- United States

- /

- Banks

- /

- NasdaqGS:FNLC

Trade Alert: The Chairman of the Board Of The First Bancorp, Inc. (NASDAQ:FNLC), Mark Rosborough, Has Just Spent US$81k Buying Shares

Even if it's not a huge purchase, we think it was good to see that Mark Rosborough, the Chairman of the Board of The First Bancorp, Inc. (NASDAQ:FNLC) recently shelled out US$81k to buy stock, at US$26.84 per share. That might not be a big purchase but it only increased their holding by 1.8%, and could be interpreted as a good sign.

View our latest analysis for First Bancorp

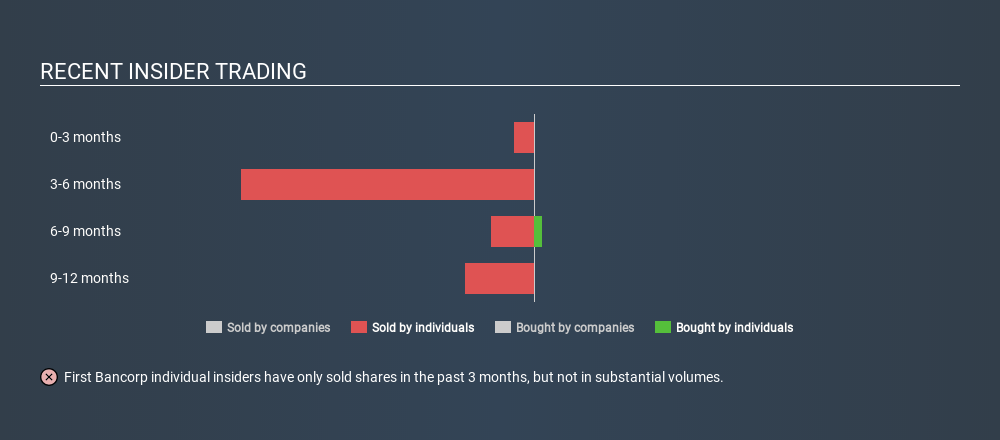

The Last 12 Months Of Insider Transactions At First Bancorp

Over the last year, we can see that the biggest insider sale was by the President, Tony McKim, for US$204k worth of shares, at about US$28.40 per share. So we know that an insider sold shares at around the present share price of US$25.58. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

Happily, we note that in the last year insiders paid US$86k for 3.20k shares. On the other hand they divested 10469.68 shares, for US$289k. All up, insiders sold more shares in First Bancorp than they bought, over the last year. The chart below shows insider transactions (by individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

I will like First Bancorp better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Insiders own 6.6% of First Bancorp shares, worth about US$18m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

What Might The Insider Transactions At First Bancorp Tell Us?

It is good to see the recent insider purchase. But we can't say the same for the transactions over the last 12 months. While recent transactions indicate confidence in First Bancorp, insiders don't own enough of the company to overcome our cautiousness about the longer term transactions. In short they are likely aligned with shareholders. I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow for free.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:FNLC

First Bancorp

Operates as the bank holding company for First National Bank that provides a range of banking products and services to individual and corporate customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives