The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by PetroTal Corp. (CVE:TAL) shareholders over the last year, as the share price declined 42%. That contrasts poorly with the market return of -32%. We wouldn't rush to judgement on PetroTal because we don't have a long term history to look at. The share price has dropped 73% in three months. However, one could argue that the price has been influenced by the general market, which is down 35% in the same timeframe.

See our latest analysis for PetroTal

Because PetroTal made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

PetroTal grew its revenue by 784% over the last year. That's well above most other pre-profit companies. The share price drop of 42% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

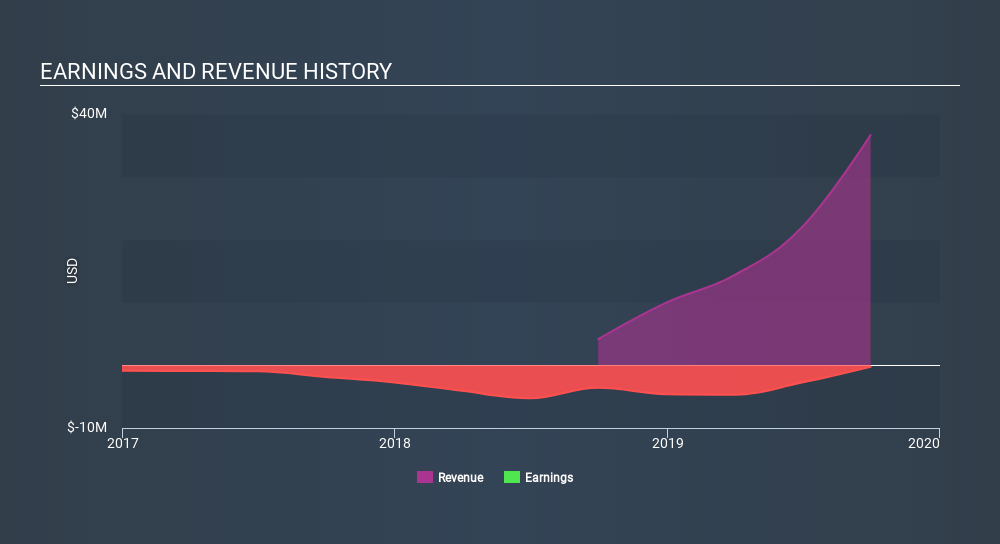

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We doubt PetroTal shareholders are happy with the loss of 42% over twelve months (even including dividends) . That falls short of the market, which lost 32%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's worth noting that the last three months did the real damage, with a 73% decline. So it seems like some holders have been dumping the stock of late - and that's not bullish. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with PetroTal (including 1 which is is potentially serious) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:TAL

PetroTal

Engages in the exploration, appraisal and development of oil and natural gas in Peru, South America.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives