- United Kingdom

- /

- Food

- /

- LSE:AEP

UK Dividend Stocks Featuring 3 Income Generators

Reviewed by Simply Wall St

In recent weeks, the UK market has faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties. Given these conditions, dividend stocks can offer a measure of stability and income generation for investors seeking to navigate market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 4.00% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.88% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.93% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.27% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.13% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.70% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.27% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.59% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.97% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.66% | ★★★★★☆ |

Click here to see the full list of 52 stocks from our Top UK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

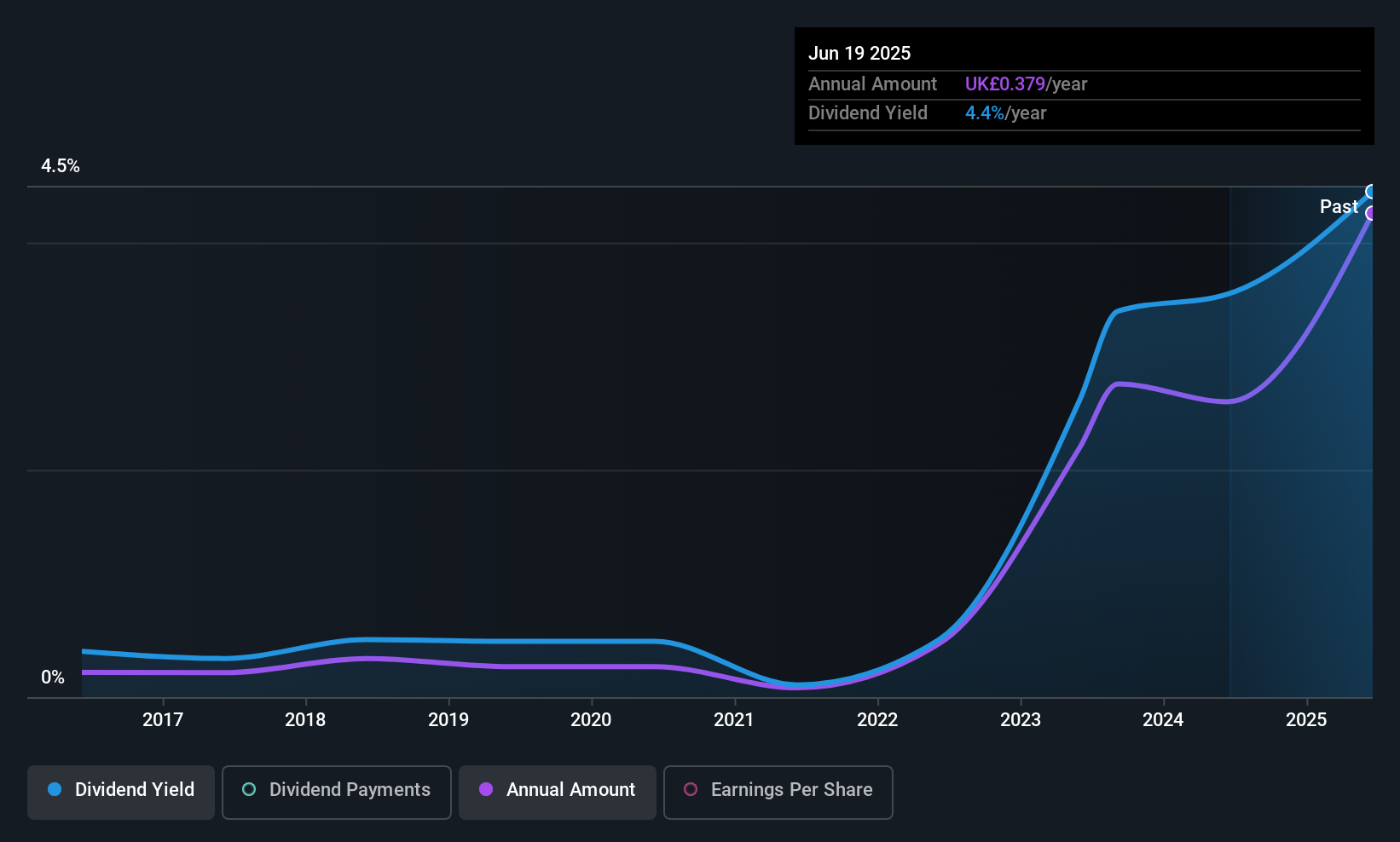

Anglo-Eastern Plantations (LSE:AEP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anglo-Eastern Plantations Plc, with a market cap of £520.38 million, owns, operates, and develops oil palm plantations in Indonesia and Malaysia.

Operations: Anglo-Eastern Plantations generates revenue of $436.63 million from its oil palm cultivation activities in Indonesia and Malaysia.

Dividend Yield: 4.2%

Anglo-Eastern Plantations recently declared an interim dividend for the first time since 2024, with a payout ratio of 39.5%, indicating dividends are well covered by earnings and cash flows. Despite past volatility in dividend payments, recent production increases and index inclusions like FTSE 250 suggest potential stability. However, its current yield of 4.23% is below top-tier UK dividend payers. The company's valuation appears attractive, trading at a discount relative to estimated fair value and peers.

- Unlock comprehensive insights into our analysis of Anglo-Eastern Plantations stock in this dividend report.

- Our valuation report here indicates Anglo-Eastern Plantations may be undervalued.

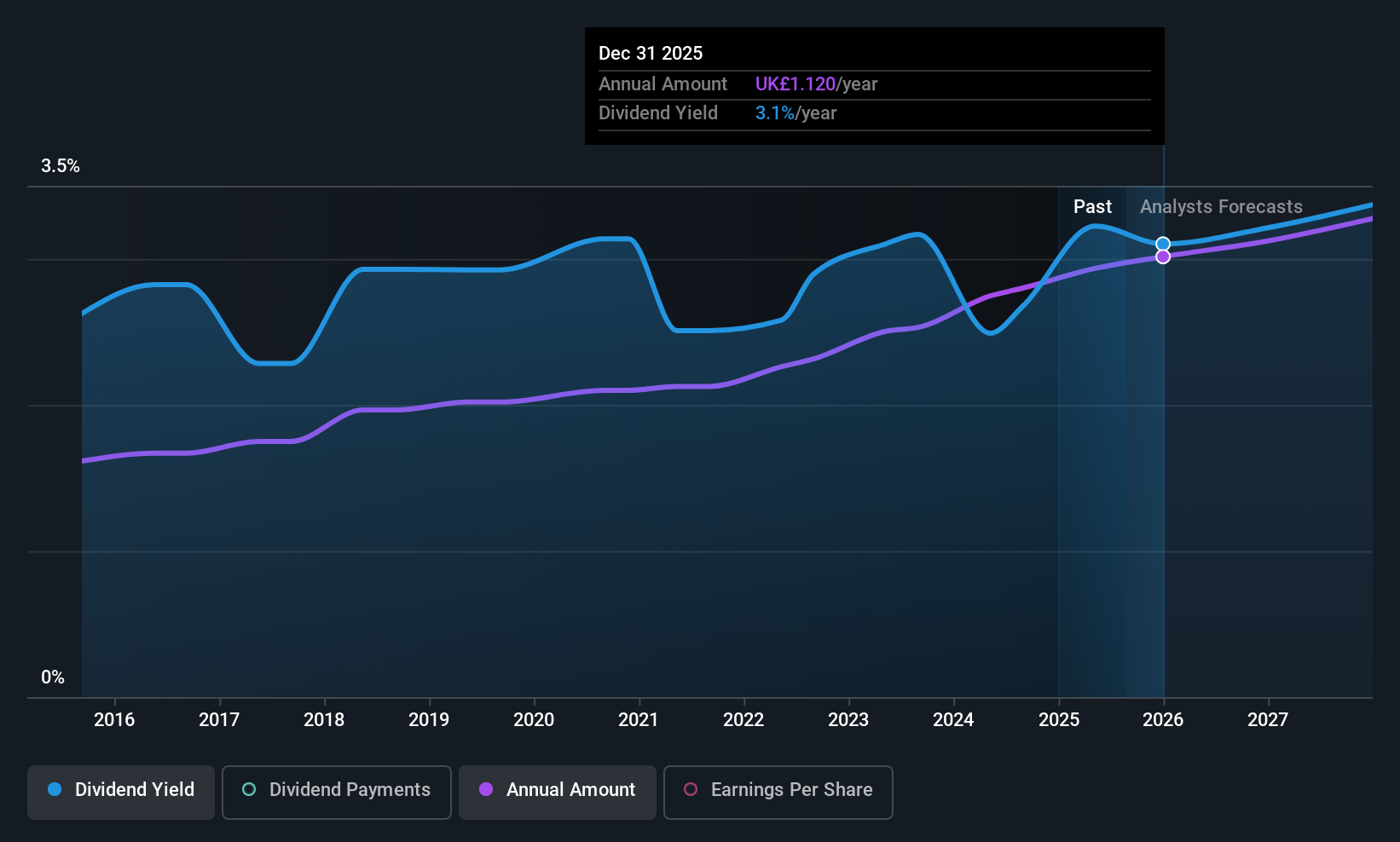

Clarkson (LSE:CKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clarkson PLC offers integrated shipping services globally, with a market cap of £1.12 billion.

Operations: Clarkson PLC generates its revenue from several segments, including Broking (£503.80 million), Support (£66.30 million), Research (£25.80 million), and Financial services (£53.20 million).

Dividend Yield: 3%

Clarkson's dividends are supported by a payout ratio of 44.9% and a cash payout ratio of 40.4%, indicating strong coverage by earnings and cash flows. However, its dividend yield of 3.01% is below the top UK dividend payers, and payments have been volatile over the past decade despite overall growth. Recent executive changes, including the retirement of CFO Jeff Woyda, may impact future stability but are being managed with an orderly transition plan in place.

- Click here and access our complete dividend analysis report to understand the dynamics of Clarkson.

- Insights from our recent valuation report point to the potential overvaluation of Clarkson shares in the market.

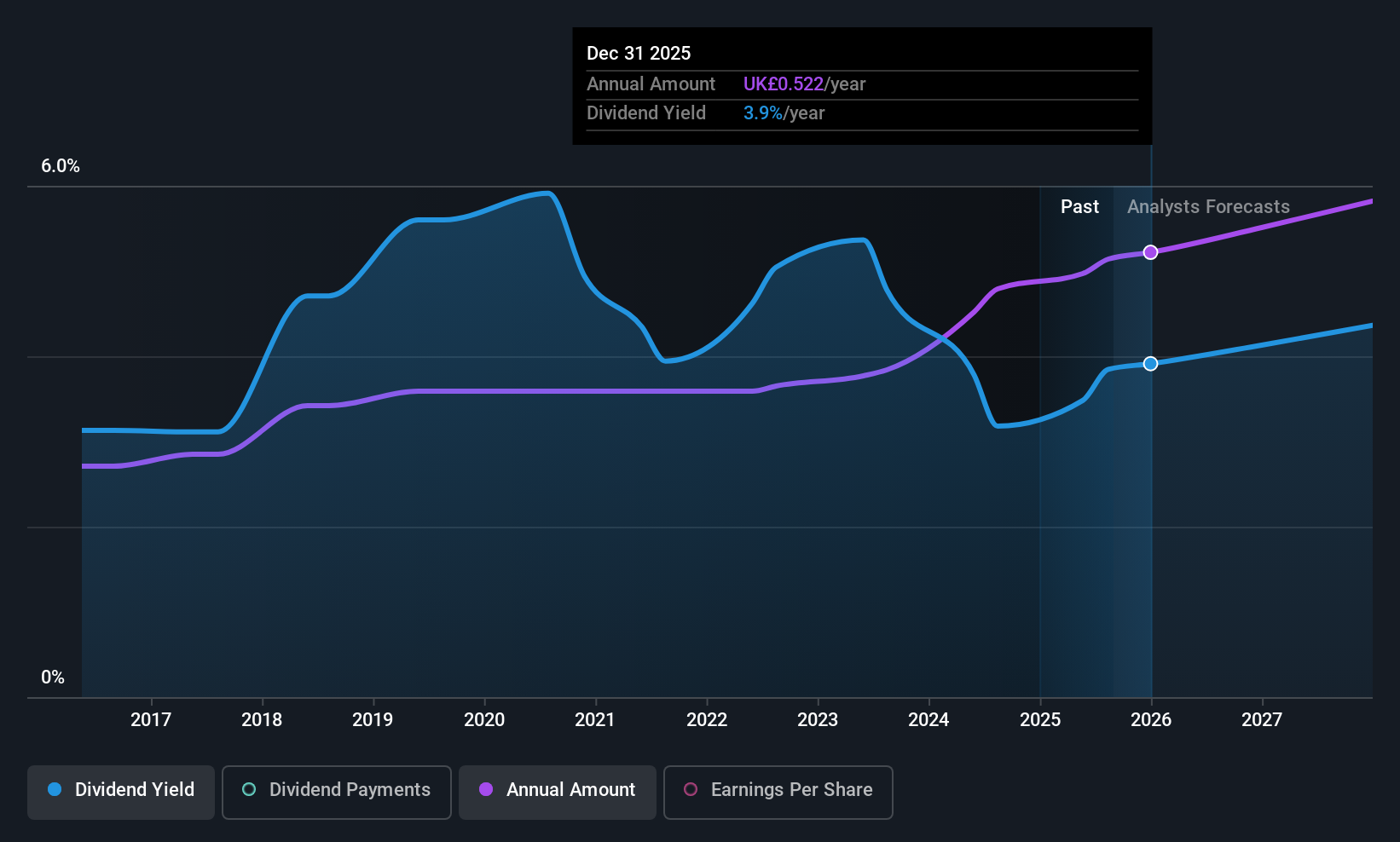

Keller Group (LSE:KLR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Keller Group plc offers specialist geotechnical services across North America, Europe, the Middle East, and the Asia-Pacific with a market cap of approximately £1.09 billion.

Operations: Keller Group plc generates its revenue primarily from specialist geotechnical services, amounting to £2.95 billion.

Dividend Yield: 3.3%

Keller Group has consistently grown its dividends over the past decade with minimal volatility, supported by a low payout ratio of 26.4% and a cash payout ratio of 35.4%, ensuring strong coverage by earnings and cash flows. Although its dividend yield of 3.27% is below the top UK payers, it trades at good value relative to peers, with earnings rising by £10.7 million last year and analysts expecting further stock price appreciation.

- Delve into the full analysis dividend report here for a deeper understanding of Keller Group.

- Our valuation report unveils the possibility Keller Group's shares may be trading at a discount.

Key Takeaways

- Click here to access our complete index of 52 Top UK Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AEP

AEP Plantations

Owns, operates, and develops oil palm plantations in Indonesia and Malaysia.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)