Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Kia Motors Corporation (KRX:000270) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Kia Motors

How Much Debt Does Kia Motors Carry?

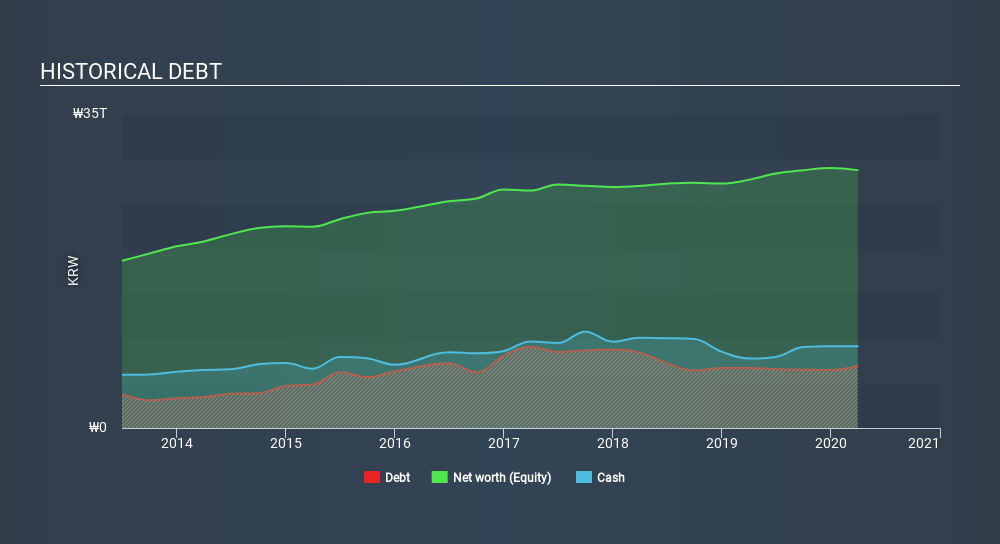

The chart below, which you can click on for greater detail, shows that Kia Motors had ₩6.95t in debt in March 2020; about the same as the year before. However, it does have ₩9.10t in cash offsetting this, leading to net cash of ₩2.15t.

How Strong Is Kia Motors's Balance Sheet?

According to the last reported balance sheet, Kia Motors had liabilities of ₩18t due within 12 months, and liabilities of ₩9.40t due beyond 12 months. Offsetting this, it had ₩9.10t in cash and ₩3.59t in receivables that were due within 12 months. So its liabilities total ₩14t more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's massive market capitalization of ₩13t, we think shareholders really should watch Kia Motors's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. Kia Motors boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total.

Another good sign is that Kia Motors has been able to increase its EBIT by 28% in twelve months, making it easier to pay down debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Kia Motors can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Kia Motors has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Kia Motors generated free cash flow amounting to a very robust 87% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Summing up

Although Kia Motors's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of ₩2.15t. And it impressed us with free cash flow of ₩2.4t, being 87% of its EBIT. So we are not troubled with Kia Motors's debt use. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Kia Motors's dividend history, without delay!

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Kia Motors or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A000270

Kia

Manufactures and sells vehicles in South Korea, North America, and Europe.

Very undervalued with flawless balance sheet and pays a dividend.