- United States

- /

- Specialized REITs

- /

- NYSE:VICI

VICI Properties (NYSE:VICI) Declares US$0.43 Quarterly Dividend for Shareholders

Reviewed by Simply Wall St

VICI Properties (NYSE:VICI) confirmed a regular quarterly cash dividend of $0.43 per share, reinforcing its commitment to shareholder value. Despite this announcement, VICI's share price remained flat over the last month, moving alongside broader market trends which showed resilience amid fluctuating economic indicators and strong corporate earnings. While major indices like the S&P 500 saw significant rallies, VICI's market performance was stable, suggesting that the dividend announcement provided investors with confidence but did not significantly impact the company's stock movements compared to larger market dynamics.

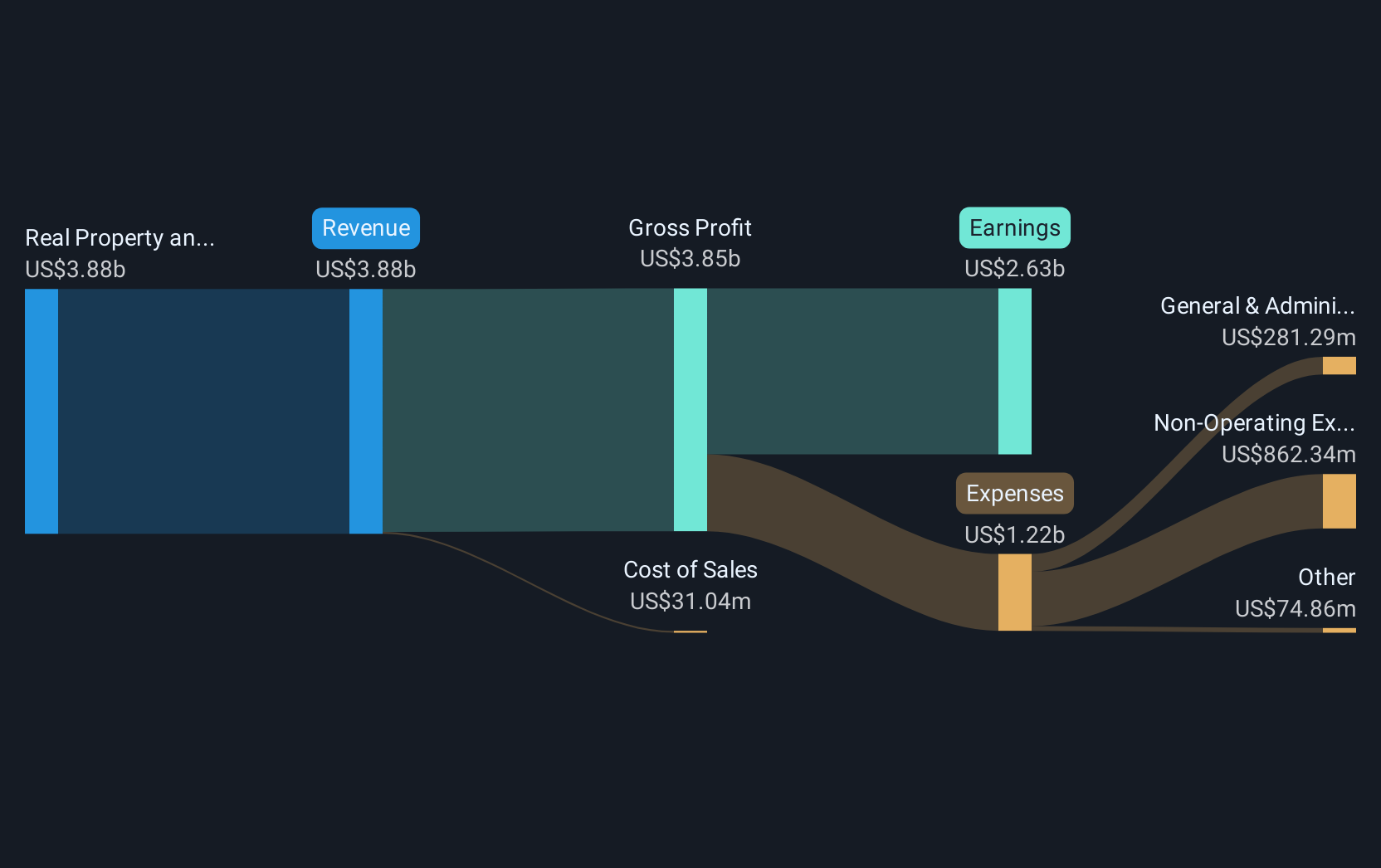

The recent confirmation of a quarterly dividend by VICI Properties underscores its ongoing commitment to shareholder returns amidst stable share price movements. Over the long-term, VICI's total return, including dividends, has climbed 98.63% over the past five years, demonstrating significant growth. This strong performance aligns well with the broader aims highlighted in their recent partnerships and expansions, which are expected to bolster future revenue and earnings potential.

With analysts forecasting an increase in both revenue and earnings, aided by strategic refinancing and increased liquidity, VICI's future looks promising. The projected casino resort completion on tribal land, in collaboration with Red Rock Resorts, could present meaningful growth opportunities. However, these developments also come with execution risks that may impact these forecasts negatively if not managed well.

Currently, VICI's share price of US$31.54 shows a 12.9% discount relative to the analyst price target of US$36.21. In comparison with the broader market, VICI has matched the US market's 11% one-year return while exceeding the US Specialized REITs industry's 9.1% return. As VICI pushes forward with its expansion plans, aligning the share price with these earnings expectations remains a focal point for both the company and its investors. The projected enhancements in earnings and dividends will likely be watched closely for their impact on achieving the analyst consensus price target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VICI

VICI Properties

An S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives