- Canada

- /

- Metals and Mining

- /

- TSXV:UGD

TSX Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As the Canadian market navigates ongoing tariff uncertainties, investors have shown resilience, with both the S&P 500 and TSX seeing significant gains in May. In times of economic fluctuation, identifying stocks with strong financials becomes crucial for those seeking stability and growth potential. Penny stocks, despite their outdated moniker, continue to offer intriguing opportunities; these smaller or newer companies can provide a unique blend of value and growth that larger firms might overlook.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.75 | CA$75.86M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.74 | CA$116.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.30 | CA$131.52M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.68 | CA$446.12M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.27 | CA$669.5M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.84 | CA$4.8M | ✅ 2 ⚠️ 5 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.74 | CA$168.18M | ✅ 3 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.58 | CA$530.69M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.65 | CA$134.5M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.405 | CA$11.6M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 876 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Haivision Systems (TSX:HAI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Haivision Systems Inc. offers mission-critical, real-time video networking and visual collaboration solutions across Canada, the United States, and internationally, with a market cap of CA$126.66 million.

Operations: The company's revenue segment includes Internet Telephone, generating CA$123.12 million.

Market Cap: CA$126.66M

Haivision Systems Inc., with a market cap of CA$126.66 million, demonstrates key attributes typical of penny stocks, including potential for high growth and inherent risks. The company has shown robust earnings growth over the past year at 63.5%, surpassing industry averages, and forecasts suggest continued strong performance. Its debt is well-covered by operating cash flow, and it maintains more cash than total debt, indicating financial prudence. However, recent earnings results revealed a net loss of CA$1.08 million for Q1 2025 against a previous net income, highlighting volatility in its financial outcomes despite high-quality earnings overall.

- Navigate through the intricacies of Haivision Systems with our comprehensive balance sheet health report here.

- Examine Haivision Systems' earnings growth report to understand how analysts expect it to perform.

EarthLabs (TSXV:SPOT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EarthLabs Inc. is a Canadian company engaged in mining investment, technology, and media operations with a market cap of CA$30.32 million.

Operations: EarthLabs Inc. has not reported any specific revenue segments.

Market Cap: CA$30.32M

EarthLabs Inc., with a market cap of CA$30.32 million, reflects typical penny stock characteristics, including volatility and speculative potential. The company has transitioned from pre-revenue to generating meaningful revenue, reporting CA$8.44 million for 2024 compared to CA$1.93 million in the previous year. Despite this growth, EarthLabs remains unprofitable with a net loss of CA$6.19 million in 2024, though improved from a larger loss previously. Its financial stability is supported by short-term assets exceeding liabilities and sufficient cash runway for over three years despite shrinking free cash flow, offering some resilience amidst its high volatility and risk profile.

- Click here and access our complete financial health analysis report to understand the dynamics of EarthLabs.

- Evaluate EarthLabs' historical performance by accessing our past performance report.

Unigold (TSXV:UGD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Unigold Inc. is a junior natural resource company engaged in exploring and developing gold projects in the Dominican Republic, with a market cap of CA$26.58 million.

Operations: Unigold Inc. does not report any revenue segments.

Market Cap: CA$26.58M

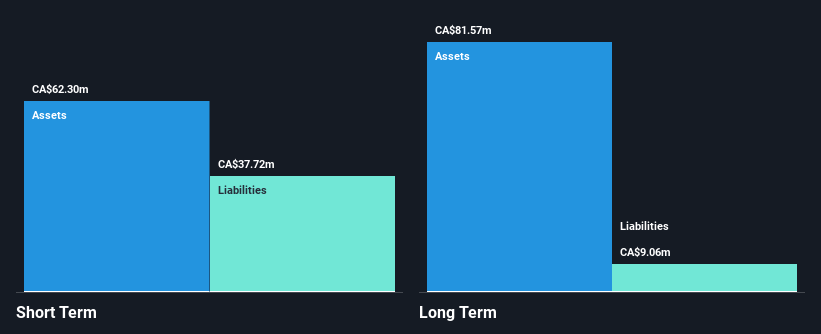

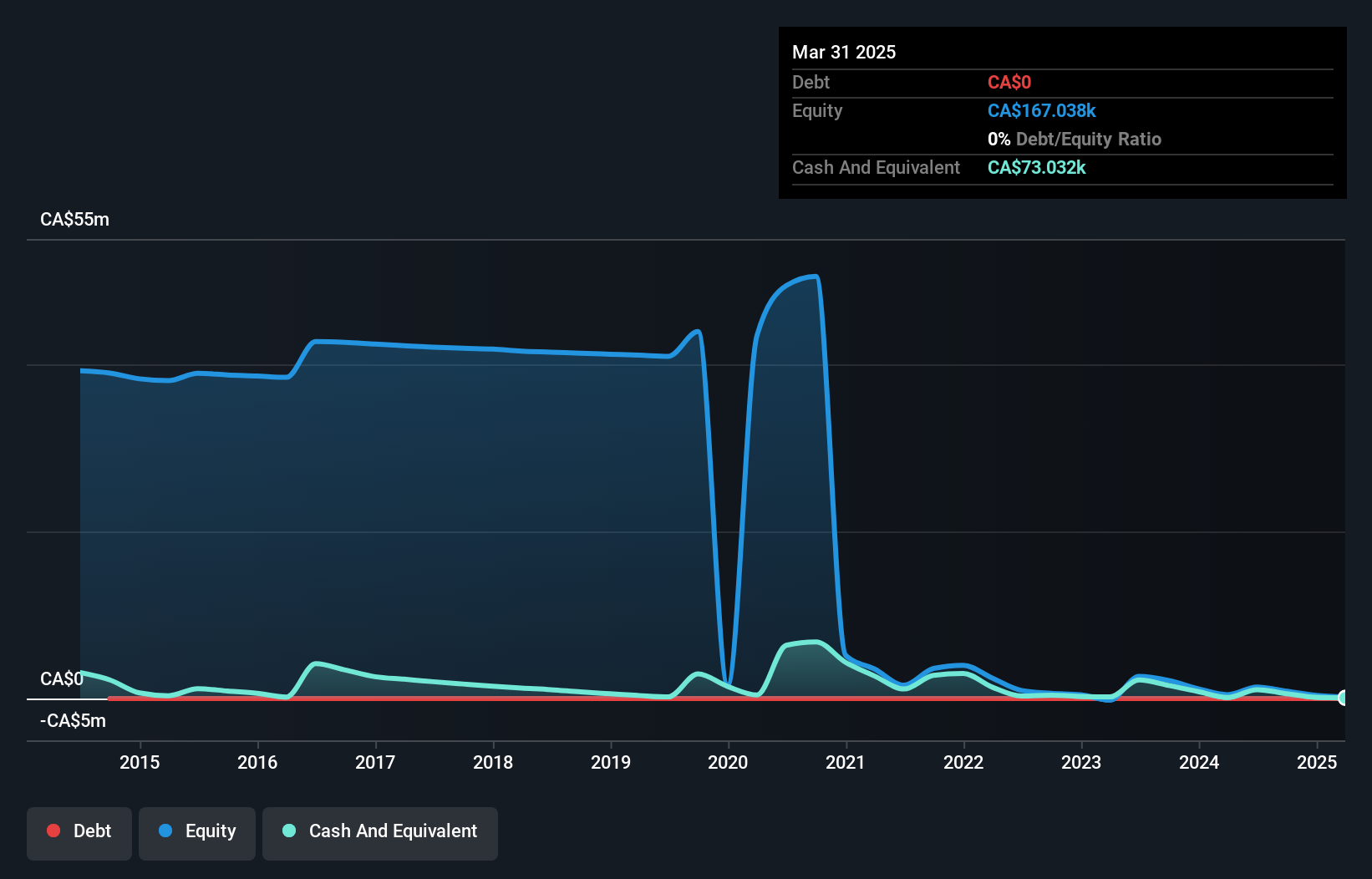

Unigold Inc., with a market cap of CA$26.58 million, exemplifies the speculative nature of penny stocks due to its pre-revenue status and high volatility. The company reported a reduced net loss for Q1 2025 at CA$0.50 million compared to CA$0.72 million the previous year, indicating some progress in minimizing losses over time. Despite having no debt and an experienced management team, Unigold faces financial challenges highlighted by auditor concerns about its ability to continue as a going concern and short-term liabilities exceeding assets. Recent capital raised through private placements offers temporary relief but underscores ongoing funding needs.

- Dive into the specifics of Unigold here with our thorough balance sheet health report.

- Assess Unigold's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Unlock our comprehensive list of 876 TSX Penny Stocks by clicking here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:UGD

Unigold

A junior natural resource company, focuses on exploring and developing gold projects in the Dominican Republic.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion