- United States

- /

- Medical Equipment

- /

- NasdaqGS:TRIB

Trinity Biotech (NASDAQ:TRIB) Seems To Be Using An Awful Lot Of Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Trinity Biotech plc (NASDAQ:TRIB) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Trinity Biotech

How Much Debt Does Trinity Biotech Carry?

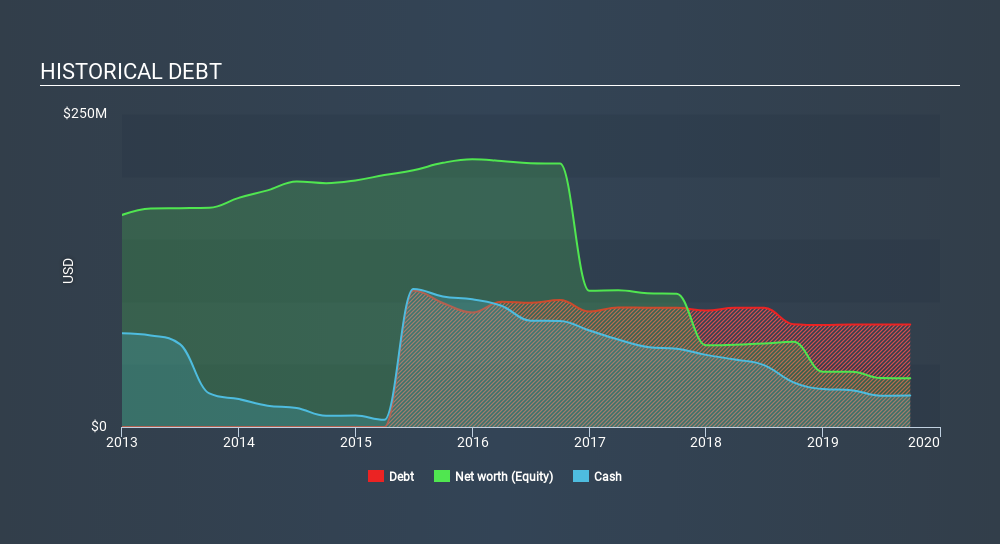

The chart below, which you can click on for greater detail, shows that Trinity Biotech had US$80.9m in debt in September 2019; about the same as the year before. On the flip side, it has US$25.1m in cash leading to net debt of about US$55.8m.

How Healthy Is Trinity Biotech's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Trinity Biotech had liabilities of US$25.9m due within 12 months and liabilities of US$108.4m due beyond that. Offsetting this, it had US$25.1m in cash and US$26.1m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$83.2m.

This deficit casts a shadow over the US$22.2m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Trinity Biotech would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 1.2 times and a disturbingly high net debt to EBITDA ratio of 7.3 hit our confidence in Trinity Biotech like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Fortunately, Trinity Biotech grew its EBIT by 3.9% in the last year, slowly shrinking its debt relative to earnings. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Trinity Biotech's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Trinity Biotech burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Trinity Biotech's conversion of EBIT to free cash flow left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. Having said that, its ability to grow its EBIT isn't such a worry. We should also note that Medical Equipment industry companies like Trinity Biotech commonly do use debt without problems. Taking into account all the aforementioned factors, it looks like Trinity Biotech has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. Even though Trinity Biotech lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check outhow earnings have been trending over the last few years.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:TRIB

Trinity Biotech

Acquires, together with its subsidiaries, develops, acquires, manufactures, and markets medical diagnostic products for the clinical laboratory and point-of-care (POC) segments of the diagnostic market in the Americas, Asia, Africa, and Europe.

Medium-low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives