, by 154%, signifying heavy investment in the business. But the silver lining is that operating revenue increased by 31% in that time. Considering both these factors, we're not particularly excited by its growth profile. In reality, this article only makes a short study of the company's growth data. This graph of historic revenue growth shows how PCI-PAL is building its business over time.

How Hard Would It Be For PCI-PAL To Raise More Cash For Growth?

Given the trajectory of PCI-PAL's cash burn, many investors will already be thinking about how it might raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of UK£11m, PCI-PAL's UK£4.6m in cash burn equates to about 40% of its market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

So, Should We Worry About PCI-PAL's Cash Burn?

On this analysis of PCI-PAL's cash burn, we think its revenue growth was reassuring, while its increasing cash burn has us a bit worried. After looking at that range of measures, we think shareholders should be extremely attentive to how the company is using its cash, as the cash burn makes us uncomfortable. Notably, our data indicates that PCI-PAL insiders have been trading the shares. You can discover if they are buyers or sellers by clicking on this link.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:PCIP

PCI-PAL

Through its subsidiaries, engages in the provision of payment card industry (PCI) compliance solutions and telephony services primarily in the United Kingdom, the United States, Canada, rest of Europe, and the Asia Pacific.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives