Update: Atlas Copco (STO:ATCO A) Stock Gained 47% In The Last Year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost returns by picking market-beating companies to own shares in. For example, the Atlas Copco AB (STO:ATCO A) share price is up 47% in the last year, clearly besting the market return of around 22% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! However, the stock hasn't done so well in the longer term, with the stock only up 24% in three years.

Check out our latest analysis for Atlas Copco

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

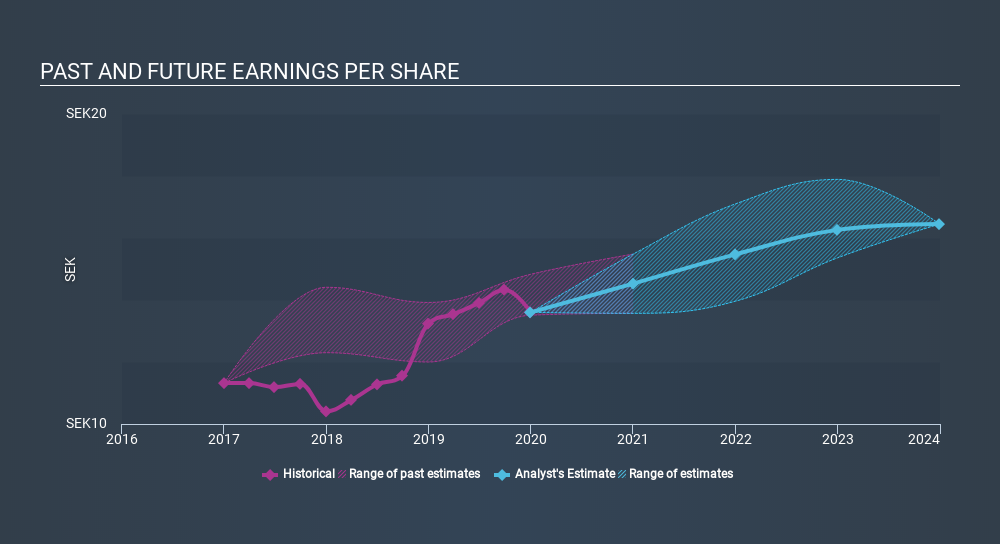

During the last year Atlas Copco grew its earnings per share (EPS) by 2.7%. This EPS growth is significantly lower than the 47% increase in the share price. This indicates that the market is now more optimistic about the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Atlas Copco's key metrics by checking this interactive graph of Atlas Copco's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Atlas Copco, it has a TSR of 50% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Atlas Copco has rewarded shareholders with a total shareholder return of 50% in the last twelve months. And that does include the dividend. That gain is better than the annual TSR over five years, which is 16%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Atlas Copco may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OM:ATCO A

Atlas Copco

Provides compressed air and gas, vacuum, energy, dewatering and industrial pumps, industrial power tools, and assembly and machine vision solutions in North America, South America, Europe, Africa, the Middle East, Asia, and Oceania.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives