Verizon Communications (VZ) Leads Network Quality And 5G Innovation With New Accolades

Reviewed by Simply Wall St

Verizon Communications (VZ) experienced a 4% increase last week, buoyed by its consecutive recognition for network quality and strong earnings report. The company's dominance in the RootMetrics study for its 5G network and reliable service boosts its standing. With quarterly revenue and net income rising, along with the broader market's upswing, these positive updates likely added weight to Verizon's share price performance. While the S&P 500 also hit new highs on trade optimism and corporate earnings, Verizon’s specific achievements in network service and financial results played a significant role in its weekly price movement.

We've identified 2 weaknesses for Verizon Communications that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent positive developments for Verizon Communications, highlighted in a 4% share price increase last week, strengthen the ongoing narrative that emphasizes the company's focus on network convergence and subscriber retention. This news complements Verizon's efforts to boost subscriber growth and customer loyalty, potentially influencing revenue positively. The accolades received for network quality and financial results could further solidify market confidence and bolster future revenue streams, aligning well with analysts' expectations of modest revenue growth.

Over the past year, Verizon's total shareholder returns, including dividends, amounted to 17.88%, indicating a favorable longer-term performance. However, when compared to the US Telecom industry, which returned 30.4%, Verizon's performance fell short over the same period. This context highlights some challenges as the company navigates an intensely competitive landscape.

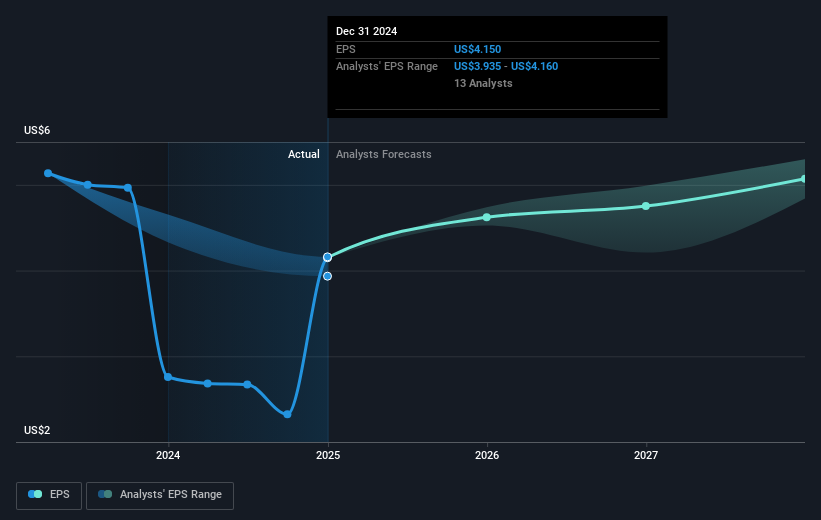

The updated earnings forecast, which suggests incremental growth, receiving a potential boost from these positive announcements, complements Verizon's share price trajectory. The current share price of US$42.96 sits below the consensus analyst price target of approximately US$48.92, representing a potential upside of around 13.88%. These figures suggest that market sentiment remains cautiously optimistic about Verizon's upcoming performance benchmarks and anticipated growth path.

Understand Verizon Communications' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives