- United Kingdom

- /

- Banks

- /

- LSE:LLOY

UK Dividend Stocks: Begbies Traynor Group And 2 Others To Consider

Reviewed by Simply Wall St

As the UK market grapples with global economic challenges, particularly the sluggish recovery in China impacting commodity-linked stocks, investors are increasingly seeking stability amidst volatility. In such an environment, dividend stocks like Begbies Traynor Group can offer a reliable income stream, making them an attractive consideration for those looking to balance risk with consistent returns.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.89% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 6.19% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.79% | ★★★★★★ |

| OSB Group (LSE:OSB) | 5.98% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.97% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.24% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.88% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.22% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.65% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.26% | ★★★★★☆ |

Click here to see the full list of 54 stocks from our Top UK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Begbies Traynor Group (AIM:BEG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Begbies Traynor Group plc offers professional services to businesses, advisors, corporations, and financial institutions in the UK with a market cap of £183.58 million.

Operations: Begbies Traynor Group plc's revenue is derived from its Property Advisory segment, which generated £46.40 million, and its Business Recovery and Advisory segment, contributing £107.30 million.

Dividend Yield: 3.7%

Begbies Traynor Group has demonstrated a consistent dividend history over the past decade, with recent increases reflecting this trend. The proposed final dividend for 2025 is up by 8% year-on-year. However, its dividends are not fully covered by earnings, as indicated by a high payout ratio of 108.5%. While cash flows support dividends with a reasonable cash payout ratio of 51%, significant insider selling and low yield compared to top UK payers may concern some investors.

- Dive into the specifics of Begbies Traynor Group here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Begbies Traynor Group is priced lower than what may be justified by its financials.

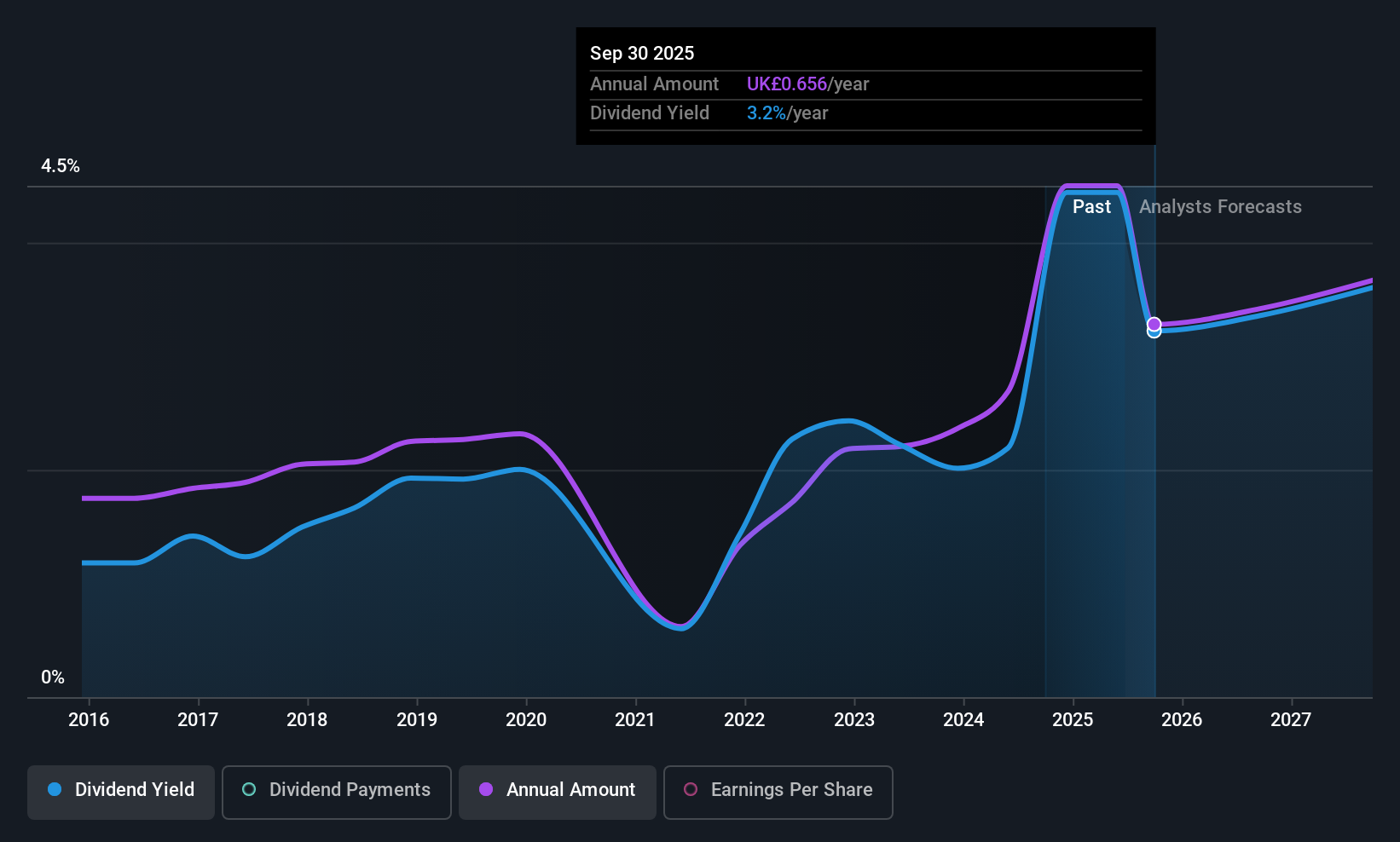

Associated British Foods (LSE:ABF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Associated British Foods plc is a diversified company engaged in food production, ingredients, and retail operations globally with a market capitalization of approximately £16.19 billion.

Operations: Associated British Foods plc generates revenue from several segments, including Sugar (£2.46 billion), Retail (£9.42 billion), Grocery (£4.21 billion), Agriculture (£1.62 billion), and Ingredients (£2.11 billion).

Dividend Yield: 4%

Associated British Foods has shown dividend growth over the past decade, but payments have been volatile and unreliable. The company's dividends are well covered by earnings, with a payout ratio of 35.4%, and cash flows, at 50%. Despite trading at good value compared to peers and being 10% below its estimated fair value, its dividend yield of 3.96% is lower than the top UK payers' average of 5.4%.

- Click to explore a detailed breakdown of our findings in Associated British Foods' dividend report.

- Our expertly prepared valuation report Associated British Foods implies its share price may be lower than expected.

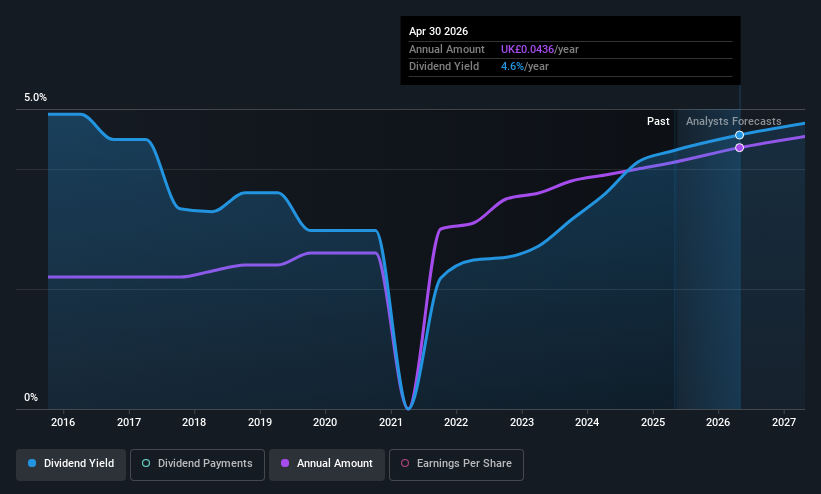

Lloyds Banking Group (LSE:LLOY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lloyds Banking Group plc, along with its subsidiaries, offers a variety of banking and financial products and services both in the United Kingdom and internationally, with a market cap of £49.49 billion.

Operations: Lloyds Banking Group generates its revenue through segments including Retail (Incl. Wealth) at £11.13 billion, Insurance, Pensions and Investments at £1.19 billion, and Commercial Banking (Excl. Credit Cards) at £5.14 billion.

Dividend Yield: 4%

Lloyds Banking Group's recent interim dividend increase of 15% reflects its commitment to a progressive policy, although its dividends have historically been volatile. The payout ratio stands at 50%, suggesting dividends are currently covered by earnings. Recent legal challenges and potential FCA compensation schemes introduce uncertainties, yet the group maintains strong financial performance with net income rising to £2.52 billion for H1 2025. Despite trading below estimated fair value, its dividend yield remains lower than top UK payers.

- Click here and access our complete dividend analysis report to understand the dynamics of Lloyds Banking Group.

- The analysis detailed in our Lloyds Banking Group valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Take a closer look at our Top UK Dividend Stocks list of 54 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LLOY

Lloyds Banking Group

Provides a range of banking and financial products and services in the United Kingdom and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives