- Canada

- /

- Energy Services

- /

- TSX:ACX

TSX Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As the Canadian market navigates ongoing tariff uncertainties, investors have shown resilience, with notable gains in May as both the S&P 500 and TSX rose over 5%. In this climate of cautious optimism, identifying stocks that combine strong fundamentals with growth potential is key. Penny stocks may seem like a relic from past trading days, but they continue to offer intriguing opportunities for investors seeking smaller or newer companies with solid financials and the potential for significant returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.75 | CA$73.84M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.64 | CA$576.47M | ✅ 3 ⚠️ 3 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.43 | CA$759.11M | ✅ 4 ⚠️ 2 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$3.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.73 | CA$472.37M | ✅ 3 ⚠️ 2 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.55 | CA$107.06M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.29 | CA$134.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.64 | CA$137.04M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.78 | CA$173.98M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 878 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

ACT Energy Technologies (TSX:ACX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ACT Energy Technologies Ltd., with a market cap of CA$166.75 million, offers directional drilling services to oil and natural gas companies in Canada and the United States through its subsidiaries.

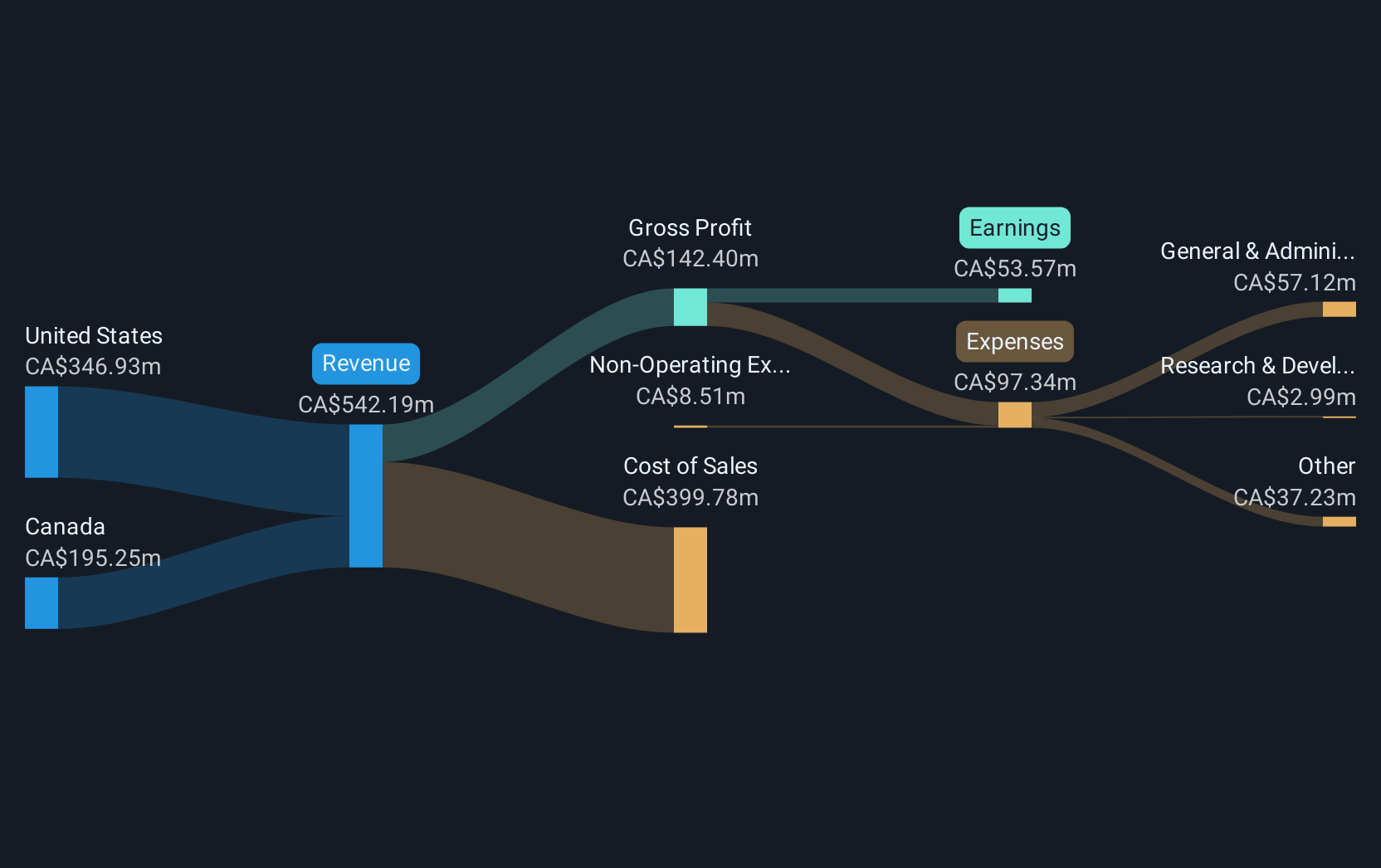

Operations: The company generates revenue of CA$542.19 million from providing directional drilling services.

Market Cap: CA$166.75M

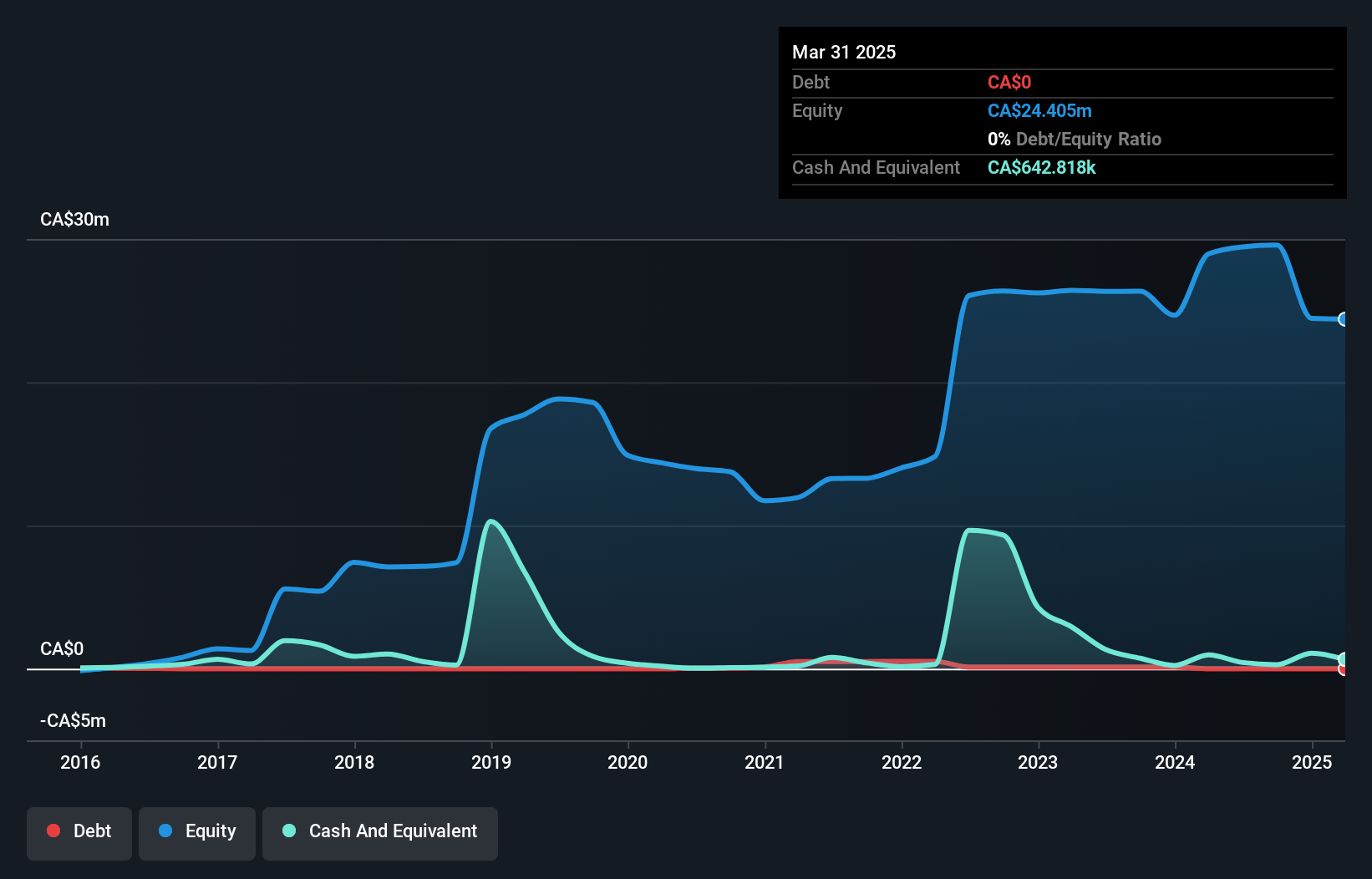

ACT Energy Technologies Ltd., with a market cap of CA$166.75 million, has demonstrated significant earnings growth, increasing profits by 150.1% over the past year and maintaining high-quality earnings. Despite a decline in first-quarter sales and net income compared to the previous year, the company remains profitable with strong coverage of interest payments by EBIT (4.7x) and satisfactory debt levels (net debt to equity ratio at 31.8%). Recent management changes include appointing Robert Skilnick as CFO, enhancing financial leadership amid ongoing share buyback activities that reduced outstanding shares by 3.84%.

- Click to explore a detailed breakdown of our findings in ACT Energy Technologies' financial health report.

- Examine ACT Energy Technologies' earnings growth report to understand how analysts expect it to perform.

Awalé Resources (TSXV:ARIC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Awalé Resources Limited is engaged in identifying and exploring precious metal projects in Côte d'Ivoire, with a market cap of CA$40.24 million.

Operations: There are no reported revenue segments for Awalé Resources Limited.

Market Cap: CA$40.24M

Awalé Resources, with a market cap of CA$40.24 million, is pre-revenue and debt-free, focusing on exploration in Côte d'Ivoire. Recent drilling at the Empire target within the Odienne Project revealed significant gold mineralization, underscoring district-scale potential. The company has raised CA$8.27 million through a private placement to fund ongoing exploration efforts across its 100%-owned properties. Despite an inexperienced board and management team, Awalé's technical expertise supports its aggressive exploration strategy in this pro-mining jurisdiction. Short-term assets of $8.6M comfortably cover liabilities of $2.8M, providing financial stability for continued project development.

- Dive into the specifics of Awalé Resources here with our thorough balance sheet health report.

- Evaluate Awalé Resources' historical performance by accessing our past performance report.

Pulse Oil (TSXV:PUL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pulse Oil Corp. is involved in the exploration and production of crude oil, natural gas, and natural gas liquids in Alberta, with a market cap of CA$6.23 million.

Operations: Pulse Oil Corp. currently has no reported revenue segments.

Market Cap: CA$6.23M

Pulse Oil Corp., with a market cap of CA$6.23 million, is navigating financial challenges as it focuses on its Bigoray enhanced oil recovery project in Alberta. The company recently secured CA$2.25 million through related-party loan agreements to fund this initiative, although high-interest rates and establishment fees increase financial pressure. Despite reporting annual revenue of CA$4.69 million for 2024, the company remains unprofitable with significant net losses and auditor concerns about its ability to continue as a going concern. Pulse's seasoned management and board offer stability amidst volatility in share price and increasing weekly returns volatility over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Pulse Oil.

- Explore historical data to track Pulse Oil's performance over time in our past results report.

Seize The Opportunity

- Reveal the 878 hidden gems among our TSX Penny Stocks screener with a single click here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ACX

ACT Energy Technologies

Provides directional drilling services to oil and natural gas companies in Canada and the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives