Volatility 101: Should SoftTech Engineers (NSE:SOFTTECH) Shares Have Dropped 37%?

SoftTech Engineers Limited (NSE:SOFTTECH) shareholders should be happy to see the share price up 12% in the last month. But that is minimal compensation for the share price under-performance over the last year. In fact the stock is down 37% in the last year, well below the market return.

See our latest analysis for SoftTech Engineers

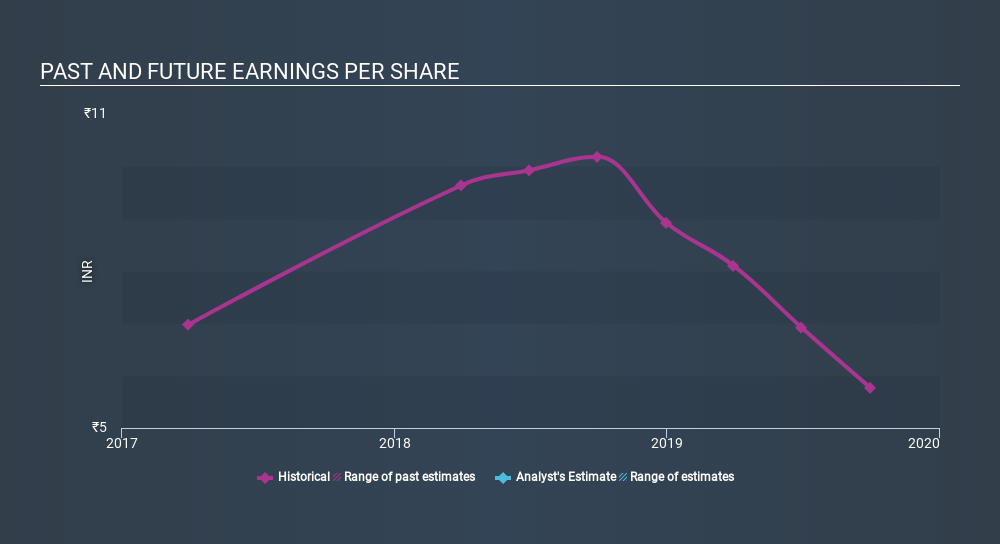

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately SoftTech Engineers reported an EPS drop of 43% for the last year. This proportional reduction in earnings per share isn't far from the 37% decrease in the share price. Therefore one could posit that the market has not become more concerned about the company, despite the lower EPS. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

SoftTech Engineers shareholders are down 36% for the year (even including dividends) , even worse than the market loss of 22%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 26% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with SoftTech Engineers (including 1 which is is a bit unpleasant) .

Of course SoftTech Engineers may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:SOFTTECH

SoftTech Engineers

Develops software products and solutions for the architecture, engineering, and construction sectors in India and internationally.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives