- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A126700

3 Dividend Stocks To Consider With Up To 4.5% Yield

Reviewed by Simply Wall St

As global markets navigate the uncertainties of policy shifts under the incoming Trump administration, investors are closely watching sector performances and interest rate expectations. Amidst this backdrop, dividend stocks can offer a stable income stream, providing potential resilience in volatile market conditions. A good dividend stock typically combines a strong yield with consistent earnings and a solid financial foundation, making it an attractive option for those seeking steady returns amidst economic fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.12% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.76% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.77% | ★★★★★☆ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

HyVision System (KOSDAQ:A126700)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HyVision System Inc focuses on developing, supplying, and selling testers and smart components, with a market cap of ₩203.66 billion.

Operations: HyVision System Inc generates revenue primarily from its Camera Module Sales, amounting to ₩37.06 billion.

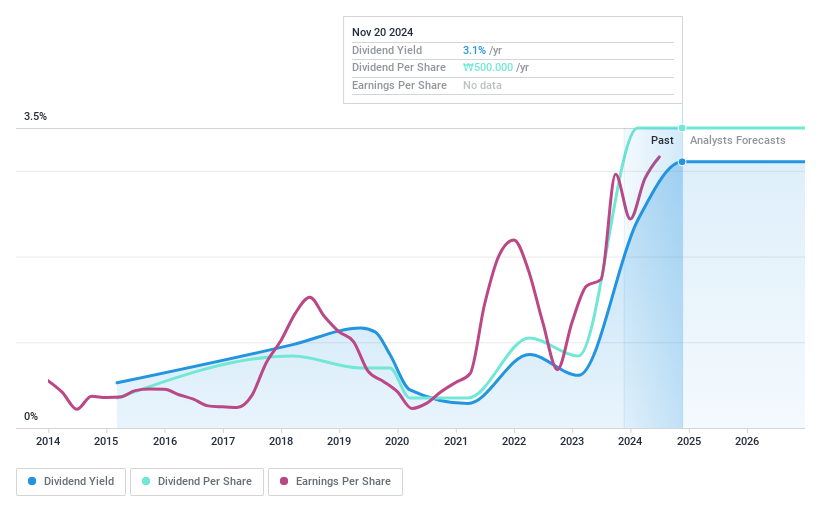

Dividend Yield: 3.1%

HyVision System's dividend payments are well-covered by earnings and cash flows, with low payout ratios of 11.1% and 10.9%, respectively, indicating sustainability. Despite a history of volatility in its dividends over the past decade, the company has managed to increase its payouts during this period. However, its current dividend yield of 3.11% is below the top tier in South Korea's market. The stock trades significantly below estimated fair value, suggesting potential for appreciation beyond dividends alone.

- Click here and access our complete dividend analysis report to understand the dynamics of HyVision System.

- In light of our recent valuation report, it seems possible that HyVision System is trading behind its estimated value.

JB Financial Group (KOSE:A175330)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Financial Group Co., Ltd. operates through its subsidiaries to offer banking products and services both in South Korea and internationally, with a market cap of approximately ₩3.46 trillion.

Operations: The revenue segments for JB Financial Group Co., Ltd. include the Banking Sector at ₩1.18 trillion, the Capital Segment at ₩375.05 billion, and the Asset Management Division at ₩20.19 billion.

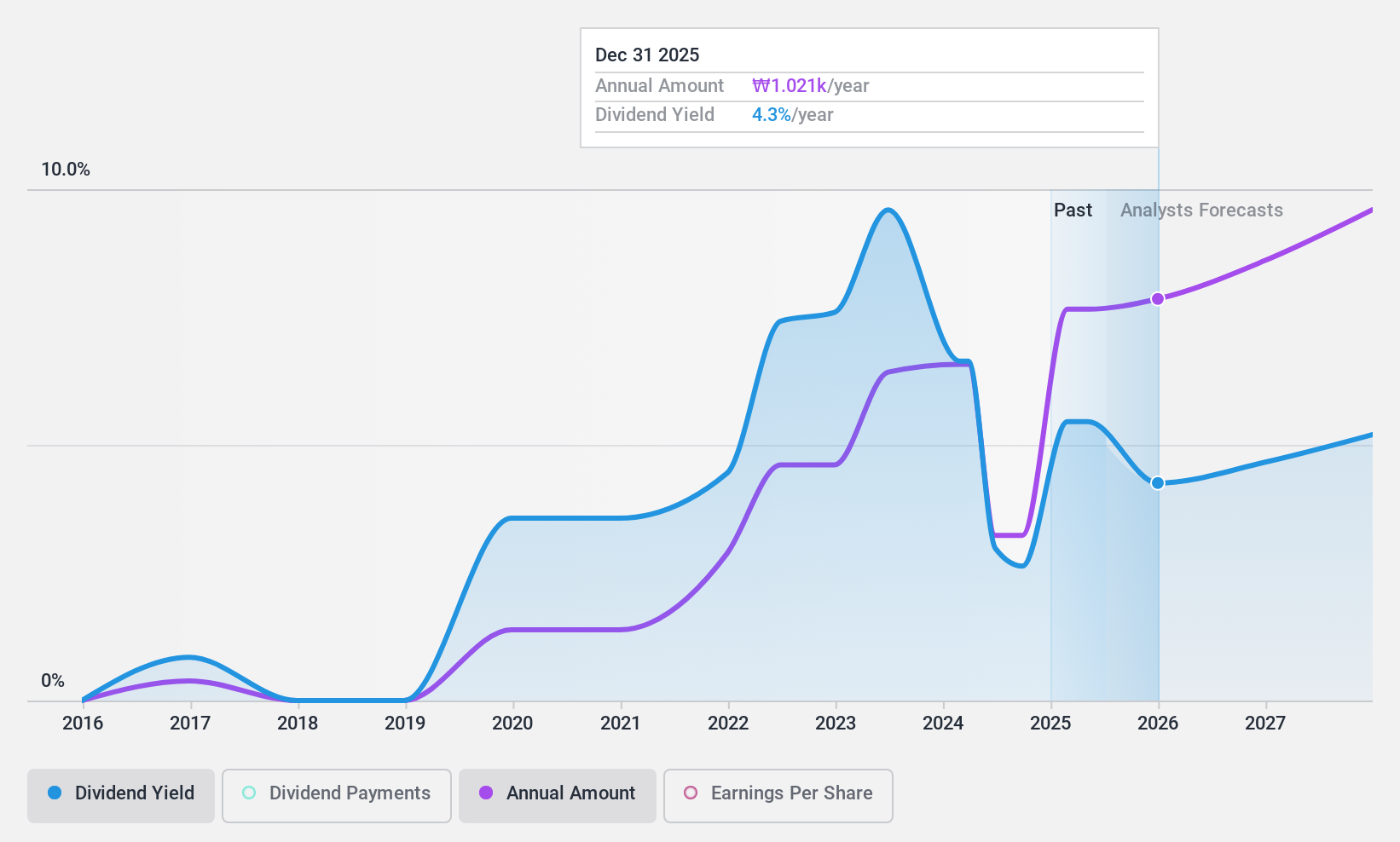

Dividend Yield: 4.6%

JB Financial Group's dividend payments are well-covered by a low payout ratio of 33.7%, suggesting sustainability, and are forecast to remain covered in three years. The company has consistently increased dividends over its nine-year history with minimal volatility. Its current yield of 4.56% ranks in the top quarter among Korean dividend payers, while the stock trades significantly below estimated fair value, offering potential for capital appreciation alongside income returns. Recent share buybacks may also enhance shareholder value.

- Unlock comprehensive insights into our analysis of JB Financial Group stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of JB Financial Group shares in the market.

Sinko Industries (TSE:6458)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sinko Industries Ltd. manufactures, sells, and installs air conditioning equipment in Japan and internationally, with a market cap of ¥96.60 billion.

Operations: Sinko Industries Ltd. generates revenue through its manufacturing, sales, and installation of air conditioning equipment both domestically and internationally.

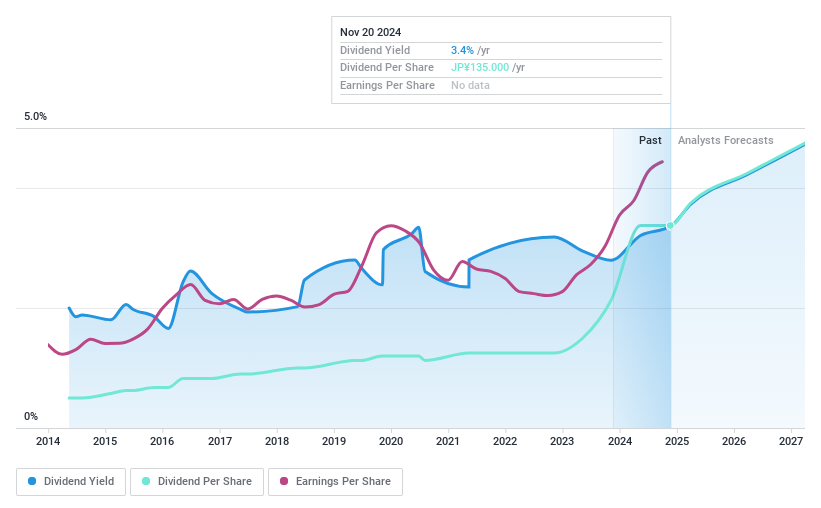

Dividend Yield: 3.4%

Sinko Industries' recent dividend increase to JPY 54.00 per share for Q2 reflects a strong earnings coverage with a payout ratio of 22.5%, indicating sustainability despite a volatile share price. However, the year-end dividend guidance suggests a decrease to JPY 32.00 per share, down from JPY 70.00 last year, highlighting potential caution in future payouts. The company has consistently maintained reliable dividends over the past decade and recently completed significant share buybacks worth ¥2 billion, potentially enhancing shareholder value.

- Delve into the full analysis dividend report here for a deeper understanding of Sinko Industries.

- The valuation report we've compiled suggests that Sinko Industries' current price could be quite moderate.

Summing It All Up

- Gain an insight into the universe of 1963 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HyVision System might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A126700

HyVision System

Primarily develops, supplies, and sells testers and smart components.

Flawless balance sheet average dividend payer.