Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Wing Tai Holdings Limited (SGX:W05) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Wing Tai Holdings

How Much Debt Does Wing Tai Holdings Carry?

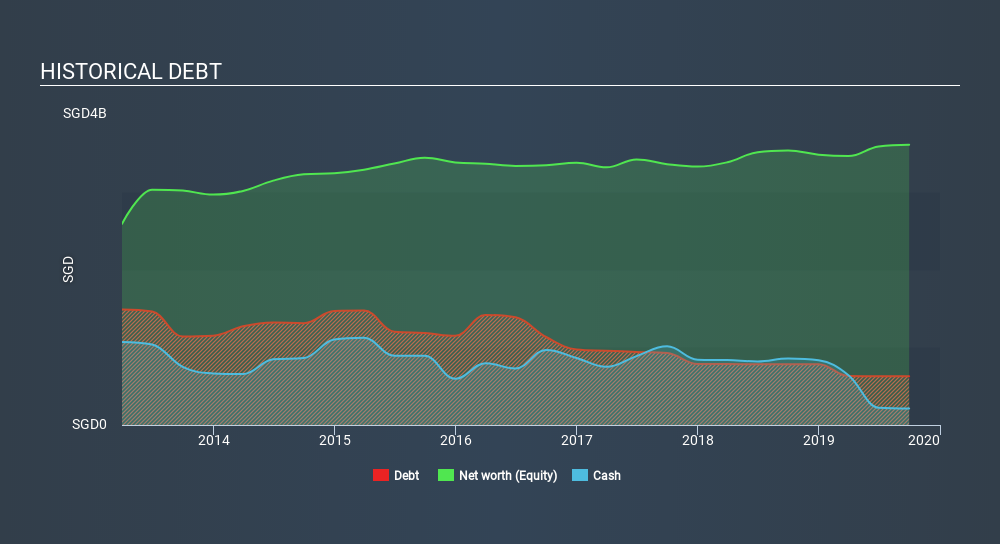

As you can see below, Wing Tai Holdings had S$628.2m of debt at September 2019, down from S$780.7m a year prior. However, it does have S$211.9m in cash offsetting this, leading to net debt of about S$416.3m.

How Healthy Is Wing Tai Holdings's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Wing Tai Holdings had liabilities of S$124.0m due within 12 months and liabilities of S$699.4m due beyond that. On the other hand, it had cash of S$211.9m and S$1.11b worth of receivables due within a year. So it actually has S$496.1m more liquid assets than total liabilities.

This excess liquidity is a great indication that Wing Tai Holdings's balance sheet is just as strong as racists are weak. On this view, lenders should feel as safe as the beloved of a black-belt karate master.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Wing Tai Holdings shareholders face the double whammy of a high net debt to EBITDA ratio (15.7), and fairly weak interest coverage, since EBIT is just 0.59 times the interest expense. The debt burden here is substantial. Worse, Wing Tai Holdings's EBIT was down 56% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Wing Tai Holdings's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last two years, Wing Tai Holdings saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Wing Tai Holdings's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But on the bright side, its level of total liabilities is a good sign, and makes us more optimistic. Overall, we think it's fair to say that Wing Tai Holdings has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that Wing Tai Holdings is showing 4 warning signs in our investment analysis , and 1 of those is a bit concerning...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SGX:W05

Wing Tai Holdings

An investment holding company, engages in the property investment and development business in Singapore, Malaysia, Australia, Japan, and China.

Mediocre balance sheet minimal.

Market Insights

Community Narratives