- Finland

- /

- Medical Equipment

- /

- HLSE:BIOBV

Uncovering Opportunities: Gabetti Property Solutions And 2 Other European Penny Stocks

Reviewed by Simply Wall St

As the European markets navigate a landscape marked by easing inflation and potential interest rate cuts, investor attention is drawn to opportunities within smaller-cap stocks. Penny stocks, despite their old-fashioned name, continue to represent a viable investment area by highlighting lesser-known companies that may offer significant value. By focusing on those with strong financials and growth potential, investors can uncover hidden gems in the market; this article will explore three such European penny stocks that exhibit both stability and promise.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.37 | SEK2.27B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.66 | SEK274.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.46 | SEK210.5M | ✅ 2 ⚠️ 2 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.96 | €62.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.916 | €30.67M | ✅ 3 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:MLERO) | €3.26 | €9.49M | ✅ 2 ⚠️ 5 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.60 | €17.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.125 | €293.39M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 449 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Gabetti Property Solutions (BIT:GAB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gabetti Property Solutions S.p.A. operates through its subsidiaries to offer real estate services both in Italy and internationally, with a market cap of €42.48 million.

Operations: The company generates revenue through its Real Estate Network Services segment, which accounts for €91.93 million, and its Agency and Corporate Services segment, contributing €50.94 million.

Market Cap: €42.48M

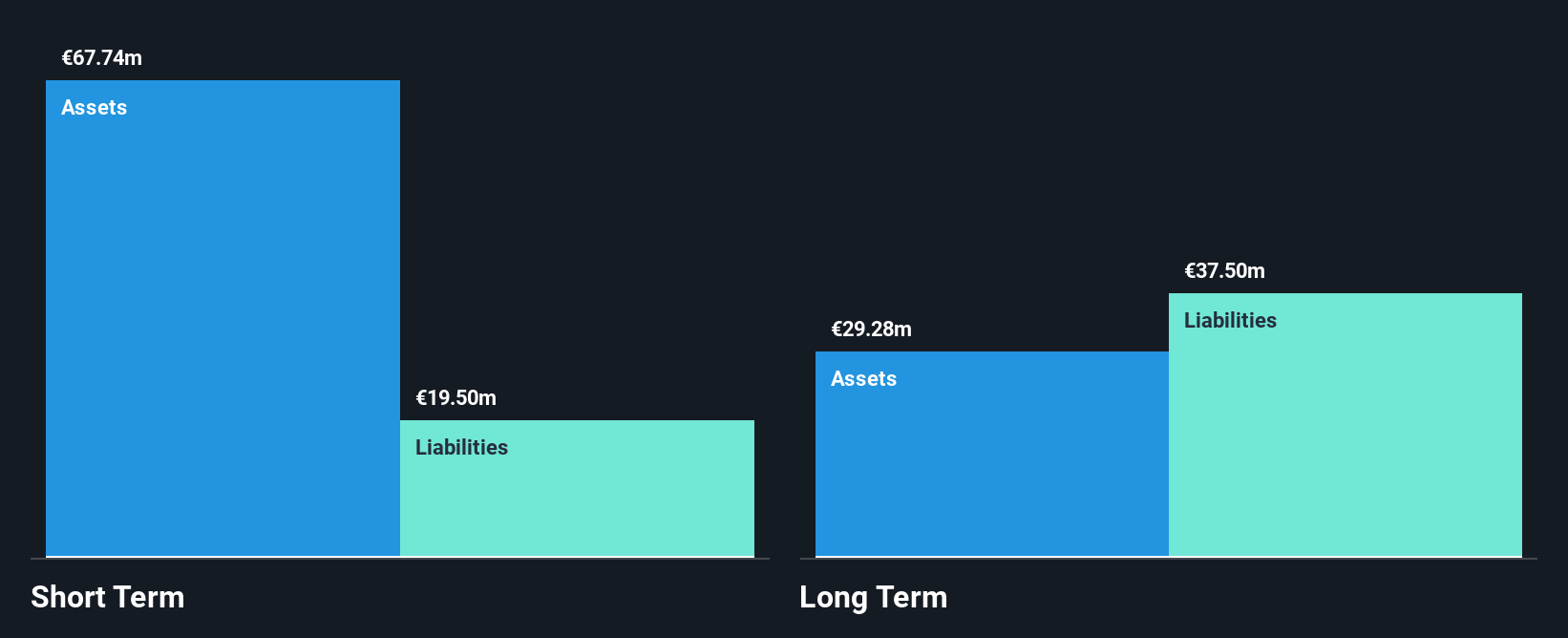

Gabetti Property Solutions S.p.A. has shown impressive earnings growth of 220.5% over the past year, outpacing the real estate industry average. However, a significant one-off loss of €12.2 million has impacted recent financial results. The company's short-term assets comfortably cover both short and long-term liabilities, indicating a stable liquidity position despite high net debt to equity ratio at 68.2%. Gabetti's interest payments are well covered by EBIT, but its management team lacks experience with an average tenure of just 0.4 years, which may present challenges in navigating future strategic decisions effectively.

- Get an in-depth perspective on Gabetti Property Solutions' performance by reading our balance sheet health report here.

- Gain insights into Gabetti Property Solutions' outlook and expected performance with our report on the company's earnings estimates.

New Sources Energy (ENXTAM:NSE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: New Sources Energy N.V. is engaged in the development, operation, exploitation, and investment in renewable energy projects with a market cap of €2.57 million.

Operations: New Sources Energy N.V. has not reported any specific revenue segments.

Market Cap: €2.57M

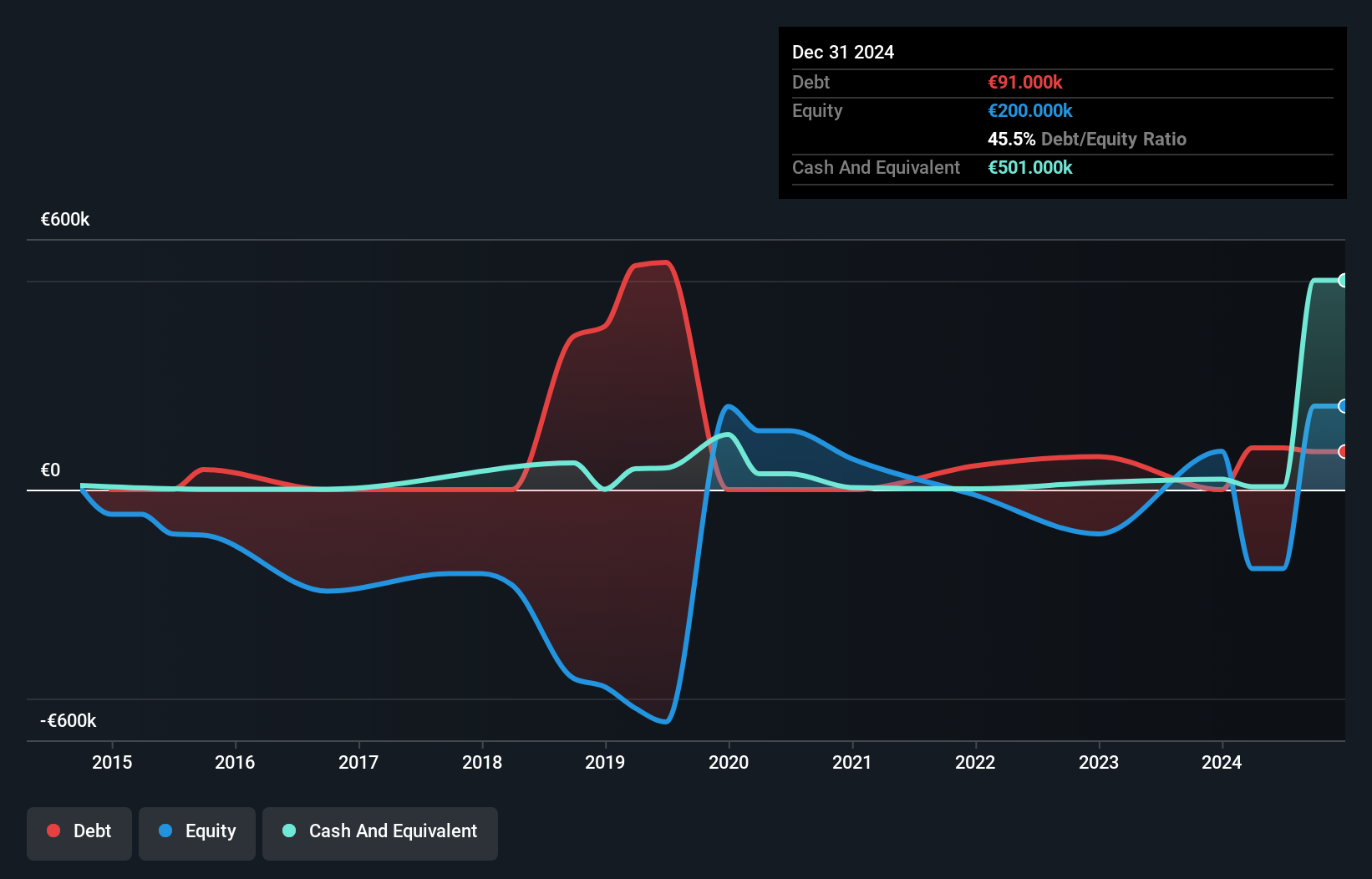

New Sources Energy N.V., with a market cap of €2.57 million, is currently pre-revenue and reported a net loss of €0.904 million for 2024, up from the previous year. The company has more cash than debt, providing a sufficient cash runway exceeding three years based on current free cash flow. However, its share price remains highly volatile and losses have increased by 32% annually over five years. Despite having no long-term liabilities and covering short-term obligations with assets of €501K against liabilities of €309K, the board's average tenure suggests inexperience that could affect strategic direction.

- Unlock comprehensive insights into our analysis of New Sources Energy stock in this financial health report.

- Learn about New Sources Energy's historical performance here.

Biohit Oyj (HLSE:BIOBV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Biohit Oyj is a biotechnology company that produces and sells bind acetaldehyde, diagnostic products, and systems for diagnostic analysis to research institutions, healthcare, and industry worldwide with a market cap of €42.52 million.

Operations: The company's revenue primarily comes from its Diagnostic Kits and Equipment segment, which generated €14.28 million.

Market Cap: €42.52M

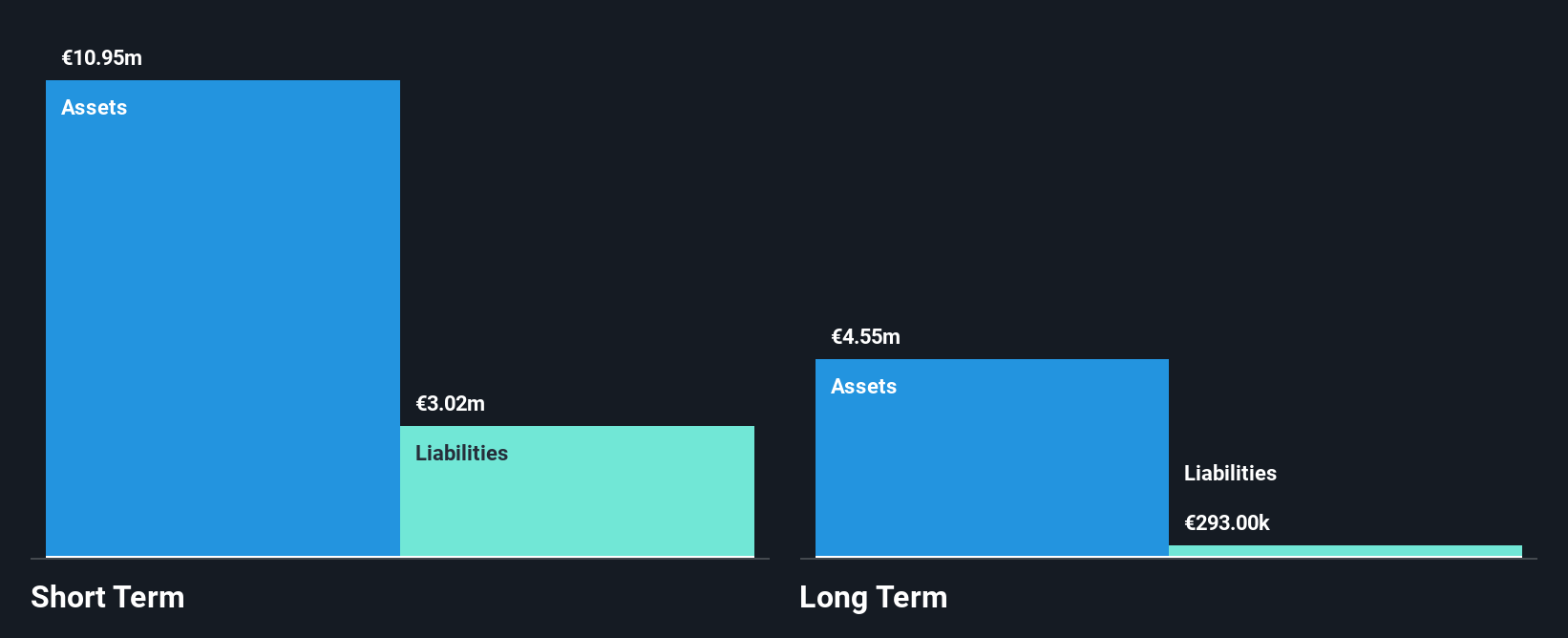

Biohit Oyj, with a market cap of €42.52 million, has demonstrated consistent growth in its earnings, which increased by 38.7% over the past year and are projected to grow annually by 10.46%. The company is debt-free and maintains strong financial health with short-term assets exceeding liabilities significantly. Its recent product innovation, the GastroPanel® quick test, enhances diagnostic capabilities for gastric cancer risk factors and shows high diagnostic accuracy in clinical studies. Biohit's experienced management team and board contribute positively to its strategic direction while trading at a discount to estimated fair value offers potential investment appeal within the penny stock segment.

- Navigate through the intricacies of Biohit Oyj with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Biohit Oyj's future.

Next Steps

- Dive into all 449 of the European Penny Stocks we have identified here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biohit Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:BIOBV

Biohit Oyj

A biotechnology company, manufactures and sells bind acetaldehyde, diagnostic products, and systems for diagnostic analysis for the use of research institutions, healthcare, and industry worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives