- United States

- /

- Aerospace & Defense

- /

- NYSE:SPCE

Virgin Galactic Holdings (SPCE) Sees 34% Stock Surge in Past Month

Reviewed by Simply Wall St

Virgin Galactic Holdings (SPCE) experienced a significant price movement of 34% over the last month, influenced by the latest developments surrounding its space tourism ventures. During this period, the broader market remained relatively flat, with major indexes showing consistent performance following strong earnings from technology giants like Microsoft and Meta. While the market's stable trajectory persisted, Virgin Galactic's stock saw an upswing likely boosted by investor interest in the nascent commercial spaceflight sector and any potential positive corporate actions. This price movement demonstrates the company's unique positioning against the backdrop of general market conditions.

Over the past year, Virgin Galactic Holdings (SPCE) experienced a total shareholder return of 48.38% decline, indicating underperformance when compared to the broader US market and Aerospace & Defense industry, which posted returns of 15.7% and 35%, respectively. This decline highlights the volatility and challenges faced by the company amidst its ambitious space tourism endeavors and broader economic conditions.

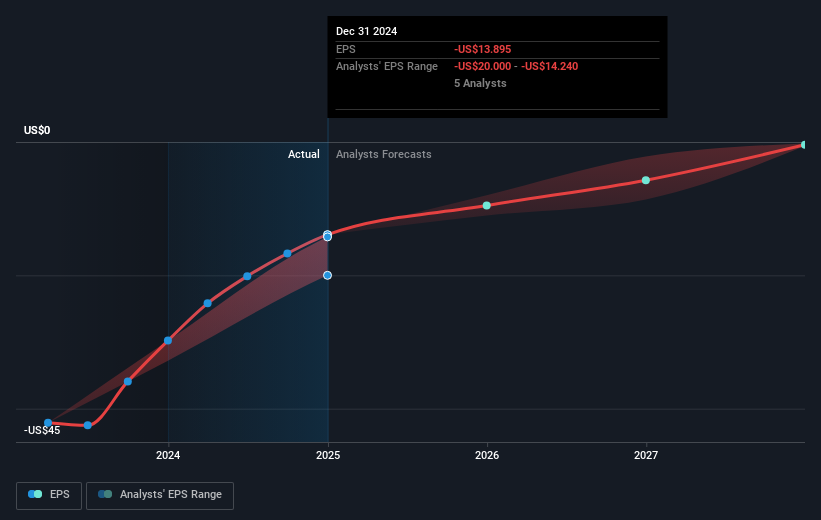

The short-term 34% surge in Virgin Galactic's stock price, influenced by recent space tourism developments, provides an interesting context for the company's longer-term financial trajectory. Over the past year, the revenue and earnings reports showed positive signs, with a reduction in net losses year-over-year and a revenue growth forecast significantly exceeding the industry average. However, the current share price of US$3.67, a substantial discount to the US$4.46 analyst consensus price target, suggests that investors remain cautious about future earnings potential and profitability, with the company not expected to achieve profitability in the next three years.

These elements contribute to the ongoing assessment of Virgin Galactic's position within the market, focusing on whether its pioneering efforts in commercial spaceflight can transition into sustainable financial performance and shareholder value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPCE

Virgin Galactic Holdings

An aerospace and space travel company, focuses on the development, manufacture, and operation of spaceships and related technologies.

High growth potential and good value.

Market Insights

Community Narratives