- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Vertex Pharmaceuticals (VRTX) Secures NHS England Agreement For Next-In-Class Cystic Fibrosis Treatment

Reviewed by Simply Wall St

Vertex Pharmaceuticals (VRTX) experienced a 4% price increase over the past month, coinciding with crucial developments in their portfolio. The recent advancement with NHS England's reimbursement agreement for the cystic fibrosis treatment ALYFTREK underscores VRTX's therapeutic expansion and patient outreach, counteracting any potential negative market effects from removing the stock from various value indices like the Russell 1000. Positive news on other fronts like long-term data for PrCASGEVY in treating sickle cell disease may have bolstered investor confidence in a generally flat market context. Coupled with ongoing strategic alliances, Vertex's recent performance aligns with broader market trends.

Find companies with promising cash flow potential yet trading below their fair value.

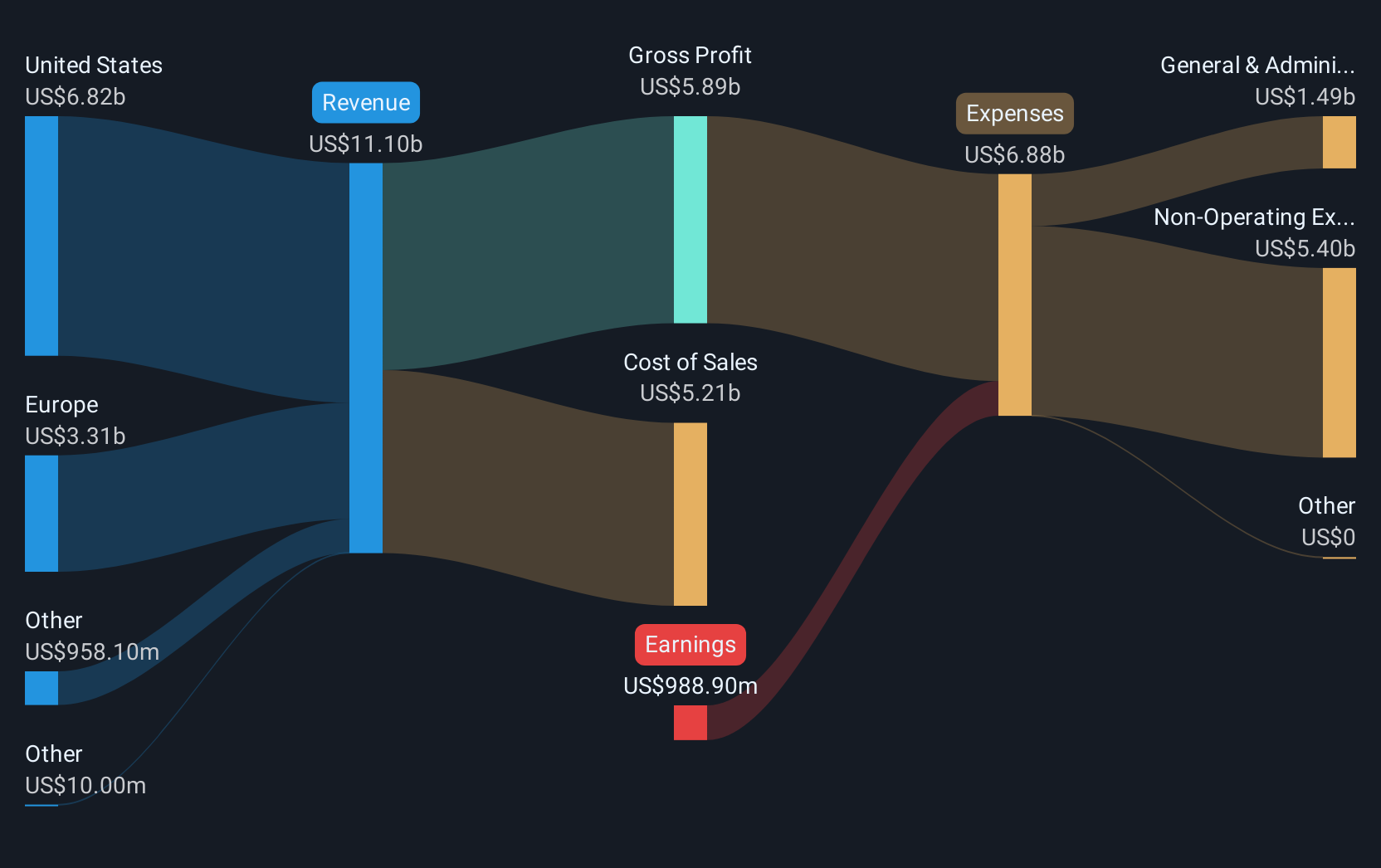

The recent developments with Vertex Pharmaceuticals, including the NHS England reimbursement agreement for ALYFTREK and promising data for PrCASGEVY, could significantly impact the company's revenue and earnings forecasts by extending its cystic fibrosis market reach and possibly driving stronger demand for its sickle cell disease treatment. These advancements highlight Vertex's commitment to diversifying its therapeutic portfolio beyond cystic fibrosis, potentially boosting its growth prospects and securing its foothold in the personalized medicine sector. Over the past three years, Vertex's total shareholder return, including share price appreciation and dividends, reached 65.12%, illustrating strong long-term performance.

In a broader context, Vertex's performance over the past year tells a more nuanced story. Despite achieving a positive long-term return, Vertex underperformed the US market's 11.4% gain, while outperforming the US Biotechs industry, which saw a decline of 11.2%. This nuanced performance underscores the competitive and evolving landscape for Vertex and highlights the importance of continuous innovation and strategic alignment. With the current share price at approximately US$472.35 and a consensus analyst price target of US$500.30, the stock trades at a slight discount to these targets, suggesting room for potential appreciation based on future performance and market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives