- United States

- /

- Building

- /

- NYSE:TT

Trane Technologies (NYSE:TT) Declares US$3.76 Annualized Dividend for 2025

Reviewed by Simply Wall St

Trane Technologies (NYSE:TT) recently declared a quarterly dividend of $0.94 per share, amid a 27% rise in its stock price over the last quarter. The company's robust Q1 results, with a notable boost in both sales and net income, contributed to its strong market performance. The company's commitment to capital allocations, including dividends and share repurchase programs, likely reinforced investor confidence. Despite broader economic uncertainties, especially related to trade policy, the company's positive earnings and strategic initiatives may have added momentum, aligning with the overall market trend, where the S&P 500 and Nasdaq experienced modest gains.

Be aware that Trane Technologies is showing 1 warning sign in our investment analysis.

The recent declaration of a quarterly dividend by Trane Technologies comes at a time when the company saw its stock rise 27% over the past quarter, suggesting increased investor confidence. Over the last five years, Trane Technologies' total return, which includes share price and dividends, has been remarkable, growing by 389.07%. This exceptional long-term performance underscores the company's ability to create shareholder value, setting it apart from many peers in the US Building industry within a comparable time frame.

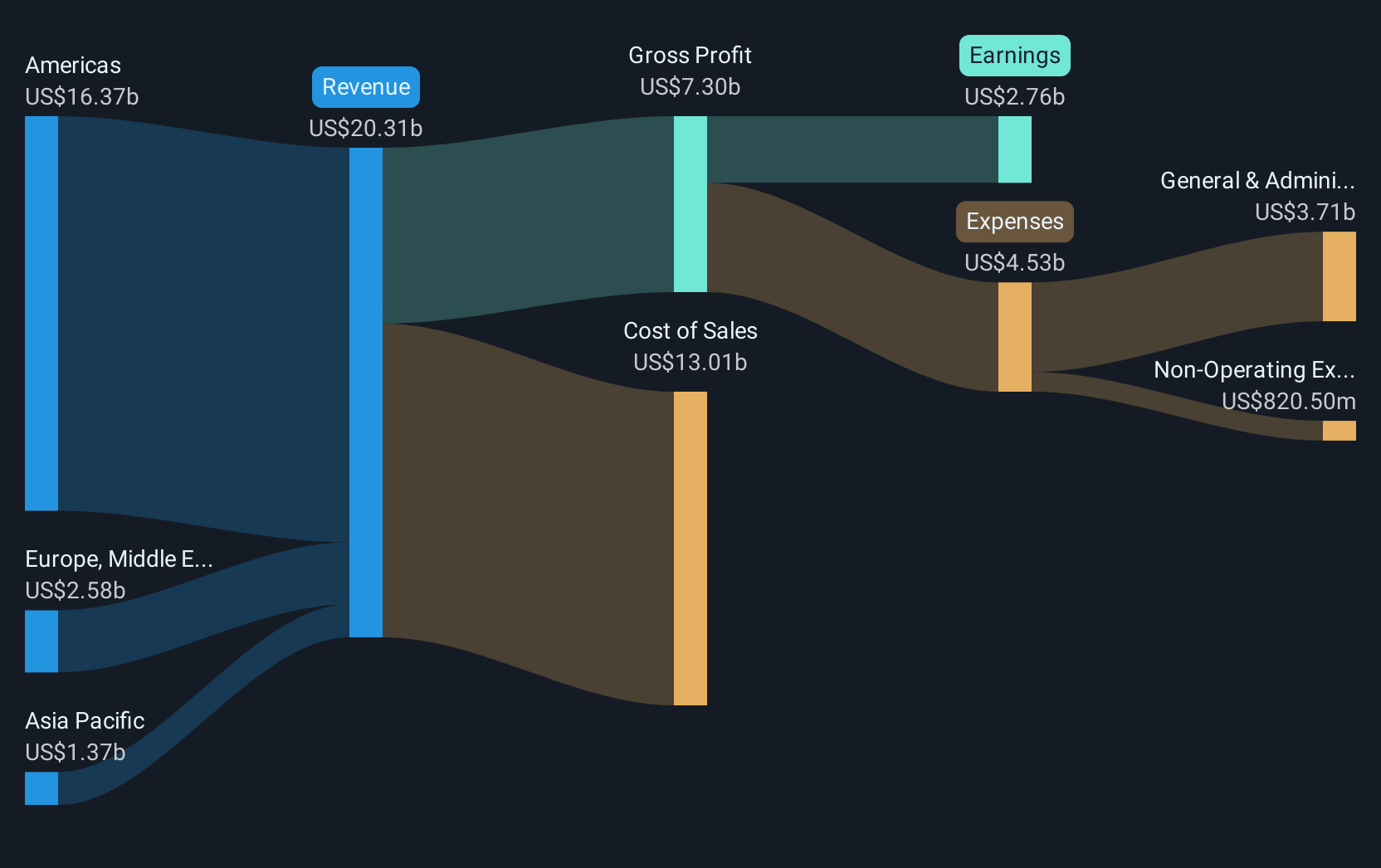

In the past year, Trane Technologies has outperformed the US Building industry and US Market, indicating resilience amid broader market conditions. Considering the company's robust Q1 results that propelled recent price movement, the positive momentum could potentially impact future revenue and earnings forecasts. The focus on energy efficiency in the Commercial HVAC sector is pivotal, aligning with broader market trends and supporting future revenue growth. Current analysts’ estimates project earnings growth from US$2.76 billion to US$3.5 billion over the next few years, but recent company initiatives could bring additional upside or challenges to these forecasts.

The company's present share price of US$406.68, slightly higher than the consensus analyst price target of US$399.35, indicates that the market may already be pricing in some anticipated growth and future potential. However, the slight discount to the target presents a nuanced view that could change based on execution and market conditions. Investors should continue to consider these factors when evaluating the company’s future prospects and inherent risks.

Our valuation report unveils the possibility Trane Technologies' shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trane Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TT

Trane Technologies

Designs, manufactures, sells, and services of solutions for heating, ventilation, air conditioning, and custom and transport refrigeration.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives