- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv Holdings Co (VRT) Appoints Wei Shen As New President For Greater China

Reviewed by Simply Wall St

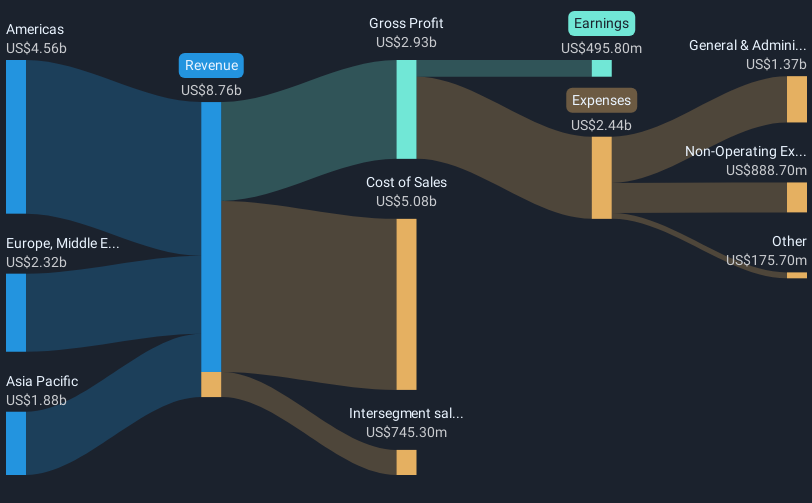

Vertiv Holdings Co (VRT) experienced a 80% price surge last quarter, influenced by key corporate events. The appointment of Wei Shen as President of Greater China, with his robust experience in power management, marked a significant leadership change within the company. Concurrently, the broader stock market was bolstered by strong earnings reports, with the S&P 500 and Nasdaq achieving new highs. Among these positive developments, Vertiv's strengthened earnings and strategic collaborations, such as its partnership with NVIDIA, aligned with market trends, likely amplifying upward momentum in its share price.

Be aware that Vertiv Holdings Co is showing 2 risks in our investment analysis.

The appointment of Wei Shen as President of Greater China and strong corporate developments, such as Vertiv's partnership with NVIDIA, could significantly influence future growth trajectories. These moves align with Vertiv's strategy of advancing AI infrastructure, aligning neatly with the company's goals of driving considerable revenue and earnings growth. The strong order pipeline and effective tariff mitigation strategies may enhance long-term profitability. These factors, combined with the recent market high, suggest potential continuity in positive momentum, despite the inherent risks of trade and supply chain challenges mentioned in the analysis.

Over a three-year period, Vertiv Holdings Co has achieved a very large total return of over 1,137.88%, highlighting substantial longer-term gains beyond the immediate quarterly surge. This compares favorably to its 1-year performance, where it surpassed both the US market's return of 14.8% and the broader US Electrical industry return of 42.1%. With the current share price at US$129.06, which exceeds the consensus analyst price target of US$127.76, there seems to be a slight divergence from market expectations. This divergence prompts consideration of the underlying risk factors and analyst assumptions regarding future growth and profitability that have been factored into the fair value estimate.

Explore Vertiv Holdings Co's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives