As global markets continue to navigate a complex landscape, marked by record highs in major U.S. indices and resilient job growth, investors are increasingly turning their attention to dividend stocks as a potential source of stability and income. In such an environment, stocks that offer consistent dividends can be appealing for those looking to balance growth with income generation amidst fluctuating economic indicators.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Soliton Systems K.K (TSE:3040) | 4.04% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.08% | ★★★★★★ |

| NCD (TSE:4783) | 4.22% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.30% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.05% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.39% | ★★★★★★ |

| Daicel (TSE:4202) | 4.94% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.12% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.48% | ★★★★★★ |

Click here to see the full list of 1542 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Samyang (KOSE:A145990)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samyang Corporation operates in the chemicals and food industries across Korea, China, Japan, the rest of Asia, Europe, and internationally with a market cap of ₩540.68 billion.

Operations: Samyang Corporation's revenue is primarily derived from its operations in the chemicals and food sectors across various international markets, including Korea, China, Japan, the rest of Asia, and Europe.

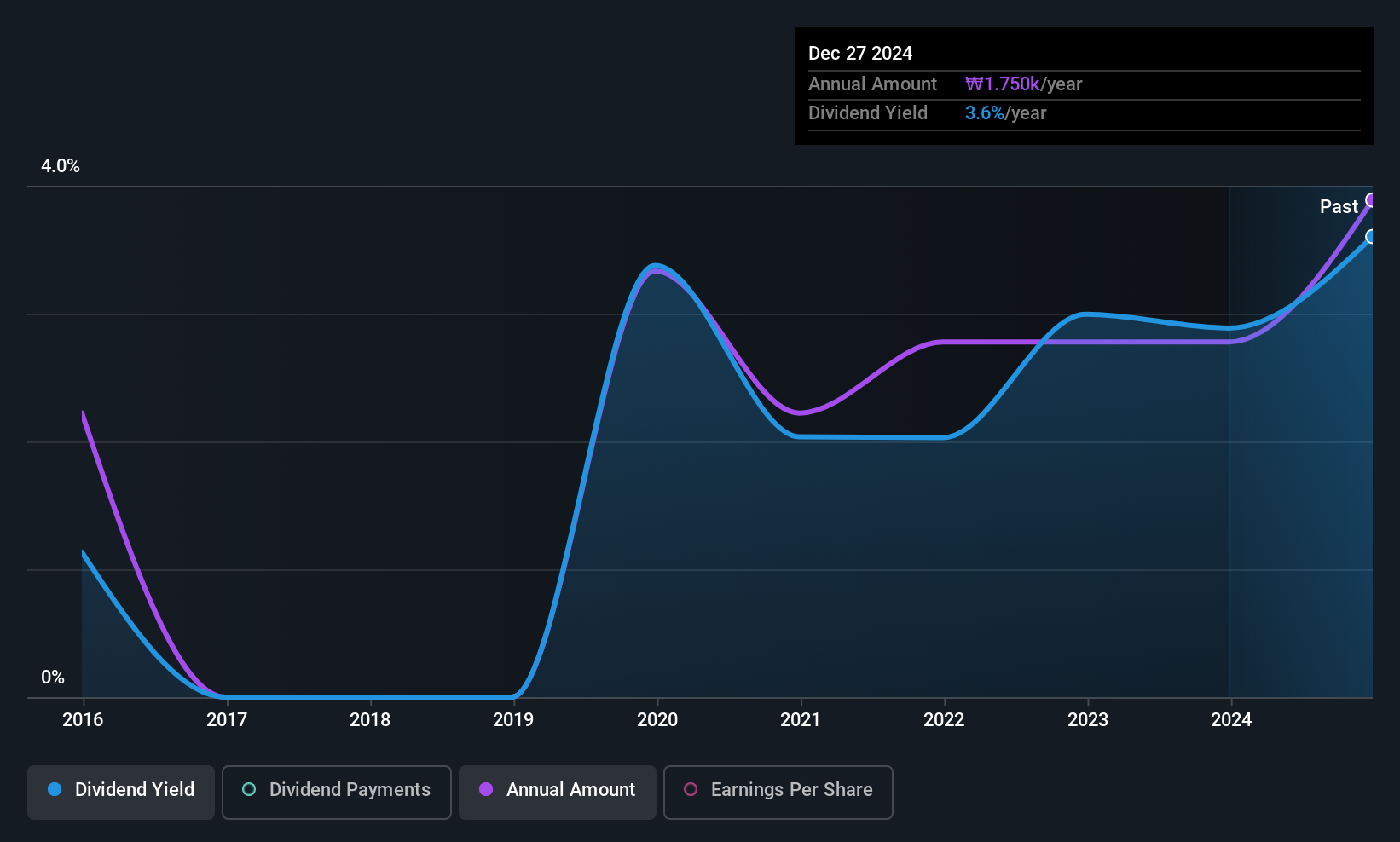

Dividend Yield: 3.2%

Samyang's dividend payments are well-supported by both earnings and cash flows, with a low payout ratio of 15.8% and a cash payout ratio of 20.2%. However, the dividend yield at 3.16% is below the top quartile in the KR market, and its track record has been unstable over the past decade despite some growth. The stock appears undervalued with a price-to-earnings ratio of 5x compared to the market average of 13.2x.

- Click here to discover the nuances of Samyang with our detailed analytical dividend report.

- Our expertly prepared valuation report Samyang implies its share price may be too high.

KurimotoLtd (TSE:5602)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kurimoto, Ltd. manufactures and sells ductile iron pipes, valves, industrial equipment and construction materials both in Japan and internationally, with a market cap of ¥72.88 billion.

Operations: Kurimoto, Ltd.'s revenue segments include the production and sale of ductile iron pipes and accessories, valves, industrial equipment and materials, as well as construction materials.

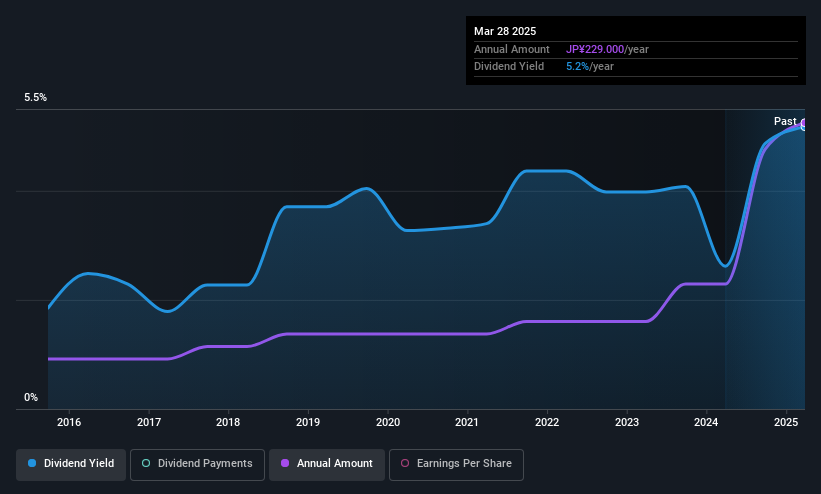

Dividend Yield: 4.5%

Kurimoto Ltd.'s dividend yield of 4.46% ranks in the top quartile of the JP market, yet it faces sustainability issues as dividends are not covered by free cash flows despite a low payout ratio of 48.1%. Recent guidance indicates a decrease in year-end dividends to ¥144 per share for March 2026 from ¥181 previously. The stock trades at a relatively low price-to-earnings ratio of 11.3x compared to the market average, suggesting potential value.

- Take a closer look at KurimotoLtd's potential here in our dividend report.

- Our valuation report unveils the possibility KurimotoLtd's shares may be trading at a premium.

TOMONY Holdings (TSE:8600)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TOMONY Holdings, Inc. operates through its subsidiaries to offer a range of banking and financial products and services, with a market cap of approximately ¥107.35 billion.

Operations: TOMONY Holdings, Inc. generates revenue primarily from its banking segment, which amounts to ¥87.65 billion.

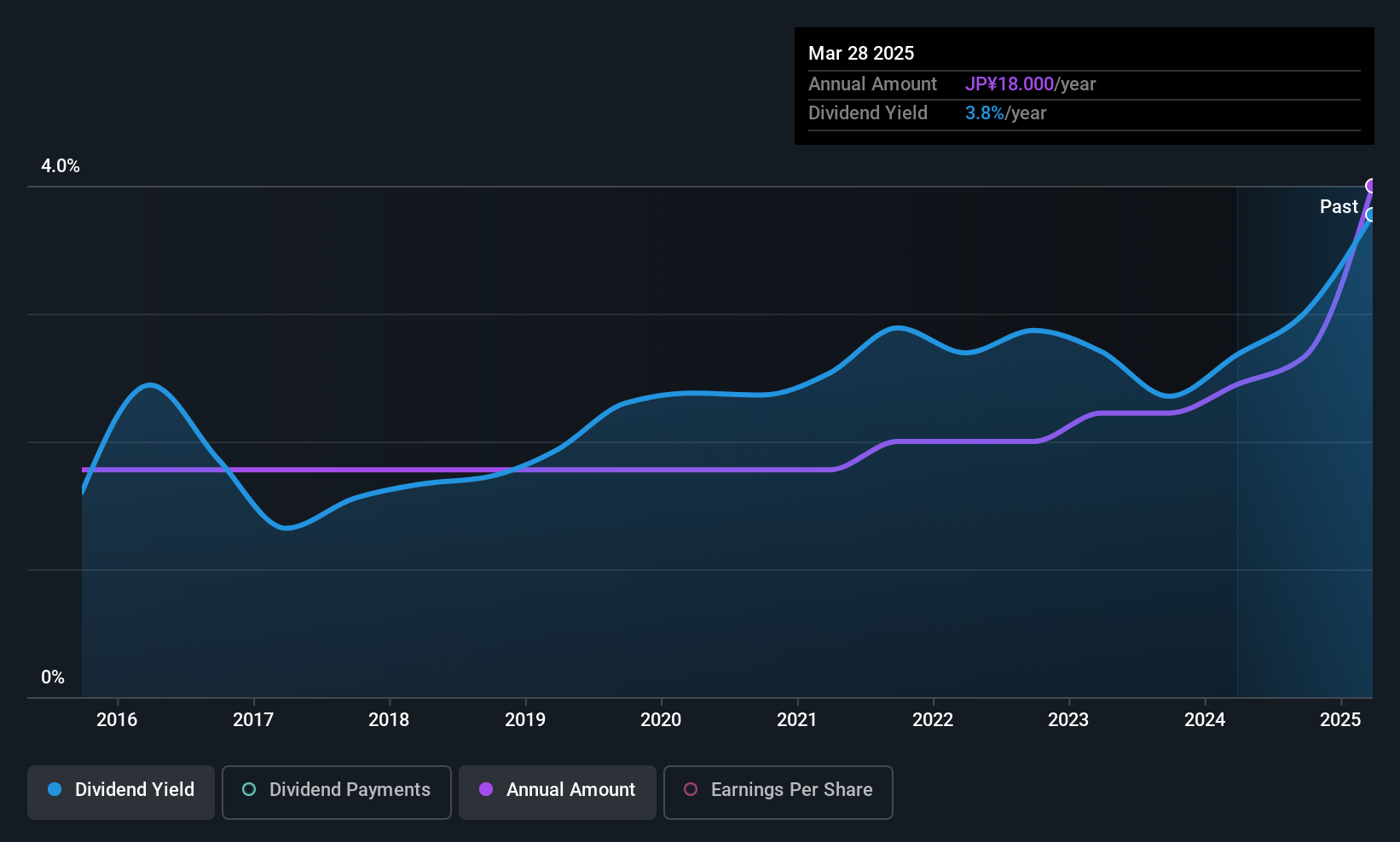

Dividend Yield: 4.5%

TOMONY Holdings offers an attractive dividend yield of 4.47%, placing it in the top 25% of JP market payers. The company's dividends have shown consistent growth and stability over the past decade, with a recent increase to ¥9.50 per share for March 2025 and expected further increases. With a low payout ratio of 20%, dividends are well covered by earnings, although future coverage remains uncertain due to insufficient data on long-term sustainability.

- Click to explore a detailed breakdown of our findings in TOMONY Holdings' dividend report.

- The valuation report we've compiled suggests that TOMONY Holdings' current price could be quite moderate.

Taking Advantage

- Gain an insight into the universe of 1542 Top Global Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOMONY Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8600

TOMONY Holdings

Through its subsidiaries, provides various banking and financial products and services.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives