- Canada

- /

- Oil and Gas

- /

- TSX:QEC

TSX's Promising Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The first half of 2025 has been a rollercoaster for investors, with the TSX and S&P 500 reaching all-time highs despite earlier volatility driven by U.S. policy shifts and trade tensions. As we navigate these uncertain times, it's essential to identify stocks that can weather economic fluctuations effectively. Penny stocks, often representing smaller or newer companies, remain relevant for investors seeking growth opportunities; when backed by strong financial health, they offer potential for significant returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$59.68M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.69 | CA$631.06M | ✅ 3 ⚠️ 4 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.06 | CA$100.61M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.96 | CA$19.22M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.47 | CA$159.88M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$177.41M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$5.65M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 444 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Questerre Energy (TSX:QEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Questerre Energy Corporation is an energy technology and innovation company focused on acquiring, exploring, and developing non-conventional oil and gas projects in Canada, with a market cap of CA$128.56 million.

Operations: The company's revenue is derived from its Oil & Gas - Exploration & Production segment, totaling CA$34.78 million.

Market Cap: CA$128.56M

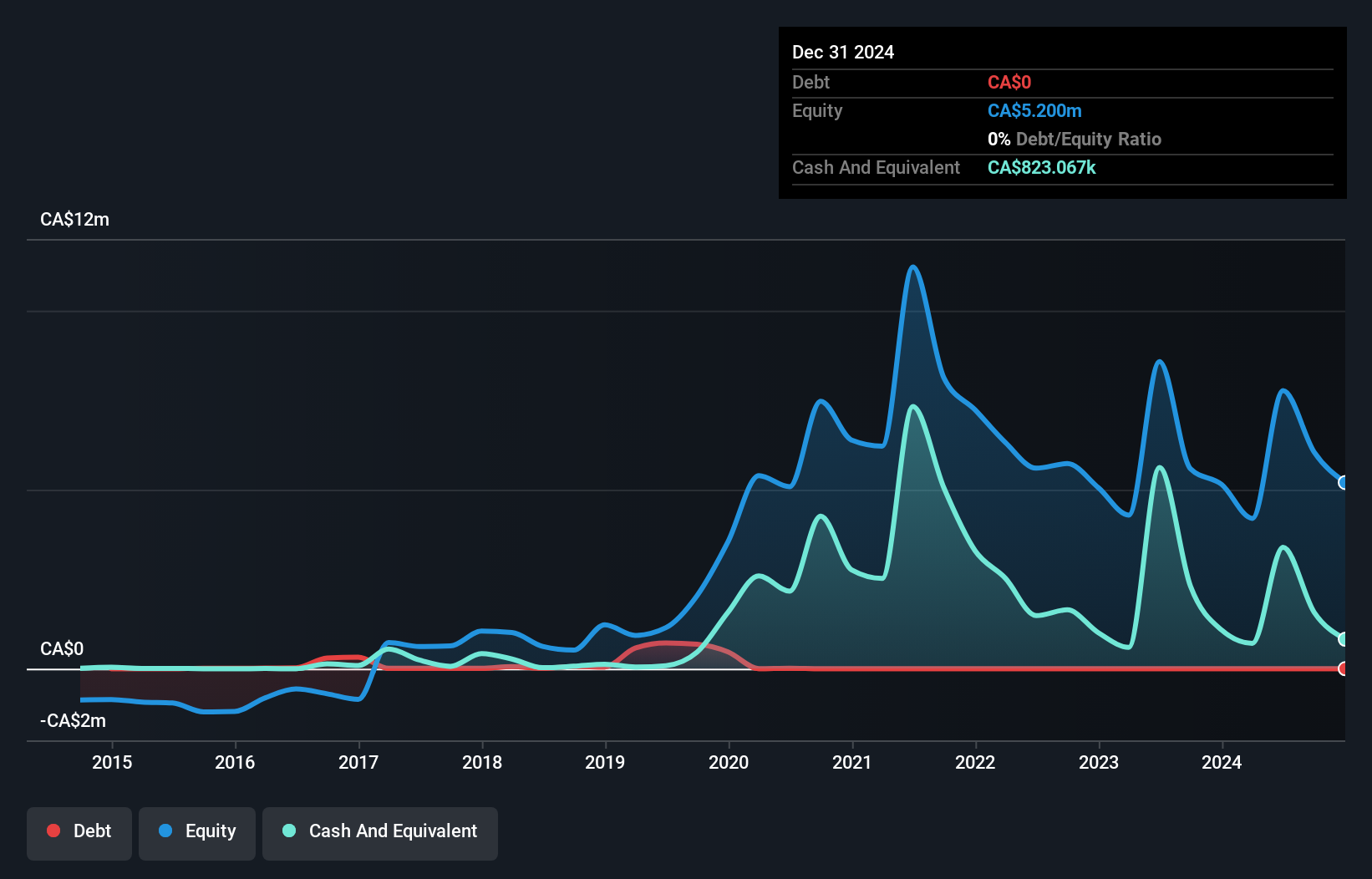

Questerre Energy Corporation, with a market cap of CA$128.56 million and first-quarter revenue of CA$8.58 million, shows some stability in the volatile penny stock arena due to its sufficient cash runway exceeding three years if free cash flow growth continues. Despite being unprofitable, the company has reduced losses by 35% annually over five years and maintains a strong financial position with more cash than debt and short-term assets covering both short- and long-term liabilities. The seasoned management team further bolsters investor confidence, although challenges remain given its negative return on equity of -5.14%.

- Navigate through the intricacies of Questerre Energy with our comprehensive balance sheet health report here.

- Assess Questerre Energy's previous results with our detailed historical performance reports.

Stillwater Critical Minerals (TSXV:PGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stillwater Critical Minerals Corp. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada and the United States, with a market cap of CA$52.12 million.

Operations: Stillwater Critical Minerals Corp. does not have any reported revenue segments at this time.

Market Cap: CA$52.12M

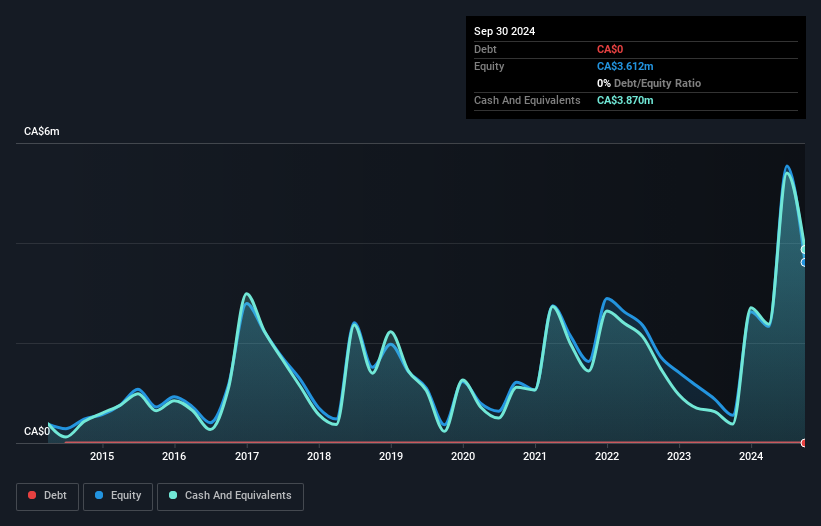

Stillwater Critical Minerals Corp., with a market cap of CA$52.12 million, operates as a pre-revenue entity focused on mineral exploration. Recent developments include the commencement of drilling at its Stillwater West project in Montana, backed by collaborations with Glencore and ALS GoldSpot to enhance targeting through AI and machine learning. Despite being debt-free and having experienced management and board teams, the company faces challenges such as high share price volatility and limited cash runway, recently bolstered by a private placement aiming to raise nearly CA$6 million for further exploration efforts.

- Jump into the full analysis health report here for a deeper understanding of Stillwater Critical Minerals.

- Examine Stillwater Critical Minerals' past performance report to understand how it has performed in prior years.

PJX Resources (TSXV:PJX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PJX Resources Inc. is involved in the acquisition, exploration, and development of mineral resource properties in Canada with a market cap of CA$21.81 million.

Operations: PJX Resources Inc. has not reported any revenue segments.

Market Cap: CA$21.81M

PJX Resources Inc., with a market cap of CA$21.81 million, is pre-revenue and engaged in mineral exploration. The company faces financial challenges, including a net loss of CA$6.04 million for 2024 and auditor concerns about its ability to continue as a going concern. Despite being debt-free and having seasoned board members, PJX has less than one year of cash runway based on current free cash flow levels. Short-term assets exceed liabilities, providing some financial stability, but the ongoing losses and limited cash reserves present significant hurdles for sustained operations without additional funding or revenue generation strategies.

- Click here to discover the nuances of PJX Resources with our detailed analytical financial health report.

- Learn about PJX Resources' historical performance here.

Make It Happen

- Take a closer look at our TSX Penny Stocks list of 444 companies by clicking here.

- Contemplating Other Strategies? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Questerre Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:QEC

Questerre Energy

An energy technology and innovation company, engages in the acquisition, exploration, and development non-conventional oil and gas projects in Canada.

Flawless balance sheet minimal.

Market Insights

Community Narratives