- United States

- /

- Life Sciences

- /

- NYSE:QGEN

Update: QIAGEN (NYSE:QGEN) Stock Gained 43% In The Last Five Years

QIAGEN N.V. (NYSE:QGEN) shareholders might be concerned after seeing the share price drop 15% in the last quarter. But the silver lining is the stock is up over five years. In that time, it is up 43%, which isn't bad, but is below the market return of 56%.

Check out our latest analysis for QIAGEN

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, QIAGEN actually saw its EPS drop 9.3% per year. The impact of extraordinary items on earnings, in the last year, partially explain the diversion.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

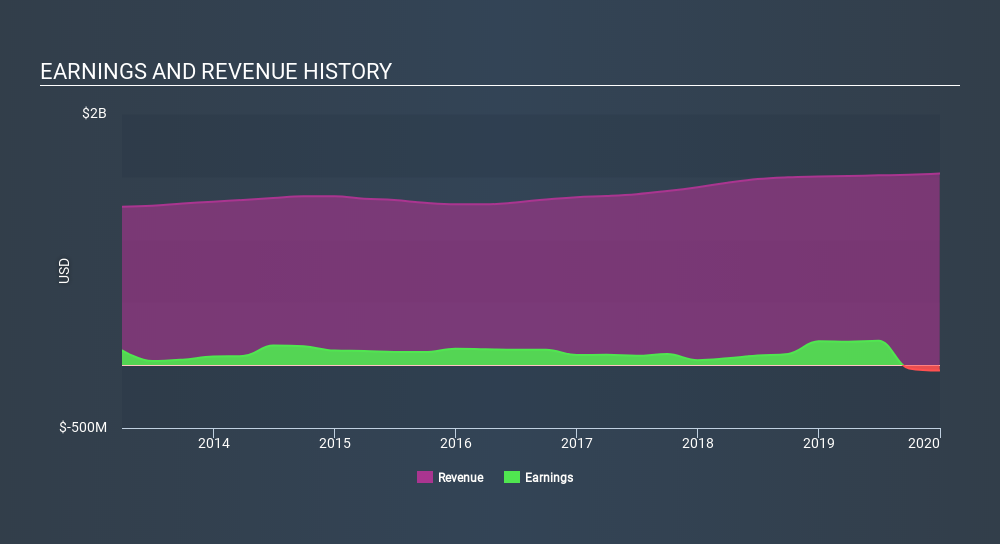

On the other hand, QIAGEN's revenue is growing nicely, at a compound rate of 3.8% over the last five years. In that case, the company may be sacrificing current earnings per share to drive growth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

QIAGEN is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

We've already covered QIAGEN's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that QIAGEN's TSR, at 48% is higher than its share price return of 43%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Investors in QIAGEN had a tough year, with a total loss of 7.1%, against a market gain of about 7.4%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 8.2%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand QIAGEN better, we need to consider many other factors. Be aware that QIAGEN is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:QGEN

Qiagen

Provides sample to insight solutions that transform biological samples into molecular insights in the Netherlands and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives