- United Kingdom

- /

- Capital Markets

- /

- LSE:BRK

Top UK Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices face downward pressure due to weak trade data from China, investors are closely watching how global economic shifts impact UK markets. In such uncertain times, dividend stocks can offer a measure of stability and income, making them an attractive option for those looking to navigate market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 9.50% | ★★★★★★ |

| Treatt (LSE:TET) | 3.34% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.85% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 5.99% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.71% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.31% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.55% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.00% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.96% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.75% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top UK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

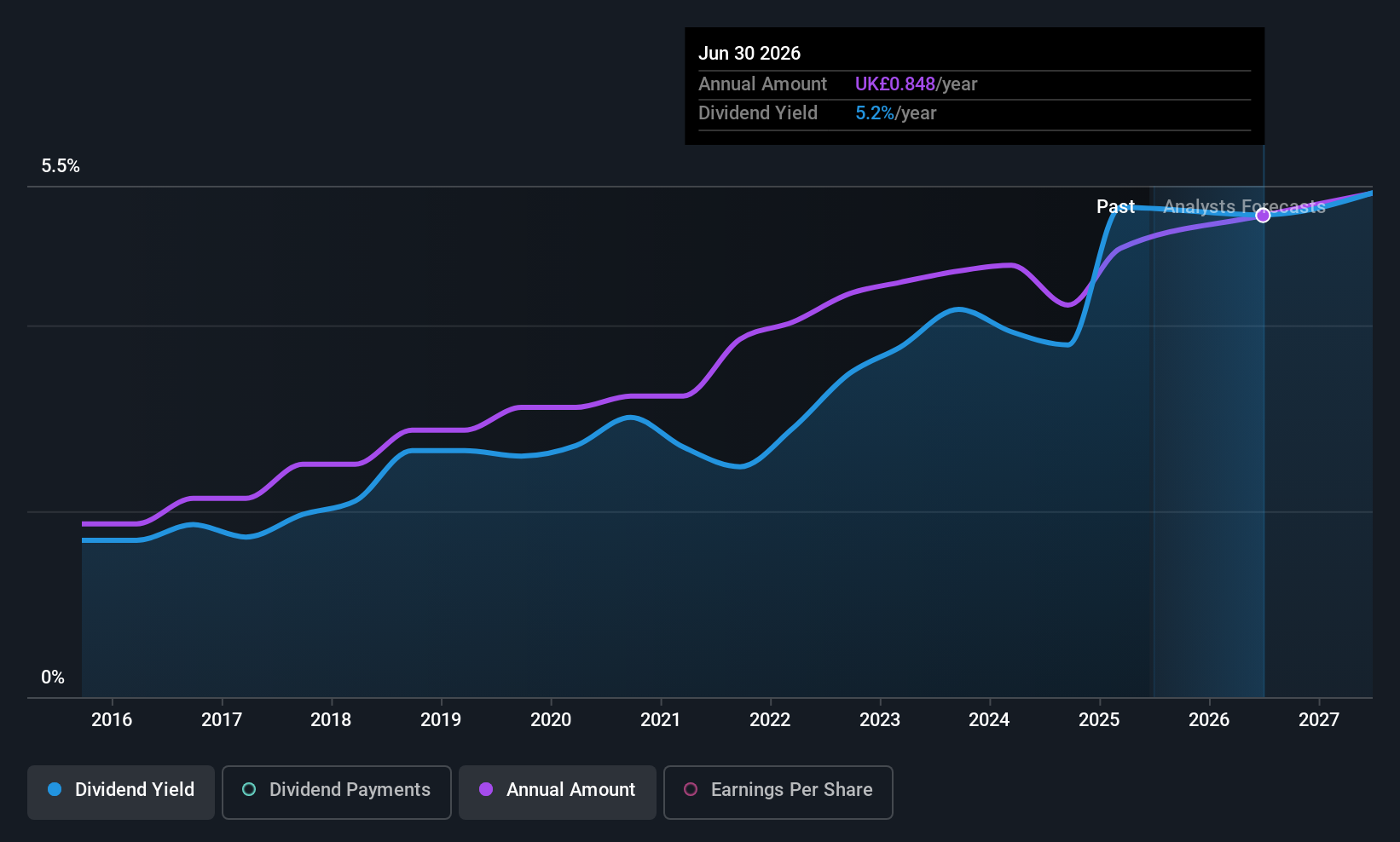

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B.P. Marsh & Partners PLC invests in early-stage and SME financial services intermediary businesses both in the United Kingdom and internationally, with a market cap of £264.77 million.

Operations: B.P. Marsh & Partners PLC generates its revenue primarily through the provision of consultancy services and trading investments in financial services, amounting to £115.24 million.

Dividend Yield: 3%

B.P. Marsh & Partners has proposed a dividend of 6.78 pence per share, with recent earnings showing significant growth to £99.5 million from £42.53 million year-on-year, indicating strong coverage for dividends given the low payout ratio of 5%. However, its dividend yield is relatively low at 3.02% compared to top UK payers and has been historically volatile and unreliable over the past decade despite recent increases in payments.

- Dive into the specifics of B.P. Marsh & Partners here with our thorough dividend report.

- The analysis detailed in our B.P. Marsh & Partners valuation report hints at an deflated share price compared to its estimated value.

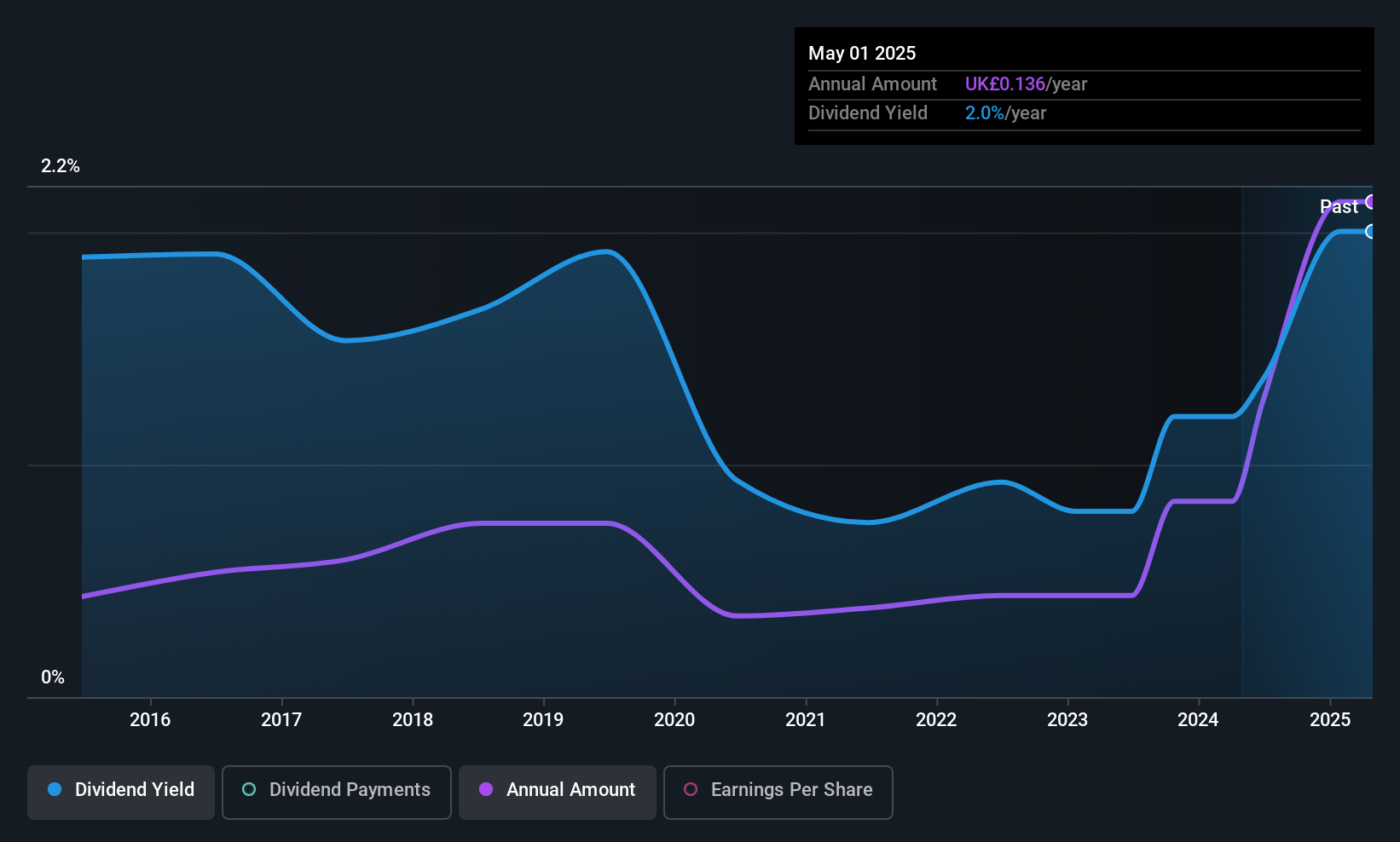

Brooks Macdonald Group (LSE:BRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Brooks Macdonald Group plc offers investment and wealth management services to private clients, pension funds, professional intermediaries, and trustees in the UK and Channel Islands, with a market cap of £276.80 million.

Operations: Brooks Macdonald Group plc generates its revenue by providing a variety of financial services, including investment and wealth management, to clients such as private individuals, pension funds, professional intermediaries, and trustees across the UK and Channel Islands.

Dividend Yield: 4.5%

Brooks Macdonald Group's dividends have been stable and reliably growing over the past decade, though its high payout ratio of 187.5% indicates dividends are not well covered by earnings. Despite this, a lower cash payout ratio of 49.9% suggests coverage by cash flows is adequate. The dividend yield of 4.46% is below top UK payers, and recent inclusion in the FTSE All-Share Index may enhance investor visibility.

- Get an in-depth perspective on Brooks Macdonald Group's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Brooks Macdonald Group's current price could be inflated.

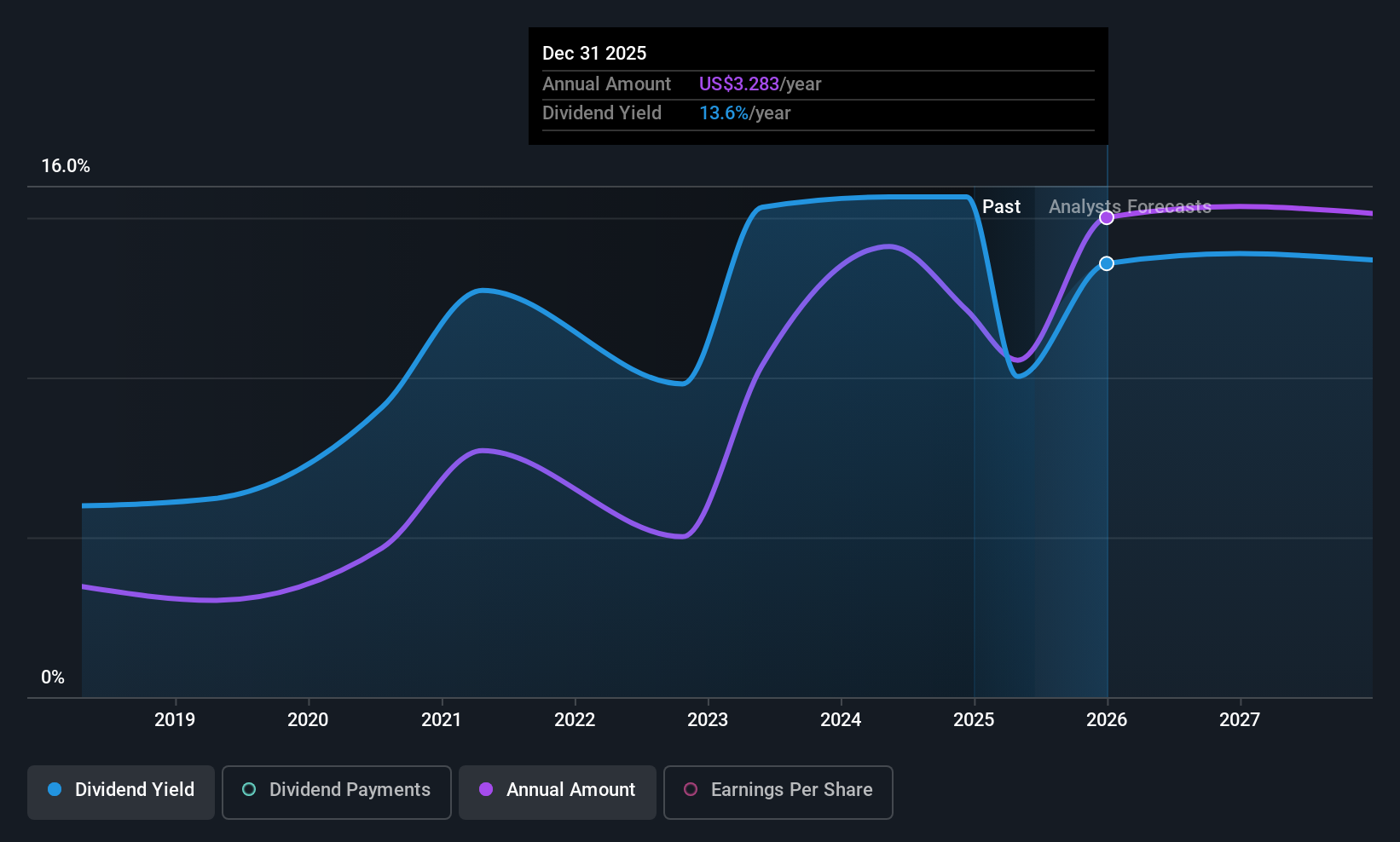

Halyk Bank of Kazakhstan (LSE:HSBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Halyk Bank of Kazakhstan Joint Stock Company, along with its subsidiaries, offers corporate and retail banking services mainly in Kazakhstan, Kyrgyzstan, Georgia, and Uzbekistan, with a market cap of $6.73 billion.

Operations: Halyk Bank of Kazakhstan's revenue is primarily derived from its Corporate Banking segment at KZT 822.96 billion, followed by Investment Banking at KZT 254.72 billion, Retail Banking at KZT 207.87 billion, and Small and Medium Enterprises (SME) Banking contributing KZT 189.80 billion.

Dividend Yield: 9.1%

Halyk Bank of Kazakhstan offers a high dividend yield, placing it among the top 25% of UK market payers. Despite past volatility in dividends, current payments are well covered by earnings with a low payout ratio of 31.7%. The bank's recent earnings growth and undervaluation compared to peers enhance its appeal, though concerns arise from a high level of bad loans at 6.8%, potentially impacting future stability.

- Unlock comprehensive insights into our analysis of Halyk Bank of Kazakhstan stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Halyk Bank of Kazakhstan shares in the market.

Key Takeaways

- Delve into our full catalog of 56 Top UK Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brooks Macdonald Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BRK

Brooks Macdonald Group

Through its subsidiaries, provides wealth management and financial planning services to private individuals, trusts, charities, and pension funds in the United Kingdom.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in