- United Kingdom

- /

- Entertainment

- /

- AIM:EVPL

UK Penny Stocks: 3 Picks With At Least £100M Market Cap

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, which has impacted global markets and commodity prices. In such fluctuating market conditions, investors often seek opportunities in areas that might offer growth potential despite broader economic challenges. Penny stocks—typically representing smaller or newer companies—remain an intriguing segment for investors looking to uncover value through strong financial fundamentals and growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.21 | £300.14M | ✅ 5 ⚠️ 0 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.99 | £448.68M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.47 | £361.12M | ✅ 5 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.912 | £1.19B | ✅ 4 ⚠️ 2 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.766 | £64.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.38 | £422.29M | ✅ 2 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.085 | £173.09M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.32 | £72.42M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 407 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

everplay group (AIM:EVPL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Everplay Group PLC, along with its subsidiaries, develops and publishes independent video games for both digital and physical markets in the United Kingdom and internationally, with a market cap of £450.98 million.

Operations: The company's revenue is primarily generated from its segment that focuses on the development and publication of games and apps, amounting to £166.62 million.

Market Cap: £450.98M

Everplay Group PLC, with a market cap of £450.98 million and revenue of £166.62 million, recently became profitable after reporting a net income of £20.19 million for 2024, compared to a loss the previous year. The company has no debt and maintains strong short-term assets (£108.5M) exceeding liabilities (£39.4M). Despite recent executive changes, including the CEO stepping down, Everplay continues to seek M&A opportunities while reiterating its 2025 trading guidance as slightly ahead of market expectations. However, its board's inexperience and low return on equity (7.7%) may pose challenges moving forward.

- Take a closer look at everplay group's potential here in our financial health report.

- Review our growth performance report to gain insights into everplay group's future.

Gaming Realms (AIM:GMR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gaming Realms plc develops, publishes, and licenses mobile gaming content across various regions including the United Kingdom, the United States, Isle of Man, Malta, and Gibraltar with a market cap of £138.11 million.

Operations: The company's revenue is primarily generated through Licensing, which accounts for £24.47 million, and Social Publishing, contributing £3.99 million.

Market Cap: £138.11M

Gaming Realms plc, with a market cap of £138.11 million, has demonstrated strong financial health by achieving net income growth to £8.84 million in 2024 from the previous year and maintaining a debt-free position. Its revenue streams are primarily driven by Licensing (£24.47 million) and Social Publishing (£3.99 million). The company trades at 58% below its estimated fair value and boasts a high return on equity (26%). While its board lacks experience with an average tenure of 2.6 years, Gaming Realms' earnings growth outpaced the Entertainment industry significantly over the past year, indicating robust operational performance.

- Dive into the specifics of Gaming Realms here with our thorough balance sheet health report.

- Evaluate Gaming Realms' prospects by accessing our earnings growth report.

Motorpoint Group (LSE:MOTR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Motorpoint Group Plc is an independent omnichannel vehicle retailer in the United Kingdom with a market cap of £141.29 million.

Operations: The company's revenue is primarily derived from its Retail segment, which accounts for £1.03 billion, complemented by its Wholesale segment at £144.7 million.

Market Cap: £141.29M

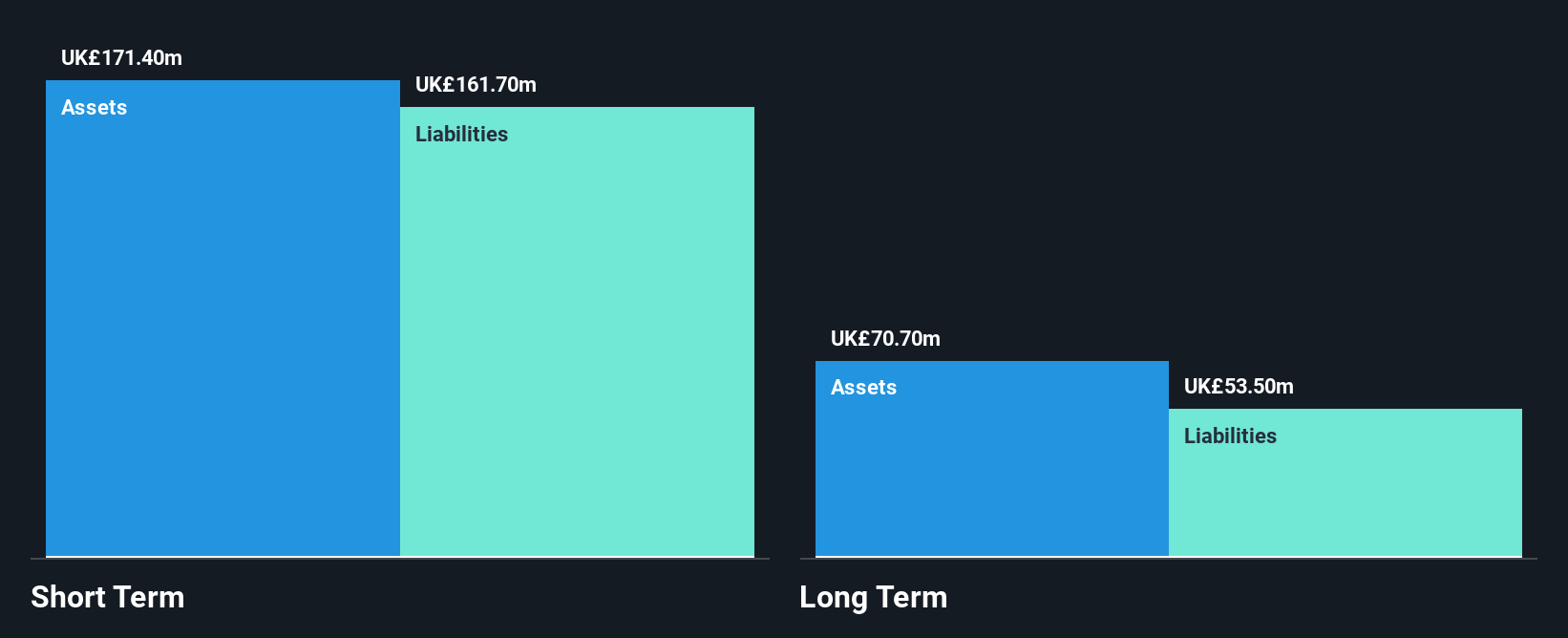

Motorpoint Group Plc, with a market cap of £141.29 million, has shown financial resilience by transitioning to profitability this year, reporting net income of £3.2 million compared to a loss the previous year. The company's revenue increased to £1.17 billion, driven primarily by its Retail segment (£1.03 billion). It remains debt-free and has managed short-term liabilities effectively with assets of £171.4 million surpassing liabilities of £161.7 million. Recent strategic moves include completing a share buyback program representing 4% of its capital and proposing a final dividend after no distribution last fiscal year, reflecting improved financial stability and shareholder returns focus.

- Get an in-depth perspective on Motorpoint Group's performance by reading our balance sheet health report here.

- Examine Motorpoint Group's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Click here to access our complete index of 407 UK Penny Stocks.

- Contemplating Other Strategies? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EVPL

everplay group

Develops and publishes independent video games for digital and physical market in the United Kingdom.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives