- United Kingdom

- /

- Health Care REITs

- /

- LSE:AGR

Trade Alert: The CFO, Member of Executive Board & Executive Director Of Assura Plc (LON:AGR), Jayne Marie Cottam, Has Just Spent UK£62k Buying 82% More Shares

Even if it's not a huge purchase, we think it was good to see that Jayne Marie Cottam, the CFO, Member of Executive Board & Executive Director of Assura Plc (LON:AGR) recently shelled out UK£62k to buy stock, at UK£0.80 per share. While that isn't the hugest buy, it actually boosted their shareholding by 82%, which is good to see.

View our latest analysis for Assura

The Last 12 Months Of Insider Transactions At Assura

In the last twelve months, the biggest single sale by an insider was when the CEO, Member of Executive Board & Executive Director, Jonathan Murphy, sold UK£272k worth of shares at a price of UK£0.78 per share. That means that even when the share price was below the current price of UK£0.80, an insider wanted to cash in some shares. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 14% of Jonathan Murphy's stake.

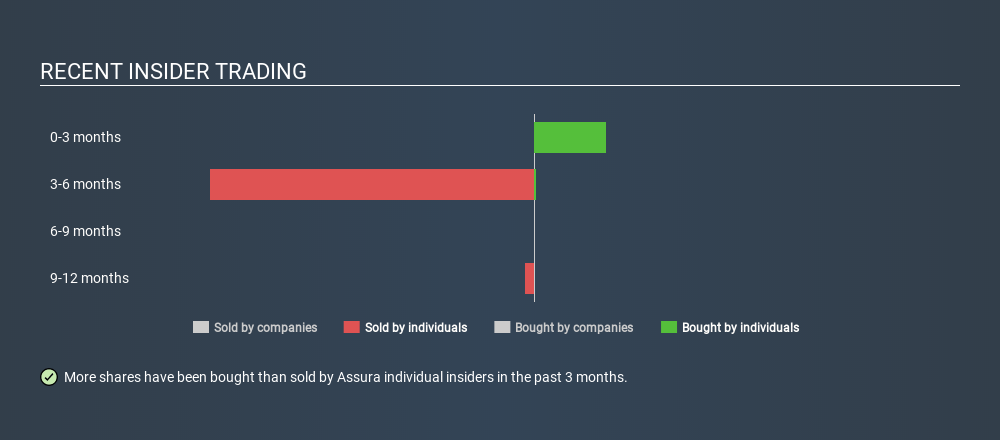

Happily, we note that in the last year insiders paid UK£63k for 79.14k shares. But insiders sold 359733 shares worth UK£279k. In total, Assura insiders sold more than they bought over the last year. The chart below shows insider transactions (by individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Assura Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Our data suggests Assura insiders own 0.1% of the company, worth about UK£2.0m. I generally like to see higher levels of ownership.

So What Do The Assura Insider Transactions Indicate?

The recent insider purchase is heartening. But we can't say the same for the transactions over the last 12 months. Neither the level of insider ownership, nor the transactions over the last twelve months inspire us, but we think the recent buying is positive. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Every company has risks, and we've spotted 3 warning signs for Assura (of which 1 is concerning!) you should know about.

Of course Assura may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About LSE:AGR

Assura

Assura plc is the UK's leading specialist healthcare property investor and developer.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives