- United Kingdom

- /

- Beverage

- /

- AIM:NICL

UK Stocks That May Be Trading Below Their Estimated Value In December 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns about global economic recovery. As investors navigate these turbulent waters, identifying stocks that may be trading below their estimated value can offer opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.20 | £12.17 | 49% |

| Tortilla Mexican Grill (AIM:MEX) | £0.42 | £0.78 | 46.1% |

| Pinewood Technologies Group (LSE:PINE) | £3.58 | £7.14 | 49.8% |

| PageGroup (LSE:PAGE) | £2.34 | £4.53 | 48.4% |

| Motorpoint Group (LSE:MOTR) | £1.37 | £2.68 | 48.9% |

| Ibstock (LSE:IBST) | £1.346 | £2.65 | 49.3% |

| Gym Group (LSE:GYM) | £1.506 | £2.94 | 48.8% |

| Fintel (AIM:FNTL) | £1.975 | £3.79 | 47.9% |

| Fevertree Drinks (AIM:FEVR) | £8.16 | £15.82 | 48.4% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.15 | £4.19 | 48.7% |

Let's review some notable picks from our screened stocks.

Nichols (AIM:NICL)

Overview: Nichols plc, with a market cap of £365.70 million, supplies soft drinks to the retail, wholesale, catering, licensed, and leisure industries across the United Kingdom and internationally in regions such as the Middle East and Africa.

Operations: The company's revenue is primarily derived from its Packaged segment, contributing £133.97 million, and the Out of Home segment, which adds £40.35 million.

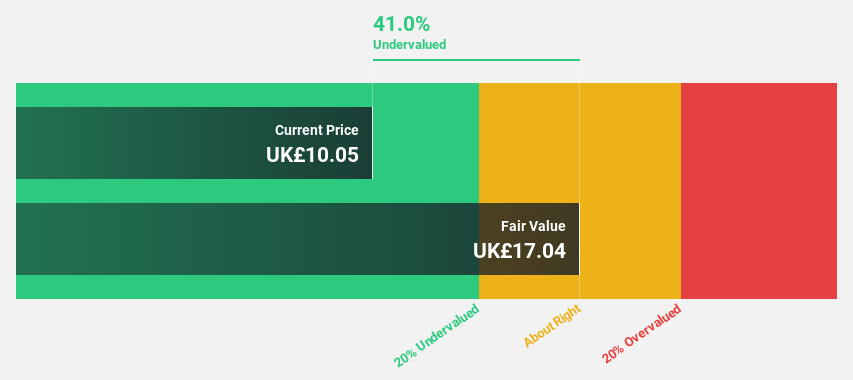

Estimated Discount To Fair Value: 46%

Nichols is trading at £10, significantly below its estimated fair value of £18.53, suggesting it may be undervalued based on cash flows. Earnings are expected to grow 16.4% annually, outpacing the UK market's growth rate of 14.2%. However, revenue growth is modest at 4.4% per year and the dividend track record is unstable. The recent appointment of Matthew Rothwell as CFO brings strategic financial expertise that could support future development and growth initiatives.

- The growth report we've compiled suggests that Nichols' future prospects could be on the up.

- Dive into the specifics of Nichols here with our thorough financial health report.

Burberry Group (LSE:BRBY)

Overview: Burberry Group plc is a global luxury goods company involved in the manufacturing, retail, and wholesale of products under the Burberry brand across regions such as the Asia Pacific, Europe, the Middle East, India, Africa, and the Americas with a market cap of approximately £4.66 billion.

Operations: The company's revenue is primarily derived from its Retail/Wholesale segment, which accounts for £2.34 billion, and Licensing, contributing £66 million.

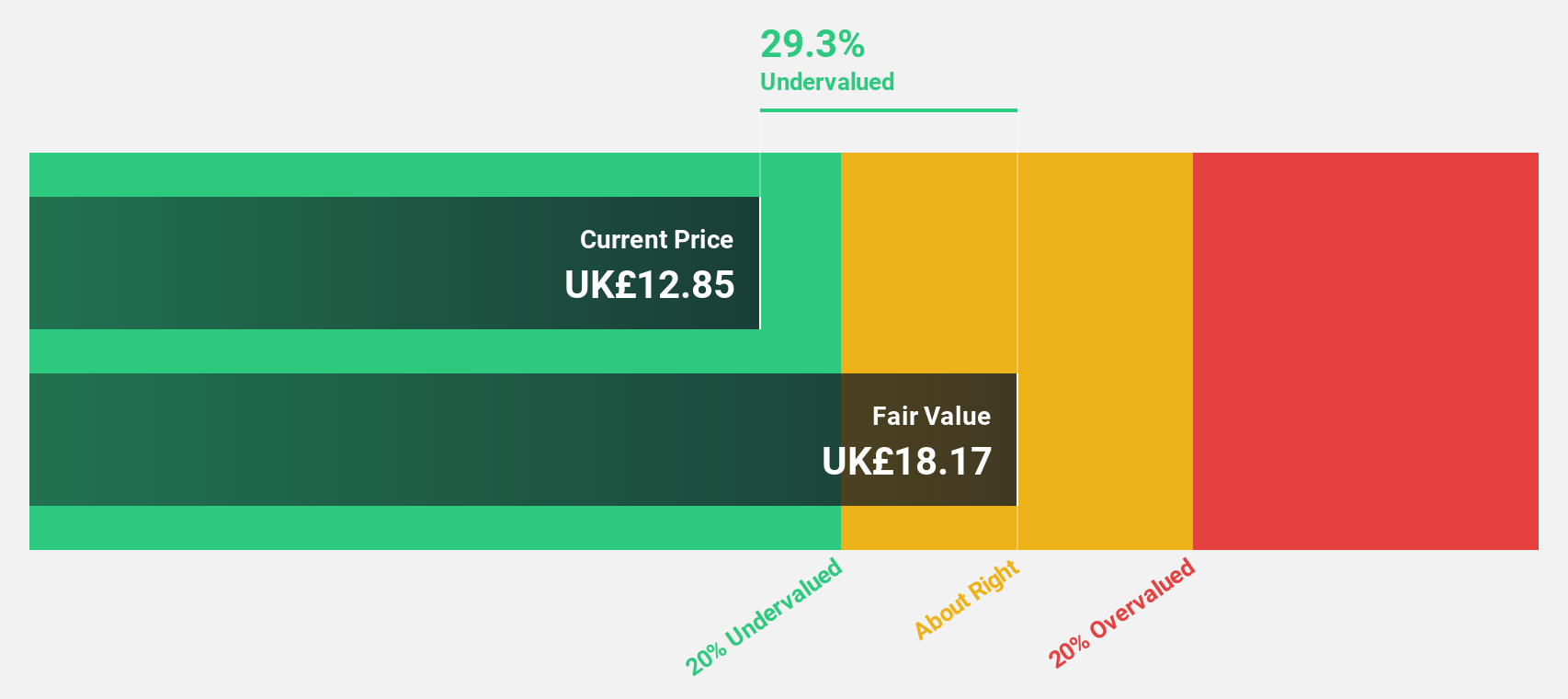

Estimated Discount To Fair Value: 32.3%

Burberry Group is trading at £12.98, well below its estimated fair value of £19.18, highlighting potential undervaluation based on cash flows. Revenue is projected to grow at 5.1% annually, surpassing the UK market's average growth rate of 4.3%. Despite a current net loss, profitability is expected within three years with earnings growing significantly each year. Recent leadership changes aim to enhance supply chain and customer engagement strategies, potentially supporting future performance improvements.

- Our growth report here indicates Burberry Group may be poised for an improving outlook.

- Navigate through the intricacies of Burberry Group with our comprehensive financial health report here.

Vistry Group (LSE:VTY)

Overview: Vistry Group PLC, with a market cap of £1.99 billion, provides housing solutions in the United Kingdom through its subsidiaries.

Operations: The company's revenue is primarily generated from its Home Builders segment, which focuses on residential and commercial projects, amounting to £3.69 billion.

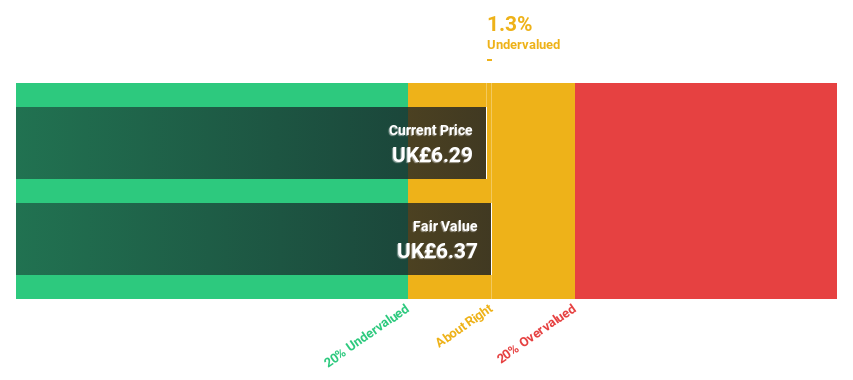

Estimated Discount To Fair Value: 49%

Vistry Group, trading at £6.20, is significantly undervalued with an estimated fair value of £12.17, suggesting a strong cash flow position. Earnings are forecast to grow at 30.3% annually, outpacing the UK market's growth rate of 14.2%. However, profit margins have decreased from 5.4% to 1%, and return on equity is expected to remain low at 6.7%. Recent board changes may impact strategic direction moving forward.

- Our earnings growth report unveils the potential for significant increases in Vistry Group's future results.

- Click to explore a detailed breakdown of our findings in Vistry Group's balance sheet health report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 55 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nichols might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NICL

Nichols

Engages in supply of soft drinks to the retail, wholesale, catering, licensed, and leisure industries in the United Kingdom, the Middle East, Africa, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion