- United States

- /

- Pharma

- /

- NasdaqGM:LGND

Volatility 101: Should Ligand Pharmaceuticals (NASDAQ:LGND) Shares Have Dropped 19%?

It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Ligand Pharmaceuticals Incorporated (NASDAQ:LGND) shareholders over the last year, as the share price declined 19%. That falls noticeably short of the market decline of around 0.6%. Zooming out, the stock is down 17% in the last three years. And the share price decline continued over the last week, dropping some 8.7%.

See our latest analysis for Ligand Pharmaceuticals

Ligand Pharmaceuticals isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In just one year Ligand Pharmaceuticals saw its revenue fall by 54%. If you think that's a particularly bad result, you're statistically on the money No surprise, then, that the share price fell 19% over the year. We would want to see improvements in the core business, and diminishing losses, before getting too excited about this one.

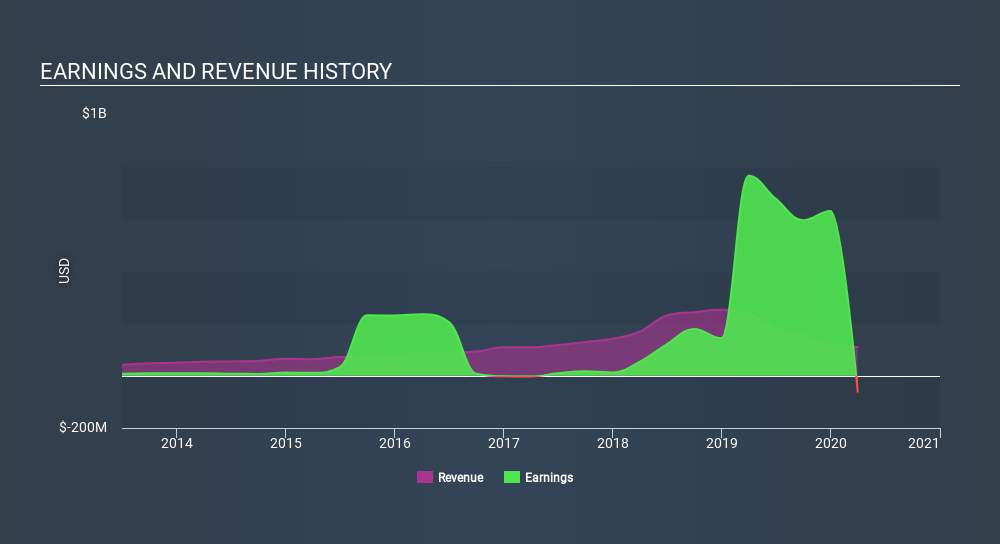

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market lost about 0.6% in the twelve months, Ligand Pharmaceuticals shareholders did even worse, losing 19%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 1.1% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Ligand Pharmaceuticals (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

Ligand Pharmaceuticals is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:LGND

Ligand Pharmaceuticals

A biopharmaceutical company, develops and licenses biopharmaceutical assets worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives