TTK Healthcare's (NSE:TTKHLTCARE) Shareholders Are Down 36% On Their Shares

TTK Healthcare Limited (NSE:TTKHLTCARE) shareholders should be happy to see the share price up 16% in the last quarter. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 36% in the last three years, falling well short of the market return.

Check out our latest analysis for TTK Healthcare

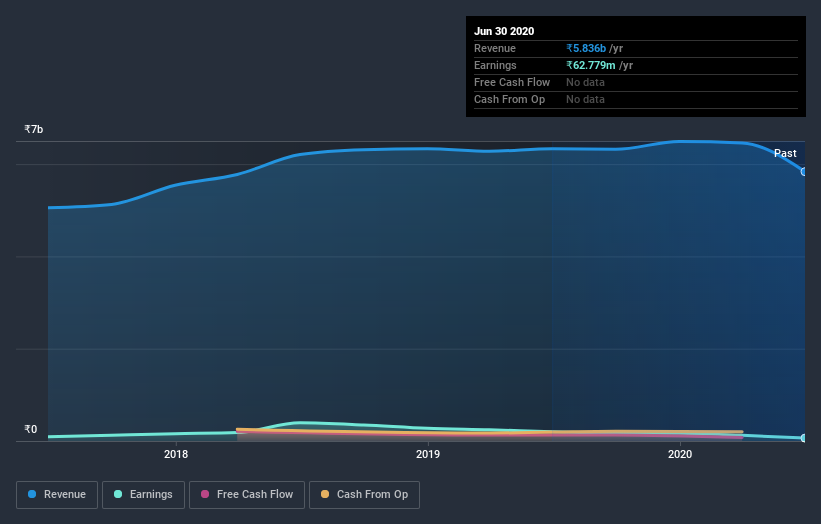

Given that TTK Healthcare only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over three years, TTK Healthcare grew revenue at 6.2% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. The stock dropped 11% during that time. If revenue growth accelerates, we might see the share price bounce. But ultimately the key will be whether the company can become profitability.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on TTK Healthcare's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

TTK Healthcare shareholders have gained 9.8% over twelve months (even including dividends). This isn't far from the market return of 11%. Shareholders can take comfort that it's certainly better than the yearly loss of about 10% per year endured over the last three years. It could well be that the business is getting back on track. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that TTK Healthcare is showing 4 warning signs in our investment analysis , and 1 of those is potentially serious...

But note: TTK Healthcare may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade TTK Healthcare, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TTK Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:TTKHLTCARE

TTK Healthcare

Engages in the animal welfare and human pharma product, consumer product, medical device, protective device, food, and other businesses in India.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives