- Hong Kong

- /

- Renewable Energy

- /

- SEHK:902

We Think Huaneng Power International (HKG:902) Is Taking Some Risk With Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Huaneng Power International, Inc. (HKG:902) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Huaneng Power International

How Much Debt Does Huaneng Power International Carry?

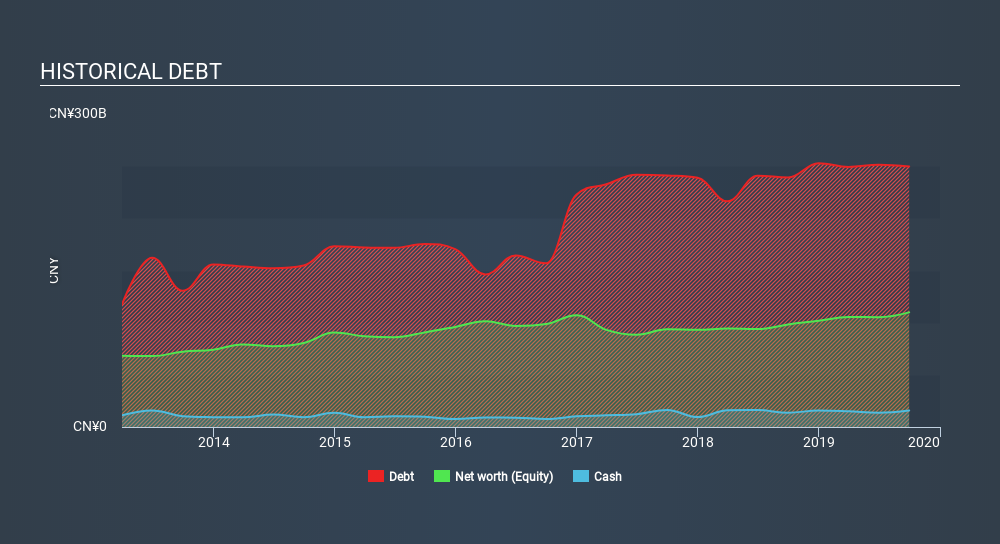

You can click the graphic below for the historical numbers, but it shows that as of September 2019 Huaneng Power International had CN¥249.4b of debt, an increase on CN¥239.2b, over one year. However, because it has a cash reserve of CN¥15.9b, its net debt is less, at about CN¥233.5b.

How Strong Is Huaneng Power International's Balance Sheet?

The latest balance sheet data shows that Huaneng Power International had liabilities of CN¥142.3b due within a year, and liabilities of CN¥152.5b falling due after that. Offsetting these obligations, it had cash of CN¥15.9b as well as receivables valued at CN¥29.6b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥249.3b.

This deficit casts a shadow over the CN¥75.9b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Huaneng Power International would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 2.0 times and a disturbingly high net debt to EBITDA ratio of 6.3 hit our confidence in Huaneng Power International like a one-two punch to the gut. The debt burden here is substantial. On a lighter note, we note that Huaneng Power International grew its EBIT by 22% in the last year. If sustained, this growth should make that debt evaporate like a scarce drinking water during an unnaturally hot summer. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Huaneng Power International can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Huaneng Power International's free cash flow amounted to 44% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

To be frank both Huaneng Power International's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at growing its EBIT; that's encouraging. Overall, it seems to us that Huaneng Power International's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Huaneng Power International is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:902

Huaneng Power International

Generates and sells electric power to the regional or provincial grid companies in the People’s Republic of China and internationally.

Good value with acceptable track record.

Market Insights

Community Narratives