- Canada

- /

- Metals and Mining

- /

- TSXV:TRO

TSX Penny Stocks To Watch: Cannabix Technologies And Two More Top Picks

Reviewed by Simply Wall St

The Canadian market is currently navigating a complex landscape shaped by international trade tensions and evolving fiscal policies, with tariffs potentially impacting demand for overseas goods. In this context, investors often seek opportunities in penny stocks—smaller or newer companies that can offer affordability and growth potential. Despite the term's outdated connotation, these stocks can present valuable opportunities when they demonstrate strong financials and a clear path to growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.69 | CA$70.8M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.16 | CA$104.26M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.41 | CA$429.38M | ✅ 4 ⚠️ 0 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$498.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.60 | CA$190.84M | ✅ 1 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.54 | CA$153.38M | ✅ 4 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.93 | CA$184.2M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.22 | CA$9.14M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 445 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Cannabix Technologies (CNSX:BLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cannabix Technologies Inc. is a technology company that develops marijuana and alcohol breathalyzers for employers, law enforcement, workplaces, and laboratories in the United States with a market cap of CA$76.21 million.

Operations: Cannabix Technologies Inc. has not reported any specific revenue segments.

Market Cap: CA$76.21M

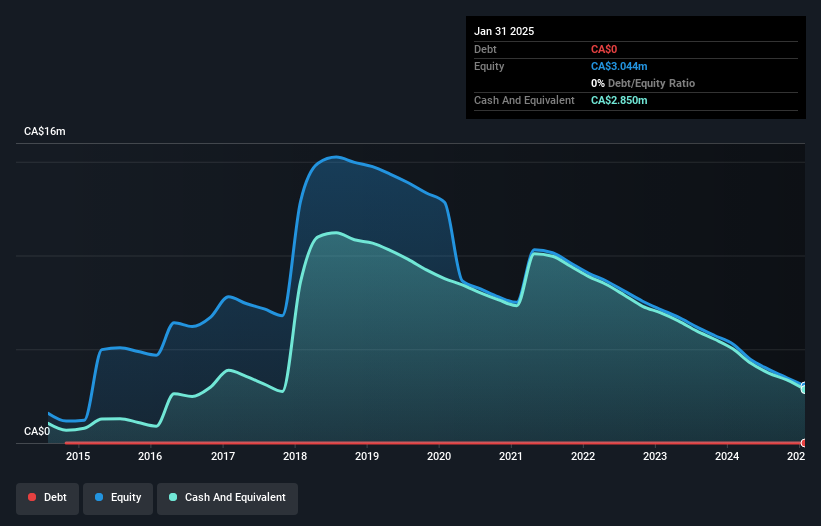

Cannabix Technologies Inc., with a market cap of CA$76.21 million, is currently pre-revenue and focuses on breathalyzer technology for marijuana and alcohol detection. The company has made significant strides in its intellectual property portfolio, receiving a notice of allowance from the USPTO for its innovative contact-free breath analysis device. Recent collaborations include Omega Laboratories' validation of Cannabix's Marijuana Breath Test technology and an exclusive distribution agreement with Breathalyser SSP in Australia for its BreathLogix devices. Despite being unprofitable, Cannabix has no debt, sufficient cash runway, and is actively expanding its commercialization efforts globally.

- Take a closer look at Cannabix Technologies' potential here in our financial health report.

- Understand Cannabix Technologies' track record by examining our performance history report.

Oroco Resource (TSXV:OCO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Oroco Resource Corp. is an exploration stage company focused on acquiring and exploring mineral properties in Mexico, with a market cap of CA$66.91 million.

Operations: Currently, there are no reported revenue segments for this exploration stage company focused on mineral properties in Mexico.

Market Cap: CA$66.91M

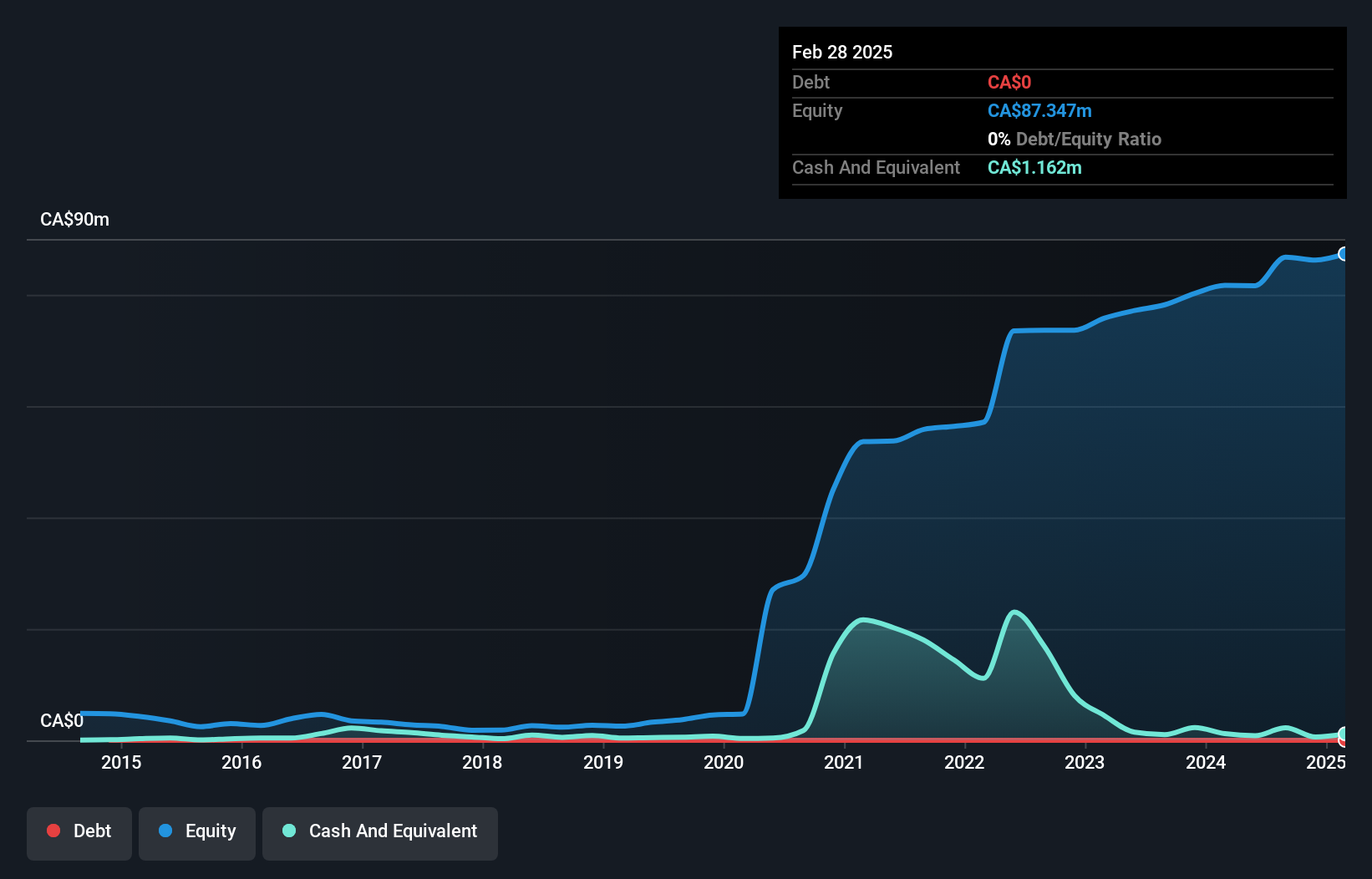

Oroco Resource Corp., with a market cap of CA$66.91 million, is pre-revenue and focused on its Santo Tomas copper project in Mexico. The company recently engaged Whittle Consulting for a Strategic Option Study to optimize mining operations, potentially enhancing project value. Oroco's management and board are experienced, though the company faces liquidity challenges with short-term assets of CA$1.5 million insufficient to cover liabilities of CA$1.8 million. Despite being debt-free, Oroco has limited cash runway but plans further equity financing in 2025 to support ongoing developments and operational strategies aimed at unlocking additional resources through environmental initiatives.

- Click here to discover the nuances of Oroco Resource with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Oroco Resource's track record.

Taranis Resources (TSXV:TRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taranis Resources Inc. is an exploration stage company focused on acquiring, exploring, and developing precious and base metal projects in Canada with a market cap of CA$27.09 million.

Operations: Taranis Resources Inc. has not reported any revenue segments as it is currently in the exploration stage, concentrating on precious and base metal projects in Canada.

Market Cap: CA$27.09M

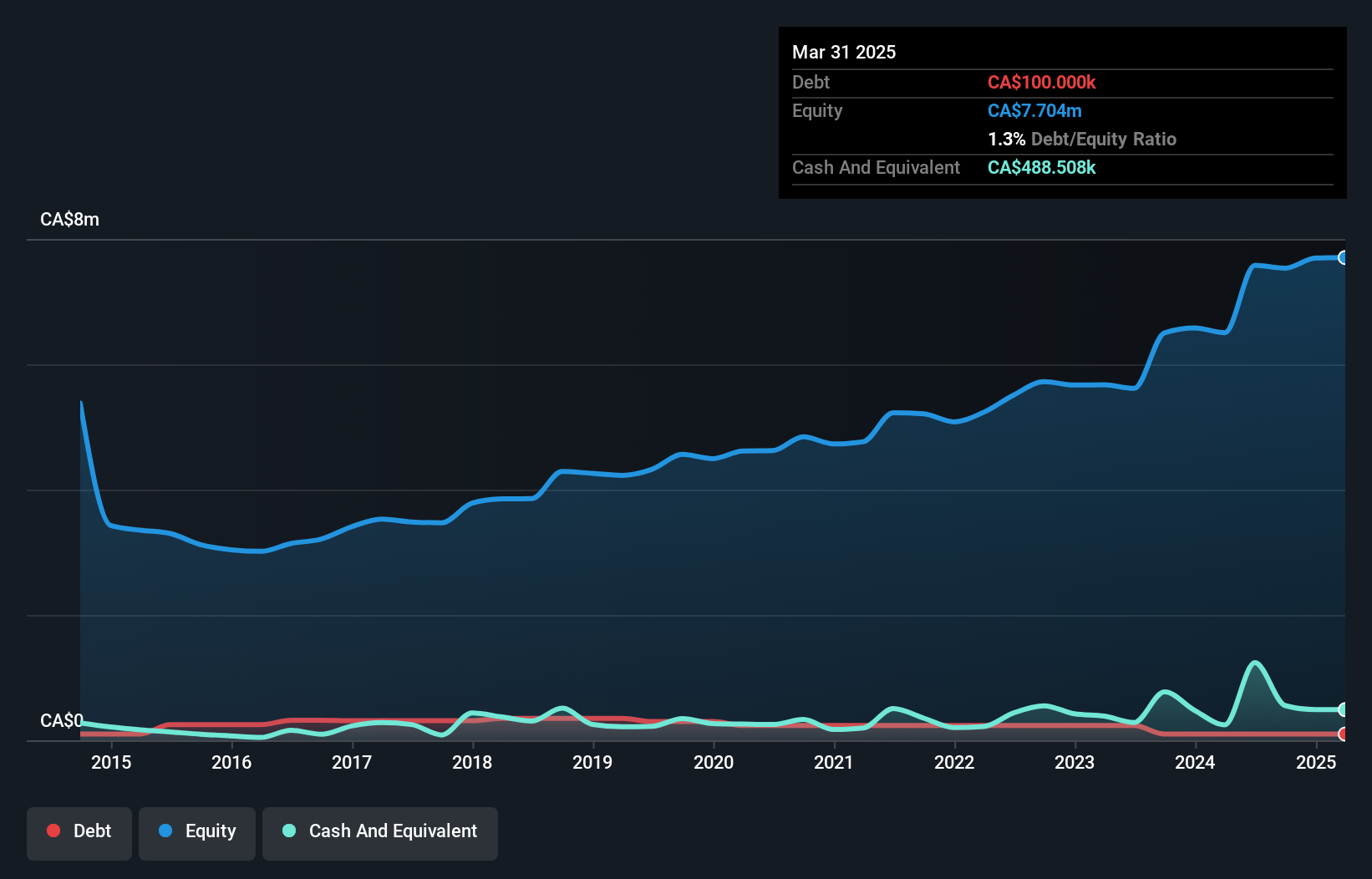

Taranis Resources Inc., with a market cap of CA$27.09 million, is a pre-revenue exploration company focusing on the Thor project in Canada. Recently, it announced a non-brokered private placement to raise CA$540,000, enhancing its cash runway beyond the current four months. Despite having more cash than debt and no significant shareholder dilution recently, Taranis faces going concern doubts from auditors due to ongoing losses and insufficient short-term assets to cover liabilities. The company's strategic expansion at Thor includes new drilling permits and engineering assessments for bulk sampling, aiming to unlock potential value from precious and critical minerals deposits.

- Navigate through the intricacies of Taranis Resources with our comprehensive balance sheet health report here.

- Evaluate Taranis Resources' historical performance by accessing our past performance report.

Summing It All Up

- Investigate our full lineup of 445 TSX Penny Stocks right here.

- Interested In Other Possibilities? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taranis Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TRO

Taranis Resources

An exploration stage company, engages in the acquisition, exploration, and development of precious and base metal projects in Canada.

Excellent balance sheet low.

Market Insights

Community Narratives