- Hong Kong

- /

- Basic Materials

- /

- SEHK:1313

We Think China Resources Cement Holdings (HKG:1313) Can Manage Its Debt With Ease

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that China Resources Cement Holdings Limited (HKG:1313) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for China Resources Cement Holdings

What Is China Resources Cement Holdings's Debt?

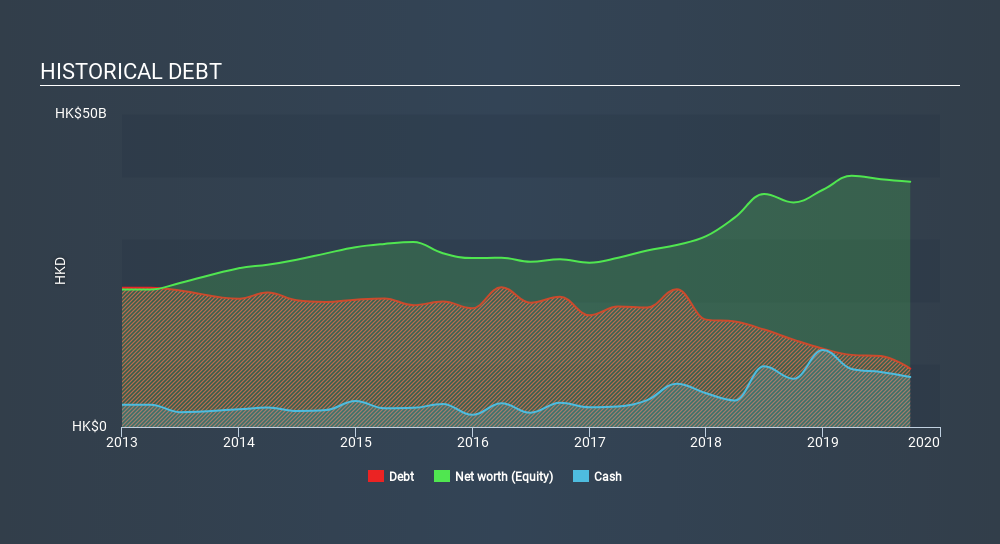

As you can see below, China Resources Cement Holdings had HK$9.17b of debt at September 2019, down from HK$14.0b a year prior. However, because it has a cash reserve of HK$7.98b, its net debt is less, at about HK$1.19b.

A Look At China Resources Cement Holdings's Liabilities

Zooming in on the latest balance sheet data, we can see that China Resources Cement Holdings had liabilities of HK$8.92b due within 12 months and liabilities of HK$9.85b due beyond that. Offsetting these obligations, it had cash of HK$7.98b as well as receivables valued at HK$6.52b due within 12 months. So it has liabilities totalling HK$4.27b more than its cash and near-term receivables, combined.

Since publicly traded China Resources Cement Holdings shares are worth a total of HK$65.2b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With debt at a measly 0.095 times EBITDA and EBIT covering interest a whopping 29.5 times, it's clear that China Resources Cement Holdings is not a desperate borrower. Indeed relative to its earnings its debt load seems light as a feather. The good news is that China Resources Cement Holdings has increased its EBIT by 6.2% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine China Resources Cement Holdings's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, China Resources Cement Holdings generated free cash flow amounting to a very robust 87% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

China Resources Cement Holdings's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. Zooming out, China Resources Cement Holdings seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check China Resources Cement Holdings's dividend history, without delay!

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1313

China Resources Building Materials Technology Holdings

An investment holding company, manufactures and sells cement, concrete, aggregates, and related products and services in Mainland China.

Moderate growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives