David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Energy One Limited (ASX:EOL) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Energy One

What Is Energy One's Net Debt?

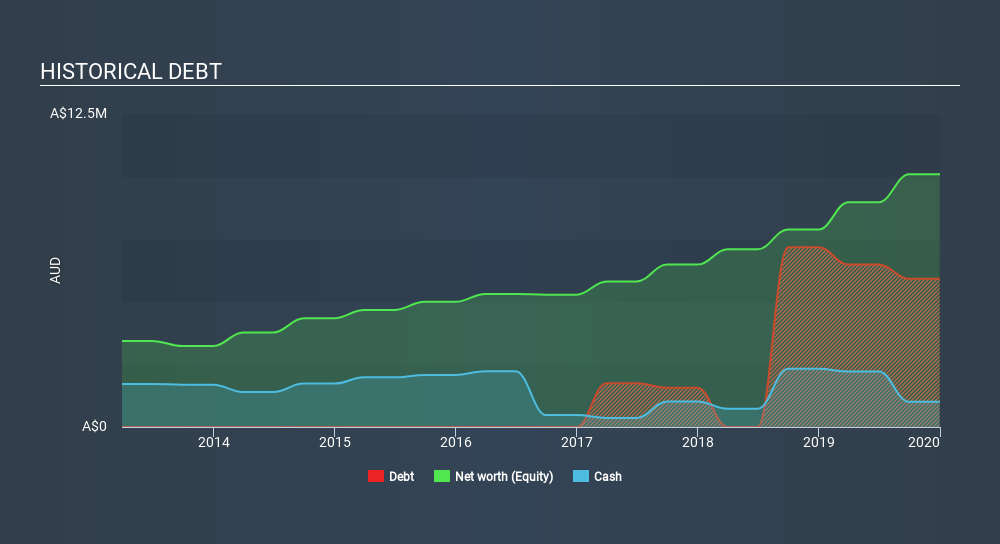

As you can see below, Energy One had AU$5.92m of debt at December 2019, down from AU$7.18m a year prior. On the flip side, it has AU$1.00m in cash leading to net debt of about AU$4.91m.

How Strong Is Energy One's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Energy One had liabilities of AU$8.41m due within 12 months and liabilities of AU$7.22m due beyond that. On the other hand, it had cash of AU$1.00m and AU$5.29m worth of receivables due within a year. So its liabilities total AU$9.34m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Energy One has a market capitalization of AU$35.5m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

We'd say that Energy One's moderate net debt to EBITDA ratio ( being 1.7), indicates prudence when it comes to debt. And its strong interest cover of 10.1 times, makes us even more comfortable. In addition to that, we're happy to report that Energy One has boosted its EBIT by 44%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But it is Energy One's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Energy One's free cash flow amounted to 49% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

Energy One's EBIT growth rate suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its interest cover is also very heartening. When we consider the range of factors above, it looks like Energy One is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for Energy One you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:EOL

Energy One

Provides software products, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets in the Australasia, and Europe.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives