Verizon Communications (VZ) Unveils New Manhattan Headquarters In Midtown Expansion

Reviewed by Simply Wall St

Verizon Communications (VZ) recently announced plans to open a new headquarters at PENN 2 in Midtown Manhattan, reflecting its commitment to New York City. Over the past month, Verizon's stock price movement remained flat, echoing broader market trends where the S&P 500 hit new records amid optimism about corporate earnings. The company's business expansions, including the new headquarters and its robust earnings report, align with the positive sentiment seen in the market. While these developments highlight Verizon's strong position, they seemed consistent with rather than a driver of market movements.

We've identified 2 weaknesses for Verizon Communications that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

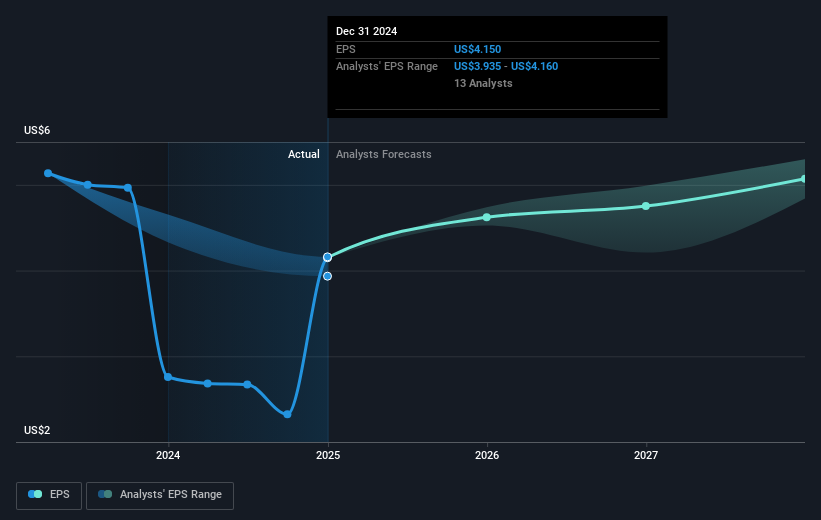

The announcement of Verizon Communications' new headquarters at PENN 2 in Midtown Manhattan could signify a reinforcement of its commitment to growth and stability in a challenging telecom environment. This move aligns with Verizon’s ongoing expansions, spotlighting its focus on infrastructure that supports the demands of connectivity and future growth avenues like 5G and fiber networks. The company's shares have experienced a 12.93% total return (including dividends) over the past year. However, this performance contrasts with the broader US telecom industry, which posted higher returns. Despite a flat share price over the past month, Verizon trades at a discount compared to the consensus price target of approximately US$48.92, indicating a potential upside.

The recent infrastructural investments could potentially enhance Verizon's revenue and earnings trajectory by increasing its competitive edge in the telecom market. Analysts forecast modest revenue growth at 1.8% annually, alongside an expected rise in profit margins. With an estimated US$22.2 billion in earnings by 2028, Verizon may see a lift in its valuation if it meets market expectations and brings its PE ratio closer to the projected 11.3x. Despite this, challenges such as competition and high debt levels could weigh on these forecasts, underlining the importance of effective cost management and strategic initiatives in achieving these targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives