- United Kingdom

- /

- Personal Products

- /

- AIM:W7L

Top UK Dividend Stocks To Watch In December 2025

Reviewed by Simply Wall St

As the UK market grapples with global economic uncertainties, particularly stemming from China's slower-than-expected recovery, the FTSE 100 has experienced a downturn, reflecting broader concerns about international trade and commodity prices. In such a volatile environment, dividend stocks can offer investors potential stability and income through regular payouts, making them an attractive consideration for those seeking to navigate these turbulent times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 4.08% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.59% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.49% | ★★★★★☆ |

| Multitude (LSE:0R4W) | 4.00% | ★★★★☆☆ |

| MONY Group (LSE:MONY) | 6.75% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.13% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 8.25% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 3.63% | ★★★★★☆ |

| Begbies Traynor Group (AIM:BEG) | 3.86% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.58% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

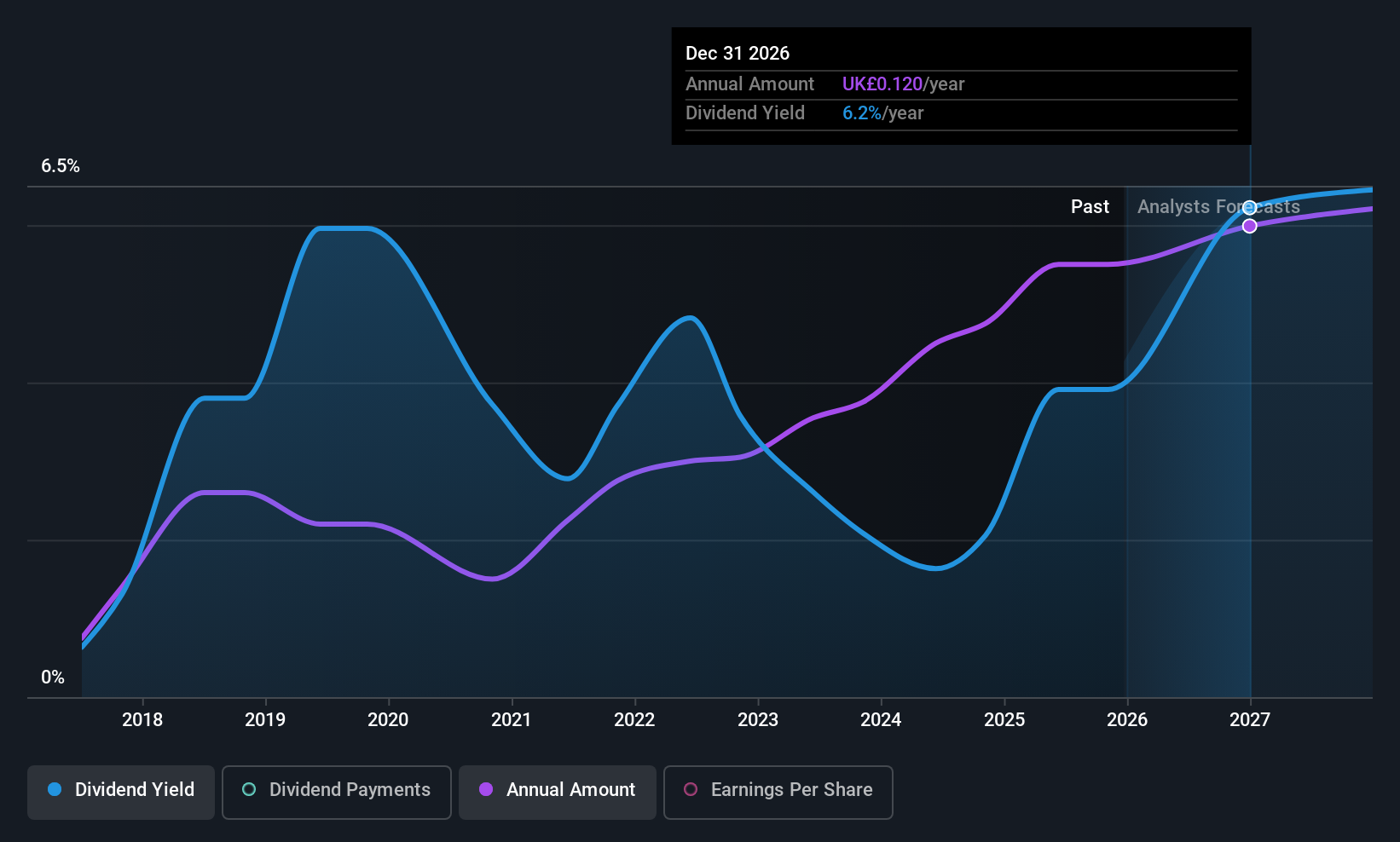

Warpaint London (AIM:W7L)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Warpaint London PLC, along with its subsidiaries, is engaged in the production and sale of cosmetics, with a market cap of £155.52 million.

Operations: Warpaint London PLC generates revenue through its segments, with £2.15 million from Close-Out sales and £102.66 million from Own Brand products.

Dividend Yield: 5.7%

Warpaint London offers a dividend yield in the top 25% of UK payers, with dividends covered by both earnings (58.4% payout ratio) and cash flows (63.5% cash payout ratio). However, its dividend history is less than a decade old and has been volatile, with drops exceeding 20%. Despite trading at 47.2% below estimated fair value, its unstable dividend record may concern some investors seeking reliability.

- Unlock comprehensive insights into our analysis of Warpaint London stock in this dividend report.

- The valuation report we've compiled suggests that Warpaint London's current price could be quite moderate.

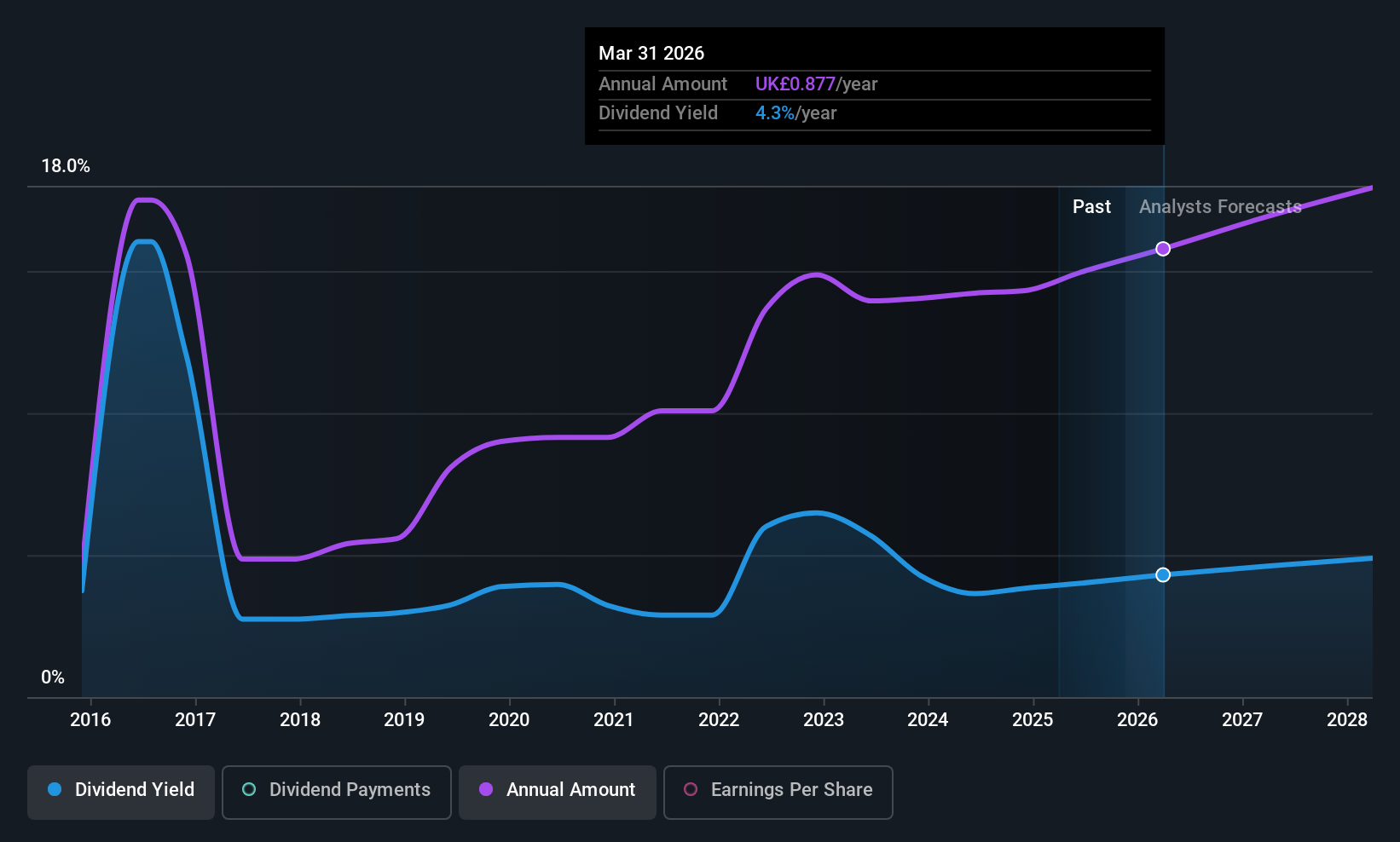

ICG (LSE:ICG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ICG plc is a private equity firm that specializes in direct and fund of fund investments, with a market cap of £5.87 billion.

Operations: ICG plc generates revenue through its Consolidated Entities (£48.10 million), Investment Company (£162.60 million), and Fund Management Company (£892.20 million) segments.

Dividend Yield: 4.1%

ICG's recent earnings report shows significant growth, with revenue at £574.5 million and net income at £297.3 million for the half year ending September 2025. The company declared an interim dividend of 27.7 pence per share, reflecting a modest increase from the previous period. While ICG's dividends are well-covered by both earnings and cash flows, their historical volatility may concern some investors seeking consistent returns despite its strategic partnership with Amundi enhancing distribution capabilities.

- Click here and access our complete dividend analysis report to understand the dynamics of ICG.

- Our expertly prepared valuation report ICG implies its share price may be lower than expected.

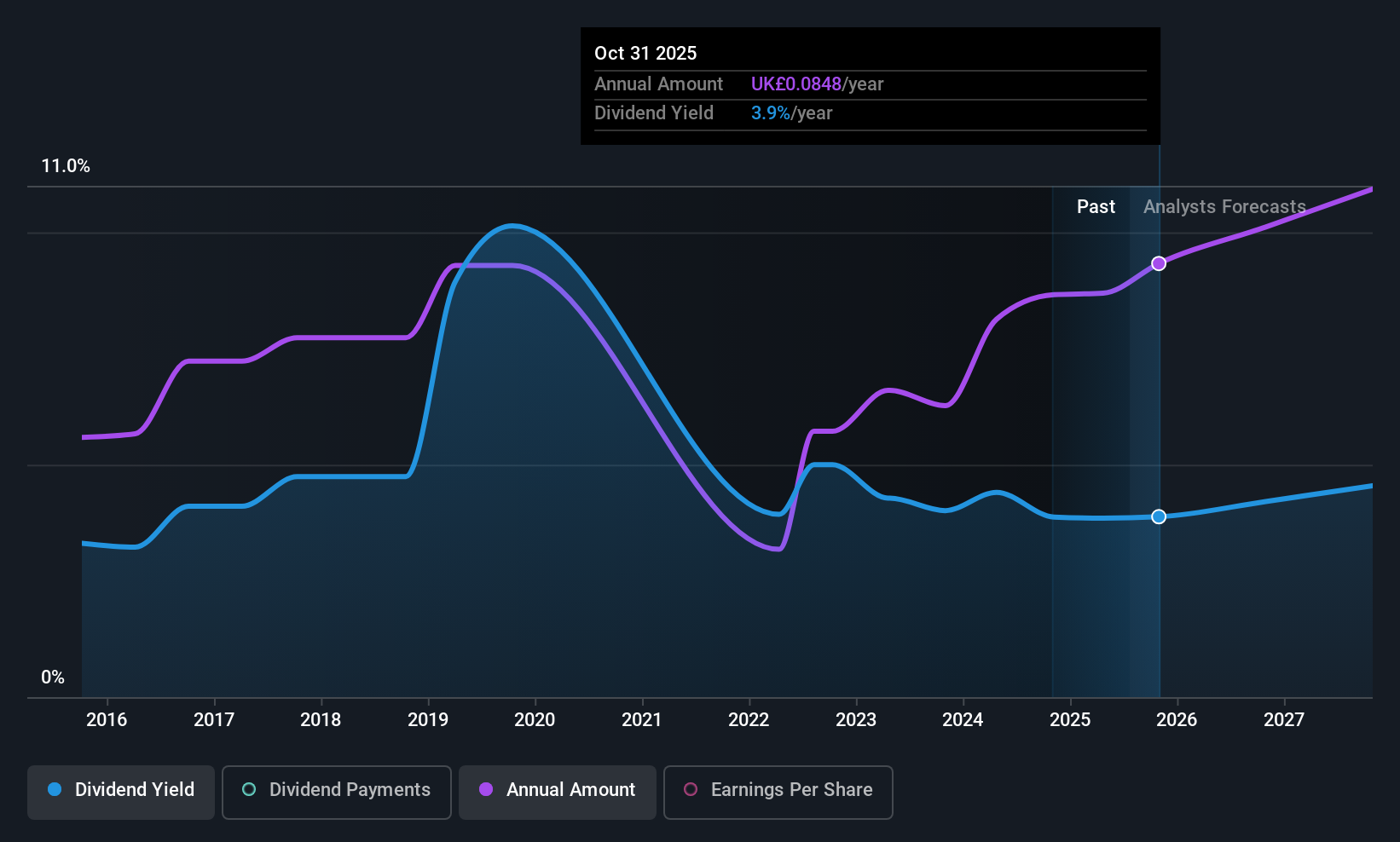

ME Group International (LSE:MEGP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market cap of £588.49 million.

Operations: ME Group International plc generates revenue from its Personal Services - Others segment, amounting to £311.32 million.

Dividend Yield: 5.1%

ME Group International's dividend payments are covered by earnings and cash flows, with a payout ratio of 54.8% and a cash payout ratio of 82.8%. However, its dividends have been volatile over the past decade, raising concerns about reliability despite recent growth. Trading at good value relative to peers and industry standards, MEGP's earnings are forecasted to grow annually by 7.35%. The company expects fiscal year revenue between £311 million and £318 million.

- Take a closer look at ME Group International's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that ME Group International is trading behind its estimated value.

Where To Now?

- Explore the 48 names from our Top UK Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Warpaint London might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:W7L

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion