- United States

- /

- Capital Markets

- /

- NYSE:DFIN

Volatility 101: Should Donnelley Financial Solutions (NYSE:DFIN) Shares Have Dropped 43%?

Donnelley Financial Solutions, Inc. (NYSE:DFIN) shareholders should be happy to see the share price up 13% in the last month. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 43% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Check out our latest analysis for Donnelley Financial Solutions

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

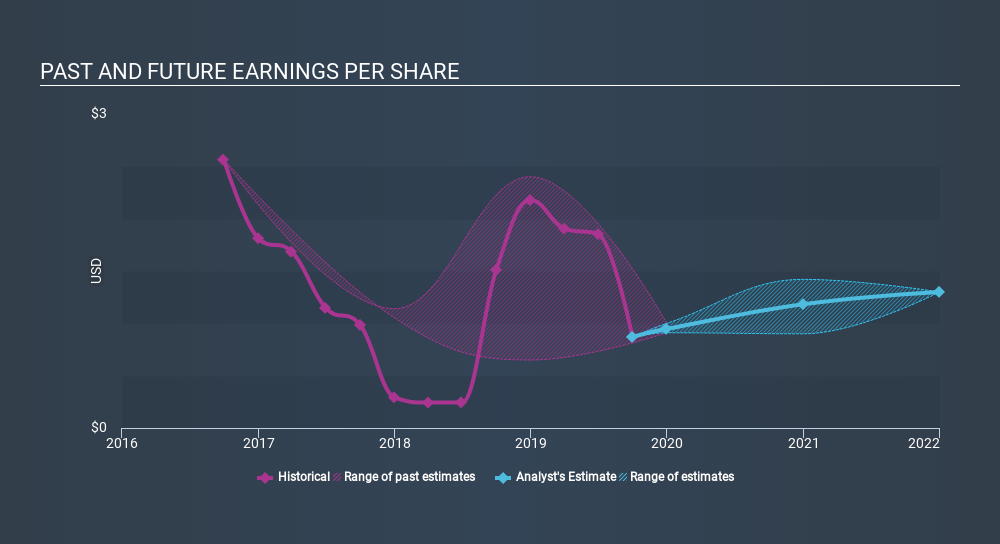

Donnelley Financial Solutions saw its EPS decline at a compound rate of 30% per year, over the last three years. This fall in the EPS is worse than the 17% compound annual share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Fundamentally, investors are buying a company's future earnings, but the stability of the business can influence the price they're willing to pay. For example, we've discovered 1 warning sign for Donnelley Financial Solutions which any shareholder or potential investor should be aware of.

A Different Perspective

Over the last year, Donnelley Financial Solutions shareholders took a loss of 18%. In contrast the market gained about 33%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 17% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Donnelley Financial Solutions by clicking this link.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:DFIN

Donnelley Financial Solutions

Provides innovative software and technology-enabled financial regulatory and compliance solutions in the United States, Asia, Europe, Canada, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives