- United Kingdom

- /

- Oil and Gas

- /

- LSE:GENL

Top UK Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

The London markets have recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, impacting companies tied to its economic fortunes. Despite these broader market pressures, penny stocks remain an intriguing area for investors seeking growth opportunities in smaller or newer companies. Although the term "penny stocks" might seem outdated, they continue to offer a blend of affordability and potential when supported by robust financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.03 | £453.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.72 | £381.32M | ✅ 5 ⚠️ 3 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.43 | £182.11M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.924 | £1.2B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.40 | £43.28M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.475 | £431.45M | ✅ 2 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.01 | £310.89M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.075 | £171.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.31 | £72.18M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 408 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cairn Homes (LSE:CRN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cairn Homes plc is a homebuilder operating in Ireland with a market capitalization of approximately £1.20 billion.

Operations: The company generates its revenue primarily through building and property development, with this segment contributing €859.87 million.

Market Cap: £1.2B

Cairn Homes plc, a homebuilder with a market capitalization of approximately £1.20 billion, has demonstrated strong financial performance with earnings growing by 34.1% over the past year, outpacing the Consumer Durables industry. The company is trading at 47.4% below its estimated fair value and maintains a satisfactory net debt to equity ratio of 20.4%. Despite experiencing significant insider selling recently, Cairn Homes' short-term assets comfortably cover both short- and long-term liabilities, and its interest payments are well covered by EBIT. The company anticipates revenue growth exceeding 10% for fiscal year 2025 with an operating profit forecasted around €160 million.

- Unlock comprehensive insights into our analysis of Cairn Homes stock in this financial health report.

- Explore Cairn Homes' analyst forecasts in our growth report.

Genel Energy (LSE:GENL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Genel Energy plc is an independent oil and gas exploration and production company with a market cap of £152.81 million.

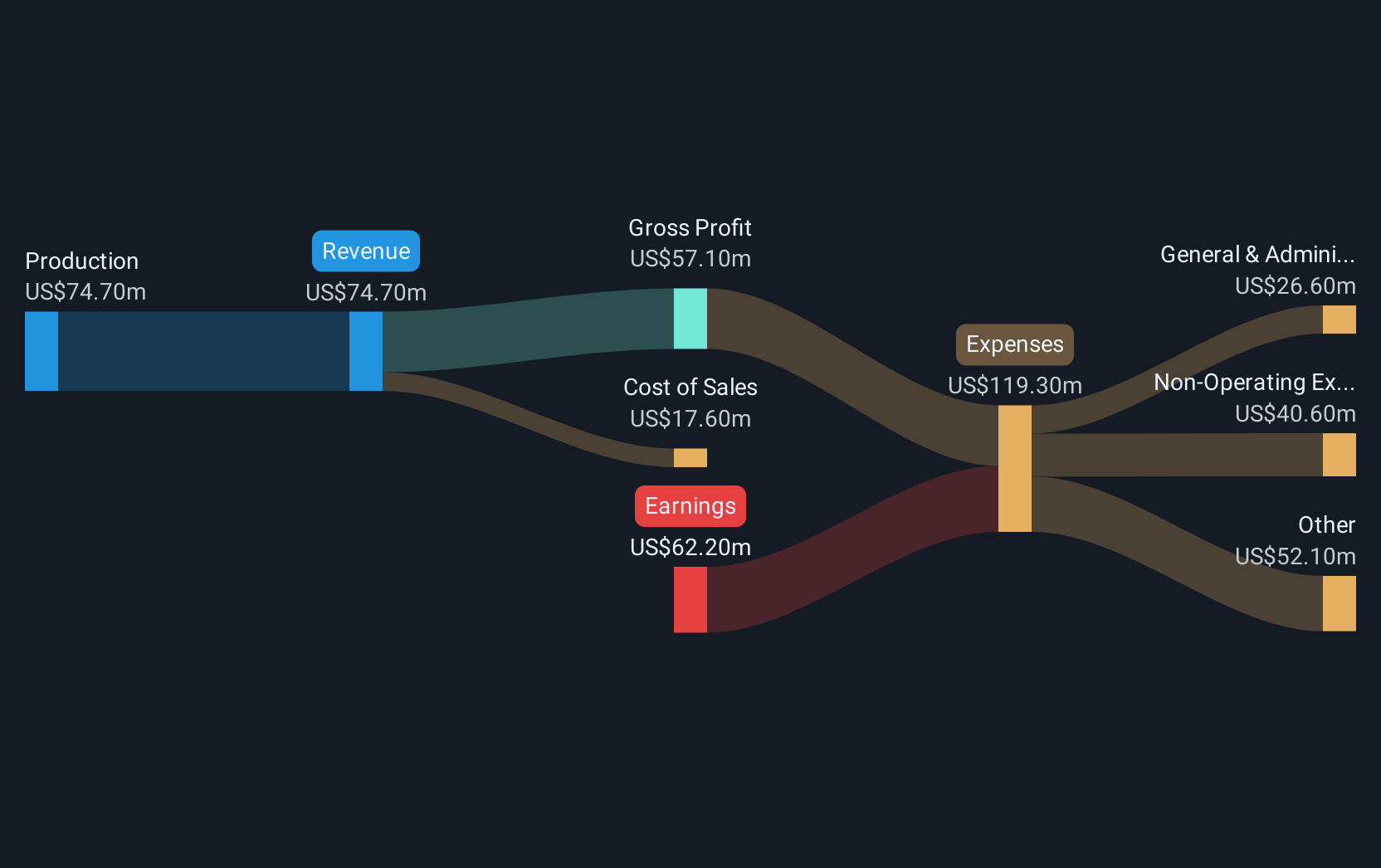

Operations: The company generates revenue primarily from its production segment, amounting to $74.7 million.

Market Cap: £152.81M

Genel Energy, with a market cap of £152.81 million, remains unprofitable but has demonstrated financial resilience by maintaining a positive cash flow and reducing its debt-to-equity ratio from 21.5% to 18.2% over five years. The company recently completed a $100 million bond issuance, indicating strong investor confidence despite reporting a net loss of $76.9 million for 2024. Its production performance remains robust with increased output from the Tawke licence, while short-term assets exceed liabilities significantly, providing stability amidst volatility in the oil and gas sector. Revenue is projected to grow at an annual rate of 10.96%.

- Click here to discover the nuances of Genel Energy with our detailed analytical financial health report.

- Assess Genel Energy's future earnings estimates with our detailed growth reports.

Raspberry Pi Holdings (LSE:RPI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Raspberry Pi Holdings plc designs and develops single board computers and compute modules globally, with a market cap of £949.67 million.

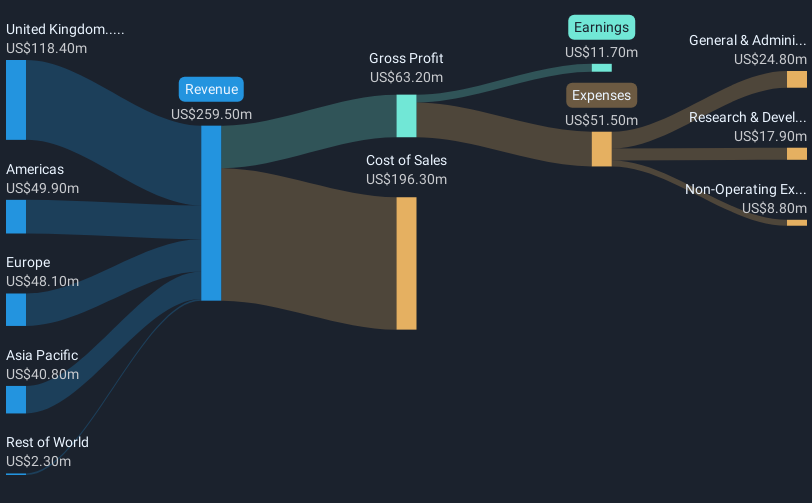

Operations: The company generates revenue primarily from its computer hardware segment, amounting to $259.5 million.

Market Cap: £949.67M

Raspberry Pi Holdings, with a market cap of £949.67 million, has experienced negative earnings growth of -62.9% over the past year, contrasting with a tech industry average growth of 26.2%. Despite this setback, the company remains debt-free and its short-term assets ($245.3M) comfortably exceed both short-term ($98.2M) and long-term liabilities ($22.8M). However, profit margins have decreased from 11.9% to 4.5%, reflecting challenges in maintaining profitability despite revenue generation from its computer hardware segment amounting to $259.5 million for 2024 compared to $265.8 million in the previous year.

- Navigate through the intricacies of Raspberry Pi Holdings with our comprehensive balance sheet health report here.

- Gain insights into Raspberry Pi Holdings' outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Access the full spectrum of 408 UK Penny Stocks by clicking on this link.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GENL

Genel Energy

Operates as an independent oil and gas exploration and production company.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives