- United Kingdom

- /

- Capital Markets

- /

- AIM:LIV

UK Dividend Stocks To Watch In August 2025

Reviewed by Simply Wall St

As the UK market grapples with the ripple effects of faltering trade data from China, reflected in a recent dip in both the FTSE 100 and FTSE 250 indices, investors are keenly observing how these global economic pressures might impact their portfolios. In such uncertain times, dividend stocks can offer a measure of stability and potential income, making them an attractive option for those looking to navigate market volatility while seeking consistent returns.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.94% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.96% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.71% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.07% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 5.00% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.28% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.87% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.18% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.59% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.19% | ★★★★★☆ |

Click here to see the full list of 55 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Livermore Investments Group (AIM:LIV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Livermore Investments Group Limited is a publicly owned investment manager with a market cap of £85.57 million.

Operations: Livermore Investments Group Limited generates its revenue from Equity and Debt Instruments Investment Activities, amounting to $12.91 million.

Dividend Yield: 6%

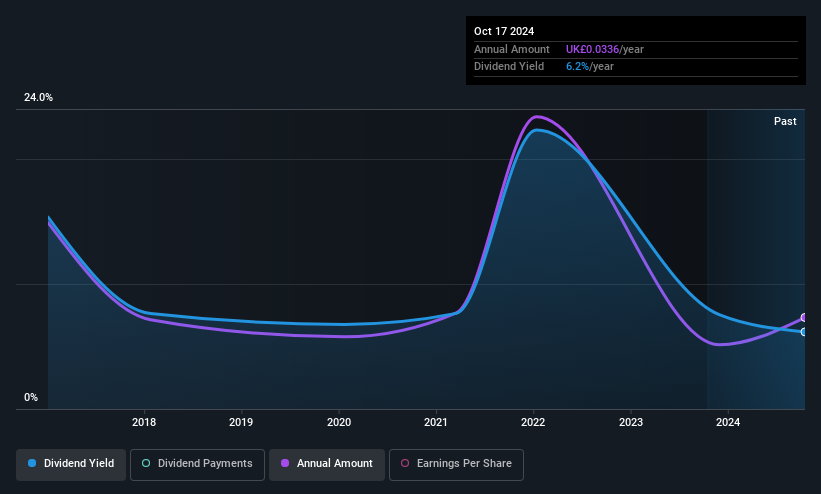

Livermore Investments Group declared an interim dividend of USD 0.0423 per share, with a yield of 5.99%, placing it in the top 25% of UK dividend payers. However, its dividends have been volatile and unreliable over the past decade. Despite a low cash payout ratio of 39.9%, the high payout ratio of 106.2% indicates dividends are not well covered by earnings, raising sustainability concerns amid declining net income from USD 13.89 million to USD 6.59 million year-on-year.

- Click here to discover the nuances of Livermore Investments Group with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Livermore Investments Group shares in the market.

Dunelm Group (LSE:DNLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dunelm Group plc operates as a retailer of homewares in the United Kingdom with a market capitalization of approximately £2.41 billion.

Operations: Dunelm Group plc generates its revenue primarily from the retail of homewares in the United Kingdom, amounting to £1.73 billion.

Dividend Yield: 6.6%

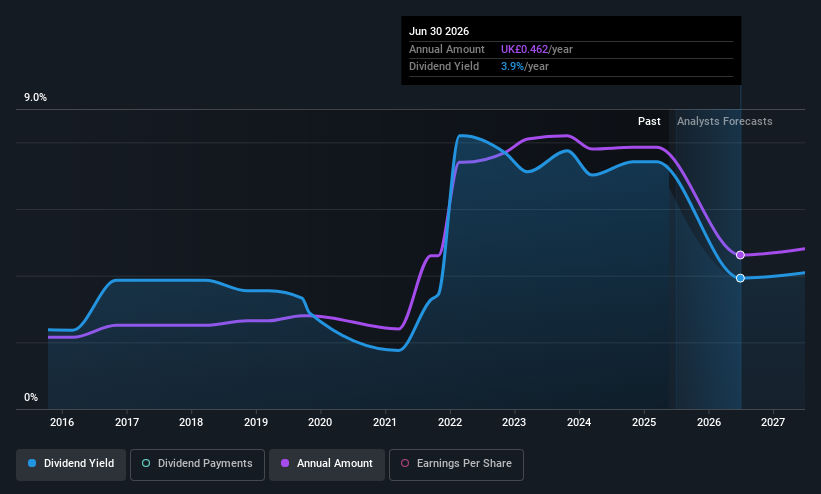

Dunelm Group's dividend yield of 6.59% ranks it among the top 25% of UK dividend payers, though its dividends have been volatile over the past decade. The payout is covered by both earnings and cash flows, with ratios at 58.6% and 52.9%, respectively, suggesting sustainability despite past unreliability. Recent sales totaled £1.77 billion for the year to June 2025, while a new CEO appointment may influence future strategic direction starting October 2025.

- Click to explore a detailed breakdown of our findings in Dunelm Group's dividend report.

- Upon reviewing our latest valuation report, Dunelm Group's share price might be too optimistic.

Pets at Home Group (LSE:PETS)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Pets at Home Group Plc operates as an omnichannel retailer of pet food, related products, and accessories in the United Kingdom with a market cap of £1.03 billion.

Operations: Pets at Home Group Plc generates revenue through its Retail segment, which accounts for £1.31 billion, and its Vet Group segment, contributing £175.30 million.

Dividend Yield: 5.7%

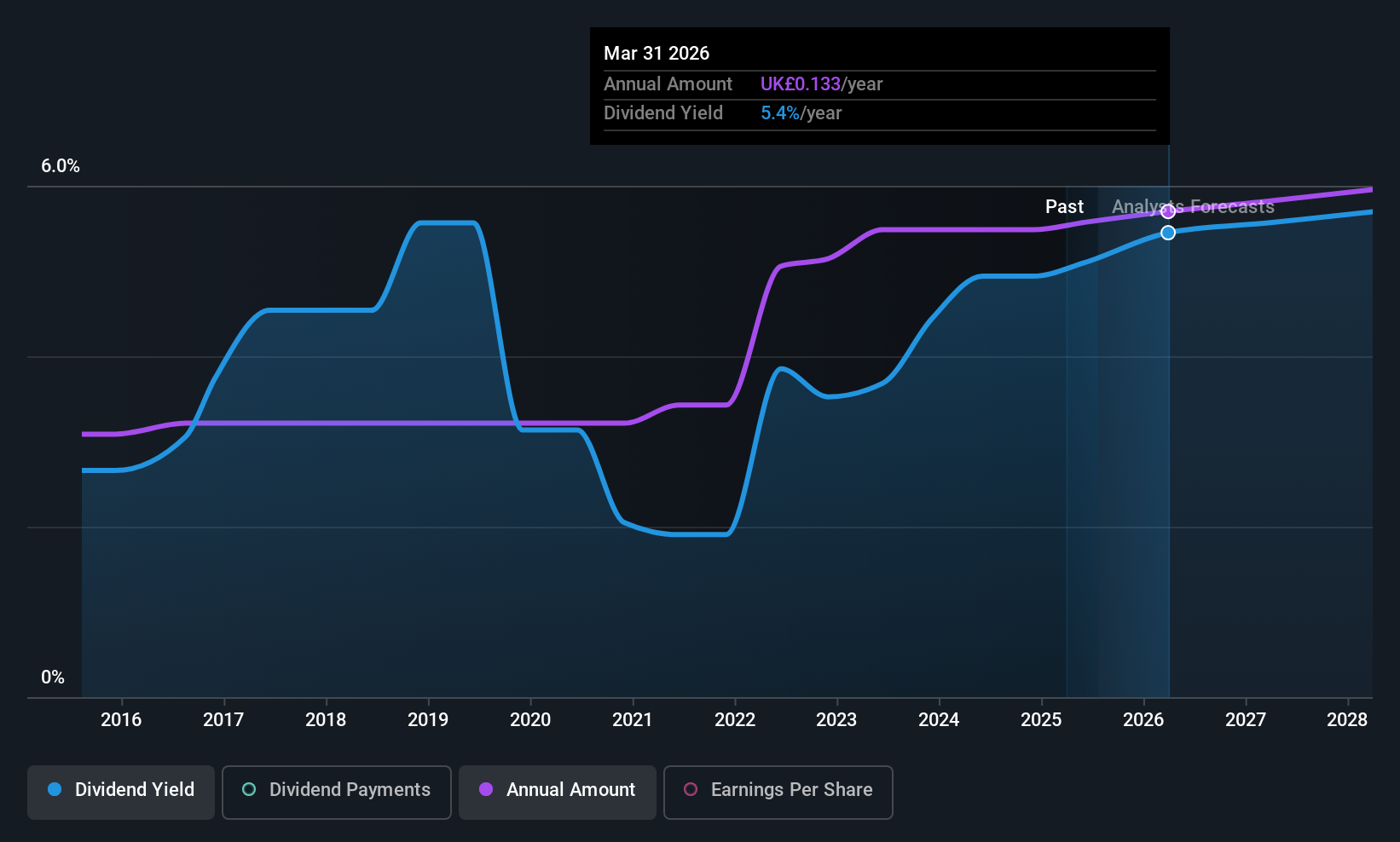

Pets at Home Group offers a high and reliable dividend yield of 5.71%, placing it in the top 25% of UK dividend payers. The company's dividends have grown consistently over the past decade, supported by a sustainable payout ratio of 68.3% from earnings and 34.6% from cash flows. Recent earnings show growth, with net income rising to £88.2 million for the year ended March 2025, while a share buyback program aims to enhance shareholder value further.

- Click here and access our complete dividend analysis report to understand the dynamics of Pets at Home Group.

- The valuation report we've compiled suggests that Pets at Home Group's current price could be quite moderate.

Next Steps

- Navigate through the entire inventory of 55 Top UK Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LIV

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives